Today’s ESG Updates

- Trump Pushes French Companies to Sign Onto Anti-DEI Policies: Ministers from France and Belgium have responded with strong pushback.

- Stocks Fall Sharply Amid Trade War: Trump announces extension of tariffs to all countries, Asian stocks take the biggest hit.

- Stellantis Avoids Emission Fines Through Credits from Tesla: The automaker will purchase carbon credits from a “pool” led by Tesla.

- Equinor, Shell, and TotalEnergies Further Carbon Capture Investments: Big oil companies announce $700M investment to expand carbon storage project.

Major French companies prompted by the U.S. government to end all DEI programs

The Trump Administration is attempting to force French companies to comply with U.S. anti-DEI and anti-discrimination programs. The order from the U.S. government to French companies states that if they do not sign off, they must provide detailed reasons, which the U.S. government will forward to their legal teams. The letter was signed by an officer of the U.S. State Department at the U.S. Embassy in Paris, but French ministers are berating the request. Both European government officials and business representatives have already claimed that companies will not comply, and that Europe’s non-discrimination policies will continue. Companies can navigate the changing regulatory environment using ESG solutions.

***

Further reading: France, Belgium scoff at anti-DEI letter from Trump administration

Asian stock markets tumble in the face of Trump’s tariff threats

Global stocks fell sharply after President Trump announced tariffs would extend to all countries, heightening the ongoing trade war. Asian markets are being hit hardest, with Japan’s Nikkei falling 4.1%, driven by concerns over the impact on automaker stocks. Additionally, gold price has reached $3,100 for the first time ever, and the U.S. dollar is weakening as lower returns on U.S. assets reduce foreign demand. Bruce Kasman, chief economist at JPMorgan, stated that recession risks are now elevated to a 40% probability.

Photo Credit: Wikimedia commons

***

Further reading: Stocks slide, bonds buoyed as tariffs fan recession fears

Europe’s second largest carmaker buys credits from a “pool” led by Tesla to avoid fines

Stellantis will purchase carbon credits from a “pool” led by Tesla to comply with EU CO2 reduction requirements. The pool, consisting of companies with lower EV sales, allows the major automaker to buy credits from leaders like Tesla to offset their emissions. The European Commission recently yielded to pressure from European manufacturers and eased compliance, changing from carmaker’s average emissions in 2025 to all emissions over the 2025-2027 period. Despite receiving this extension to meet emissions goals, Stellantis’ European head Jean-Philippe Imparato emphasized that buying credits from Tesla would still be necessary to meet targets.

Photo Credit: Wikimedia commons

***

Further Reading: Stellantis to buy CO2 credits from Tesla ‘pool’ also in 2025, exec says

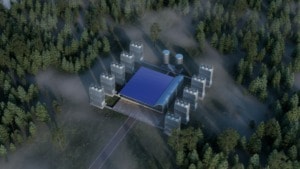

Big oil expands Northern Lights carbon storage project to meet emission goals

Equinor, Shell, and TotalEnergies announced late last week investments in phase 2 of a large-scale carbon capture and storage (CCS) project. As demand increases, the Northern Lights CCS facility in Norway will move from storing 1.5 million tons to 5 million tons per year of CO2 per year. To help European industrial companies reduce their CO2 emissions, the facility transports, receives and stores CO2 in geological layers buried about 2,600 meters below the seabed in the North Sea. While this expansion marks progress in CCS technology, it allows big oil companies to continue emitting without fundamentally changing their reliance on fossil fuels. Companies can ensure sustainable and responsible business practices with ESG tools.

Photo Credit: PHLAIR

***

Further reading: Northern Lights: the First Major Carbon Capture and Storage Project in Norway

Editor’s Note: The opinions expressed here by the authors are their own, not those of impakter.com — Cover Photo Credit: Rebecca Hausner