Relocation 2004-2014: a Mirage or a Reality?

Back in 2004, I was given the unique opportunity of guiding the relocation of the production process of several Italian fashion industries in that distant and complex country. An amazing experience! I shall be writing several articles about it here and share with you what I have learned from ten years in the role of production manager and buyer for several italian labels.

First, a couple of words about myself and why I ended up in that role. I’ve always had a deep interest for fashion, since an early age. Though my dream was to work in the fashion business, I was obliged to follow a different path in my studies and ended up studying Oriental Languages and Culture in Rome, at La Sapienza University, one of the oldest universities in Europe. That wasn’t really time lost, languages and traveling are subjects that I am very fond of as you will see, and very useful too.

Fortunately, the first job I landed was in the fashion industry, thanks to my fluency in Mandarin. No question, this was my destiny! I began as a freelance translator, and then moved up into the production and purchasing areas. At first, my clients were few, but as I moved up, more wanted my support.

In the last 10 years, both the Italian and Chinese markets have undergone drastic change. It all began with the transition overseas of the Italian companies and an accompanying rise of Italian investments in China. Nevertheless, in the last three years, it’s interesting to observe that there has been a slowdown in capital flows and possibly a return to the roots from a growing number of companies.

Capital flows began in earnest when China joined WTO in 2001 and they reached an unprecedented level in 2005, when Europe lifted almost all the restrictions against the importation of Chinese products. Globalization also allowed countries such as Italy to discover new potential markets for their sales but also for production.

China soon became the country with the highest flow of foreign investments, overtaking the USA. Chinese exports boomed, showing consistently high growth rates, and an incredible 25% rate in the first year.

Globalization created more competition, especially in the clothing industry as several new production options were introduced in the market using Chinese inputs. Large players like Zara, H&M, and other important labels got attracted to this incredible value proposition.

Italy, however, had its own strong tailoring traditions; relocating production to China was therefore done more with a view to reduce costs and make Italian clothing more price competitive. They saw in China a new potential market for their own creations.

Big Italian companies were the first to launch this relocation process. After them, smaller companies jumped in on the Chinese scene. This, though, was not achieved without facing a lot of difficulties that will be explored in the next article.

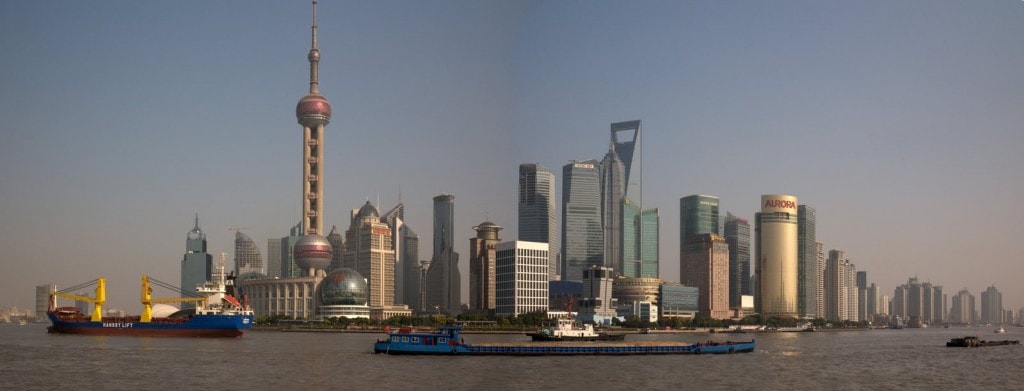

( Yiwu, Zhejiang – China, 2003 circa )