At this week’s meeting of G7 leaders, fossil fuels are on the agenda. Governments have agreed to phase out financing for “carbon-intensive” energy projects but have so far failed to adopt a clear timeline to end support to oil and gas. This is a serious blind spot: gas projects receive more international public finance in low- and middle-income countries than any other energy source, four times as much as wind or solar.

This is a poor use of public money, serving the interests of powerful and polluting companies when it could be used instead to help countries in the Global South transition to zero-carbon energy systems.

The gas industry increasingly sees its future in developing countries, where it is calling on governments—especially in Asia and Africa—to make a dash for gas. Expanding liquefied natural gas exporters such as the United States and Australia are seeking new markets, while gas companies look for new resources to extract and export. This expansion risks locking Global South countries into a high-carbon pathway, imperilling their economic future and the global climate.

As early as the 1980s, the gas industry began to propose that their product could serve as a bridge from coal and oil to cleaner energy on the other shore. More than 30 years on, the same argument is being made, now targeted mainly at the Global South.

Gas is more like a wall than a bridge, impeding rather than enabling the energy transition.

Today, however, the idea of a bridge is obsolete for three reasons. First, after decades of continually rising carbon emissions, there is no longer room for more fossil fuels of any type: the International Energy Agency argued last month that to meet the Paris Agreement goals, there should be no investments in new gas, oil, or coal production.

Related Articles: Clash Over Energy Charter Treaty’s Protection for Fossil Fuels | Are the G7 Countries Sabotaging Their Own Climate Efforts?

Second, the costs of renewable energy have fallen dramatically, and renewables are now cheaper than fossil fuels in most of the world. Third, recent findings on the extent of methane leakage from gas infrastructure undermine claims of environmental benefits over other fossil fuels.

In other words, we have missed the opportunity to cross by bridge, but we don’t actually need one anyway. Besides, gas is more like a wall than a bridge, impeding rather than enabling the energy transition by competing with renewable energy for investment and policy support.

The largest use of gas is in power generation. But in the majority of countries for which data are available, wind and solar are now the cheapest power sources. And although gas advocates may argue that wind and solar are too variable to power the grid single-handedly, fluctuations in power generation are better addressed by batteries than fossil fuels.

Battery costs too are falling rapidly, and the combined cost of wind or solar with batteries is often less than that of “peaker” gas plants, which add power to the grid during times of high demand. For the minority of gas uses where clean alternatives are not yet available or affordable—such as in heavy industry—rapid technological development is underway, with commercialization expected by the early 2030s.

Gas is also a poor solution to the problem of energy access. Of the 800 million people worldwide lacking electricity, 85% live in rural areas where decentralized renewable energy is a better, cheaper option for electrification. Providing clean cooking fuels for the 3 billion people relying on dangerous solid biomass is an urgent priority, but costly plans to expand natural gas connections to residential consumers may prove obsolete as the cost of renewables falls and the efficiency of electric stoves rises.

Gas advocates may argue that wind and solar are too variable to power the grid single-handedly, but fluctuations in power generation are better addressed by batteries than fossil fuels.

If we want to achieve the goals of the Paris Agreement, we need far less private capital flowing into fossil fuels and far more into renewables. Public finance plays an outsized role in influencing private funds by de-risking projects and sending market signals.

Instead of funding the gas industry, public money could help unlock renewables projects in the Global South, opening the doors to more private funding. Public financial institutions could also help with technology transfer, integrating renewables into often weak or unstable electricity grids, and delivering energy access.

The greatest impacts of climate change will be felt in the Global South, especially by the poorest people. New gas expansion compounds this threat, putting countries in danger of being left behind as the world transitions to clean energy, saddled with stranded assets, more expensive energy, and a dependence on imports.

The COVID-19 pandemic has exposed how rapid global change can affect countries in deeply inequitable ways and underscored the importance of building resilient and socially just economies. As economic resources remain constrained in the coming years, it will be vital that scarce public funds are devoted to building back better, away from fossil fuels.

The G7 has an opportunity to lead and should use this week’s summit to announce an end to all finance for fossil fuels, directing energy finance instead to clean energy solutions.

