Global investments in low-carbon energy totalled $1.1 trillion in 2022, the same as investments in fossil fuel-powered energy, BloombergNEF’s (BNEF) new report shows.

For the first time in history, “investment in low-carbon technologies appears to have reached parity with capital deployed in support of fossil fuel supply,” say BNEF, Bloomberg’s research organisation.

The report, called “Energy Transition Investment Trends,” is released annually with the aim of estimating “how much funding businesses, financial institutions, governments and end-users are committing to the low-carbon energy transition.”

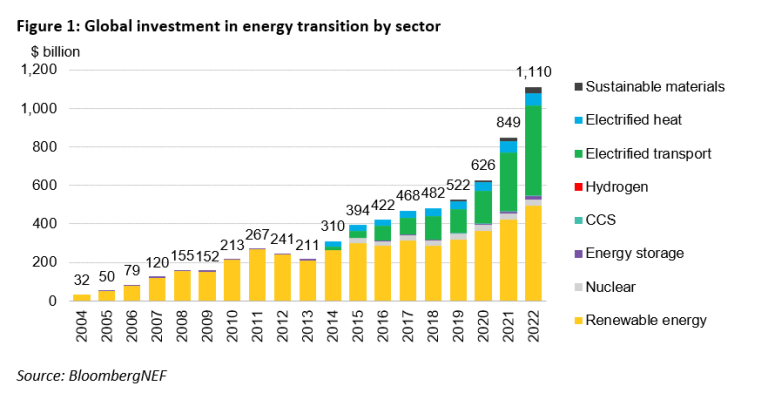

According to the 2023 edition, the $1.1 trillion invested in the energy transition in 2022 represents a new record and is far higher – 31% to be precise – than the 2021 investments, which totaled $775 billion.

These gigantic increases have been taking sizeable leaps year on year, with even the 2021 figure being 21% higher than the 2020 one.

Renewable energy sees the most investment, China invests the most

Except for one, all low-carbon energy sectors covered in the BNEF report have broken investment records in 2022.

The sectors that broke the records include energy storage, electrified transport, electrified heat, carbon capture and storage (CCS), hydrogen and sustainable materials. The only sector that did not see record investments in 2022 was nuclear energy.

While hydrogen received the least investment last year, with just 0.1% of the $1.1 trillion that was put into the industry, it still received more investment than ever and remains one of the fastest growing sectors with triple the investment in comparison to the year before.

While hydrogen received the least investment last year, with just 0.1% of the $1.1 trillion that was put into the industry, it still received more investment than ever and remains one of the fastest growing sectors with triple the investment in comparison to the year before.

The sector with the highest investment was renewable energy, which includes biofuels, wind, and solar. A new record was hit in 2022 with $495 billion being invested, up 17% from 2021.

In 2022, electric transport almost overtook the renewable energy sector; it received $466 billion in investments in 2022, a rapid increase of 54% from the previous year.

Related Articles: A Record Year for Solar Power in Europe: Is Our Renewable Energy Future Closer Than Expected? | A Year in Review: How Has Europe Fared for Sustainability in 2022? | Biden Pauses New Solar Tariffs to Revive the Solar Industry, but at What Cost?

As to who invested the most, BNEF’s findings show China committed $546 billion, almost half of the $1.1 trillion world total. If the European Union as a whole had been treated as a singular block, it would have come in second, at $180 billion.

On the individual country basis, however, the US came in second with $141 billion invested, Germany came in third, France fourth, and the UK fifth.

Does this put us on a path to achieving net zero by 2050?

It’s great that governments appear to be doing more than ever to tackle the climate crisis, but disappointing that it has taken so long to reach this point considering they have been aware of the problems with fossil fuels for an awfully long time.

More importantly, there is still a long way to go if we are to achieve net-zero goals by 2050.

As Albert Cheung, Head of Global Analysis at BloombergNEF, explains, “[t]hese investments will drive short-term job creation and help to address medium-term energy security objectives. But much more investment is needed to get on track for net zero in the long term.” (bolding added)

The report did, however, identify one area that received enough investment to put us on the path to achieving net zero by 2050: Clean energy manufacturing facilities.

Investments in manufacturing facilities for clean energy technologies increased to $78.7 billion in 2022, a giant scale-up from 2021 when $52.6 billion were invested in clean energy technology. In 2022, China accounted for 91% of these investments.

BNEF estimates that factory investment for clean energy technologies in fact needs less than half of this $78.7 billion per year; instead, just $35 billion is necessary for this sector to achieve the net-zero goal.

So how much more investment in low-carbon energy is needed overall to meet our net zero goals?

According to BNEF’s estimates, $4.55 trillion needs to be invested in low-carbon energy each year for us to meet the zero carbon emissions goal so yearningly spoken of. That’s over three times more than we invested in 2022, our record year of low-carbon energy investments.

Evidently, although we have made record-breaking steps in the right direction, a large gap still needs to be filled in order to fulfill our goals. However, considering the rapid incline of investment from 2020 to 2022, it could be argued that tripling this number isn’t at all impossible.

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — In the Featured Photo: Wind vs. Coal. Featured Photo Credit: Roland Skof-Peschetz.