Exacerbated by COVID-19 and building on economic and climate challenges, a major debt crisis is brewing in the developing world.

The International Monetary Fund projects that average GDP in emerging market and developing countries will decline 3.3% in 2020. These developments make existing debts more onerous, as government revenues plummet and foreign exchange from tourism and oil exports dries up. Outstanding multilateral and bilateral debt totaled $738 billion and $424 billion, respectively, in 2017.

A vicious cycle is emerging. Highly indebted countries have less room to spend on economic recovery and stimulus to alleviate the pandemic’s impacts or insulate against coming shocks, including from climate change. High debt burdens mean more difficult choices on where to spend, and less funding for climate action means more vulnerability to climate shocks. For example, in Fiji, which is highly vulnerable to climate impacts, there has already been a 32% decline in allocation of government funds for climate-related projects.

There is a way out of this cycle. Countries that are owed money by developing countries should forgive some of that debt in exchange for clear, verifiable climate action and investments in healthcare — a climate-health-debt swap. That will require multilateral and bilateral creditors to work together. As the world’s largest bilateral creditor to developing countries, China has the potential to play a pivotal role in enabling countries to navigate the compound crises of the COVID-19 pandemic, economic shock and the climate crisis.

What Is a Climate-Health-Debt Swap?

How does this idea become a reality? One place to look is debt-for-environment swaps (DFES), which have been around for decades. A DFES is a legal agreement through which the debtor government agrees to invest, in its own currency, in environmental projects domestically, instead of making loan payments in hard currency to a creditor nation. What we propose is a variation of these older initiatives — a climate-health-debt swap where the debtor country invests in measures at the intersection of climate action and human health. This is critically important given that COVID-19 has exposed the weak healthcare systems in many developing countries.

Crucially, the swap could have several features to avoid the pitfalls that have bedeviled previous efforts.

The first DFES was created in Bolivia in 1987, where the government of Bolivia and Conservation International agreed to a debt-for-nature swap. Conservation International acquired $650,000 of Bolivian external debt at a discounted price of $100,000. In return, Bolivia agreed to provide the Beni Biosphere Reserve with maximum legal protection and to create three adjacent protected areas. From 1991-2003, almost $1.1 billion was generated for conservation through debt for environment swaps.

There have been recent calls for debt swaps that include both biodiversity conservation and climate protection. Armenia and France have discussed developing a climate finance mechanism around debt-for-nature swaps to address in part the country’s $1 billion bilateral debt. The Seychelles just announced the creation of 13 new protected marine areas as part of a larger debt deal with the Nature Conservancy that commits the country to fund marine conservation and climate adaptation activities.

DFES have a number of advantages. Most notably, they alleviate the fiscal pressure of debt repayment, helping improve macroeconomic stability. Secondly, they can generate long-term, stable streams of revenue for environmental projects, as they operate over the lifetime of a sovereign loan and can leverage funds for environmental conservation. Lastly, they can help build capacity in managing public environmental expenditure.

Related Articles: How Forgiving Debt Could Help Save the Earth | China’s Debt-Trap Diplomacy

However, DFES also have their critics. They have resulted in relatively small amounts of debt relief, limiting their impact on overall debt burdens. The early DFES were negotiated by environmental NGOs, which didn’t always have the resources to implement large-scale programs. Transaction costs can be high, and DFES can be hampered by lengthy negotiations. As a long-term commitment, they are sensitive to macroeconomic and political instability, and there is a risk that corruption will lead to mismanagement of the funds. And debtor countries would prefer no-strings-attached debt relief and restructuring.

Where Can a Bilateral Debt-for-Climate Deal Come From?

Despite some success, there have been no systematic efforts to establish a larger program of DFES swaps. Even during the COVID-19 crisis, as the G20 agreed to temporarily suspend debt service payments, an effort extended at the World Bank’s and IMF fall meetings, so far there has been no debt forgiveness. This is a missed opportunity.