— —

About the author: Greg Muttitt is Senior Policy Advisor, Energy Supply at IISD.

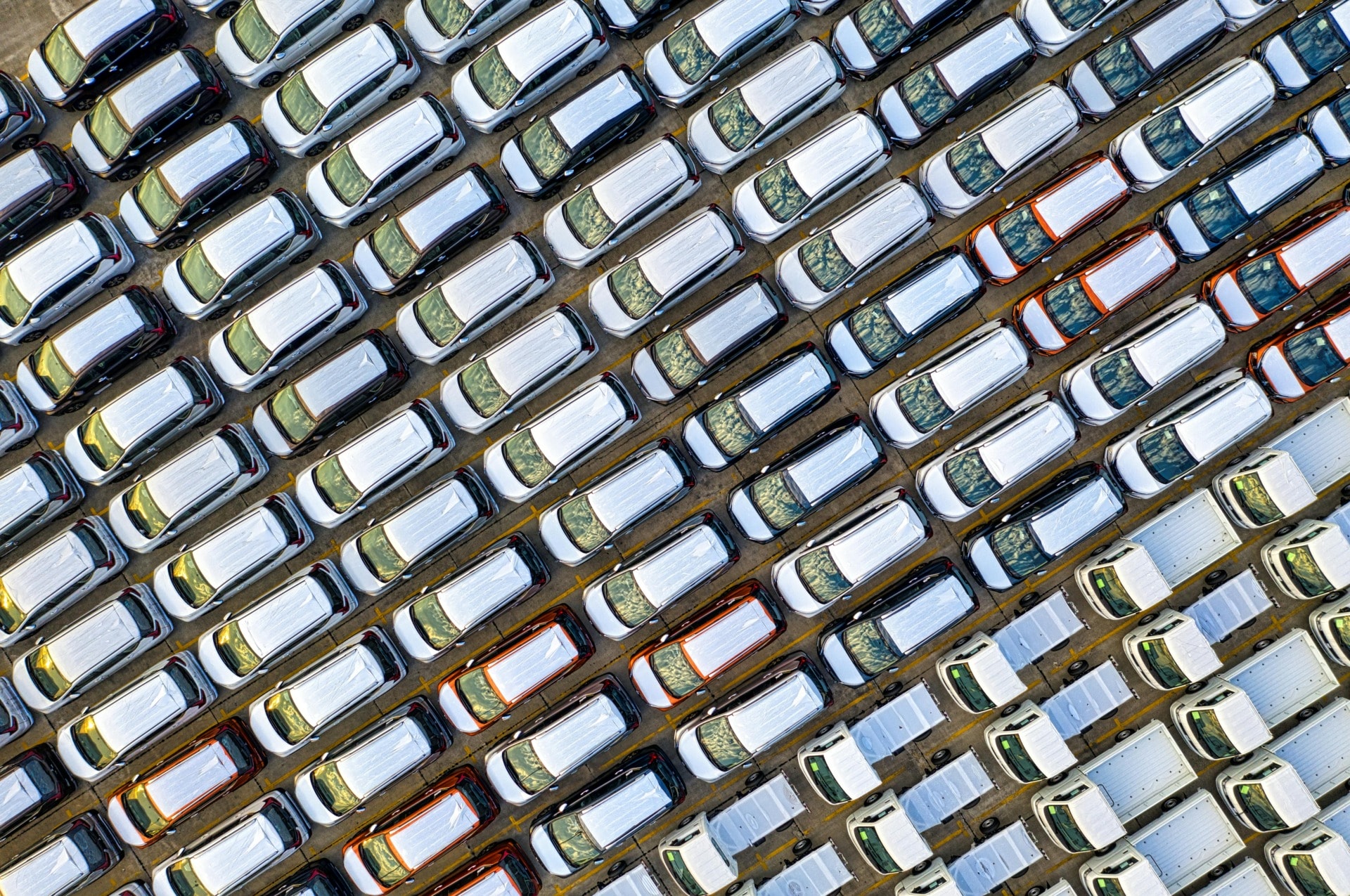

Editor’s Note: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com.— In the Featured Photo: Natural gas plant. Featured Photo Credit: Ryan Adams / Flickr