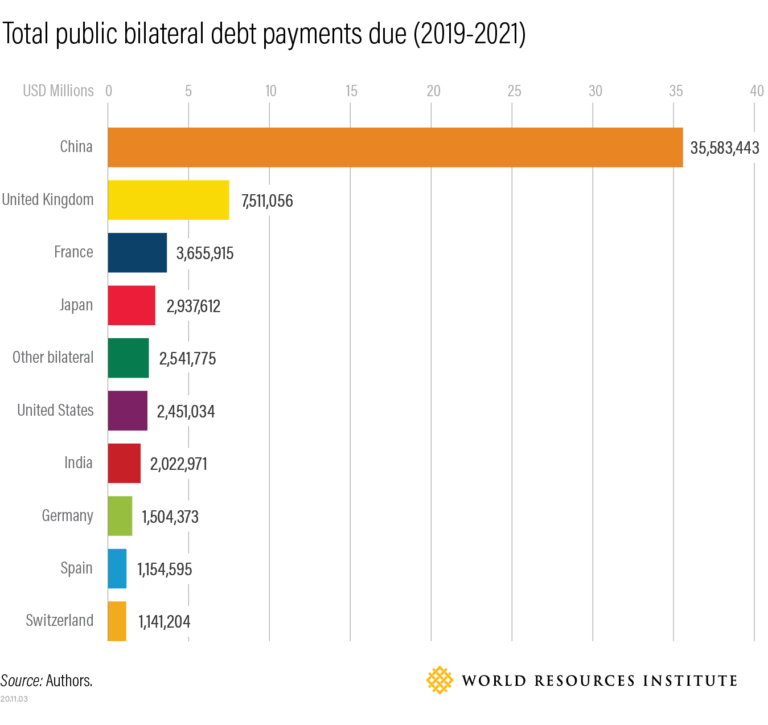

Who might lead the charge on a debt-for-climate deal? Multilateral institutions, such as the World Bank and other multilateral development banks (MDBs), should surely play a role. European bilateral creditors that are climate champions should also join. But because of the sheer size of its outstanding credits to the developing world, one player’s role is key: China.

Public and publicly-guaranteed debt to China from the 73 eligible countries of Debt Service Suspension Initiative (DSSI) (the G20’s debt service suspension initiative) amounted to $102 billion in 2018. However, that could be a small fraction of China’s total. One estimate suggests the Chinese state and its subsidiaries have lent about $1.5 trillion in direct loans and trade credits to more than 150 countries. One thing is clear: China dwarfs the other bilateral official creditors.

China has engaged in debt relief before, including both debt cancelation (writing off part of or all debt) and debt restructuring (renegotiating the terms of debt). For example, between 2000 and 2019, China canceled roughly $3.4 billion of official zero-interest loans to African countries and restructured additional $7.5 billion debt to those countries.

Now, China has an opportunity to display major-power credentials by engaging in further debt relief, this time linked to climate action. This could complement China’s domestic commitment to achieve carbon neutrality by 2060 and burnish its image as a climate champion.

However, it is unlikely that China will do this on its own. China has traditionally undertaken major initiatives like this one in the context of a larger multilateral effort. As a result, the multilaterals and several governments should take the initiative and convene this effort first, bringing China into the fold. This approach is more likely to generate political support among Chinese stakeholders.

How Climate-Health Debt Swaps Could Work

A climate-health debt swap program would have several features:

- Focus on the intersection of climate and health.

This would include measures to foster resilience in the climate and health systems, such as healthcare infrastructure, information technology and social protection schemes, and spending that achieves health benefits by reducing air pollution from the burning of fossil fuels. Reduction in air pollution has massive health benefits: currently about 4.2 million people die prematurely due to ambient air pollution. Simultaneously addressing climate and health needs is consistent with many countries’ nationally determined contributions (NDCs). Among top-10 debtor countries to China, all but Pakistan either mention health as one of the most vulnerable sectors or identify health as a priority for adaptation in their NDCs.

- Use of climate change trust funds to increase accountability.

Each debtor country would be required to channel the money that would have gone to debt service into a ring-fenced trust fund (controlled by the debtor country government but complying with fiduciary standards of the World Bank or other MDBs), which would then dispense the funds to approved climate and health projects. This would help to ensure transparency and reduce the risk of corruption.

- Debt reduction would be a function of climate vulnerability.

To include a debt reduction component for this program, bilateral creditors could reduce the debt principal (redemption price) in proportion to a country’s overall climate vulnerability (e.g. the ND-GAIN Country Index), recognizing the macro-economic impacts of climate change that could increasingly hit these countries. For example, Ethiopia is much more vulnerable to climate change than Kyrgyz Republic (GAIN score of 0.559 vs. 0.373), so its loan principal could be reduced by a greater percentage.

The developing world is reeling from the human tragedy of the coronavirus and a looming debt crisis. It is time for China and other climate champions to implement solutions like climate-health-debt swaps that can address economic distress, human health and social protection, while furthering climate action.

— —

About the Authors: Shuang Liu is a Senior Associate at the WRI Sustainable Finance Center. She leads the Center’s work on China finance and the Belt and Road Initiative. Michael I. Westphal is a former Senior Associate in the WRI Sustainable Finance team.

Editor’s Note: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com. — In the Featured Photo: Beijing, China, at night. Featured Photo Credit: zhang kaiyv