Today’s ESG updates

- Shell: Shareholders push Shell to reassess its LNG strategy, citing concerns over alignment with climate goals.

- UK Wind Power: Wind power surpasses natural gas as the UK’s leading electricity source in 2024, bolstering its renewable energy commitment.

- EBA ESG Guidelines: EBA releases new guidelines to help financial institutions integrate and manage ESG risks amid rising regulatory pressures.

- Bayer & Neste: Bayer and Neste team up to develop renewable fuels, aiming to support decarbonization in sectors like aviation and shipping.

Shell faces shareholder pushback on LNG strategy amid climate commitments

During Shell’s latest annual meeting, it revealed plans to re-evaluate its strategy on Liquefied natural gas (LNG). This climate resolution is being questioned by shareholders, who are calling for a reassessing of strategy. The resolution challenges the oil giant’s plan to expand LNG operations, citing a growing disconnect between its climate pledges and the continued development of fossil fuel infrastructure. Industry leaders aiming to align with climate goals can look to use ESG solutions to meet growing regulatory demands.

***

Further reading: Shareholders’ climate resolution challenges ‘disconnect’ in Shell’s LNG strategy

UK wind power surpasses gas in electricity generation

Wind power has overtaken natural gas as the UK’s primary source of electricity in 2024. Last year, wind turbines generated more than 40% of the country’s electricity. Wind power has proven to be a successful initiative for the UK government, which has been aiming to highlight itself as a renewable energy leader within the global market. This initiative should provide a vote of confidence for the future of renewable energy as countries look to move away from fossil fuels.

***

Further reading: NESO: Wind overtook gas as UK’s biggest source of electricity in 2024

EBA releases new guidelines for managing ESG risks in the financial sector

The European Banking Authority (EBA) has published final guidelines aimed at helping financial institutions manage Environmental, Social, and Governance (ESG) risks. A new framework provides instructions on how to integrate ESG factors into risk management practices. The framework is there to help businesses navigate the growing regulations on sustainability.

Businesses looking to meet these regulations can make the use of ESG tools to aid with the transition.

***

Further Reading: The EBA publishes its final Guidelines on the management of ESG risks

Bayer and Neste partner to develop renewable fuels

Bayer and Neste have formed a partnership to invest in sustainable feedstocks for renewable fuels. This collaboration aims to target the aviation and shipping industry in a push towards making cleaner fuels more viable for sustainable integration. Both industries struggle to transition to electrification, requiring large-scale rapid development to do so. Renewable fuels offer a more realistic, sustainable solution to meet industry climate goals. These hard-to-decarbonise sectors currently benefit more from investing in renewable fuels to align with emission regulations.

***

Further reading: Bayer and Neste to Collaborate on Developing Feedstocks for Renewable Fuels

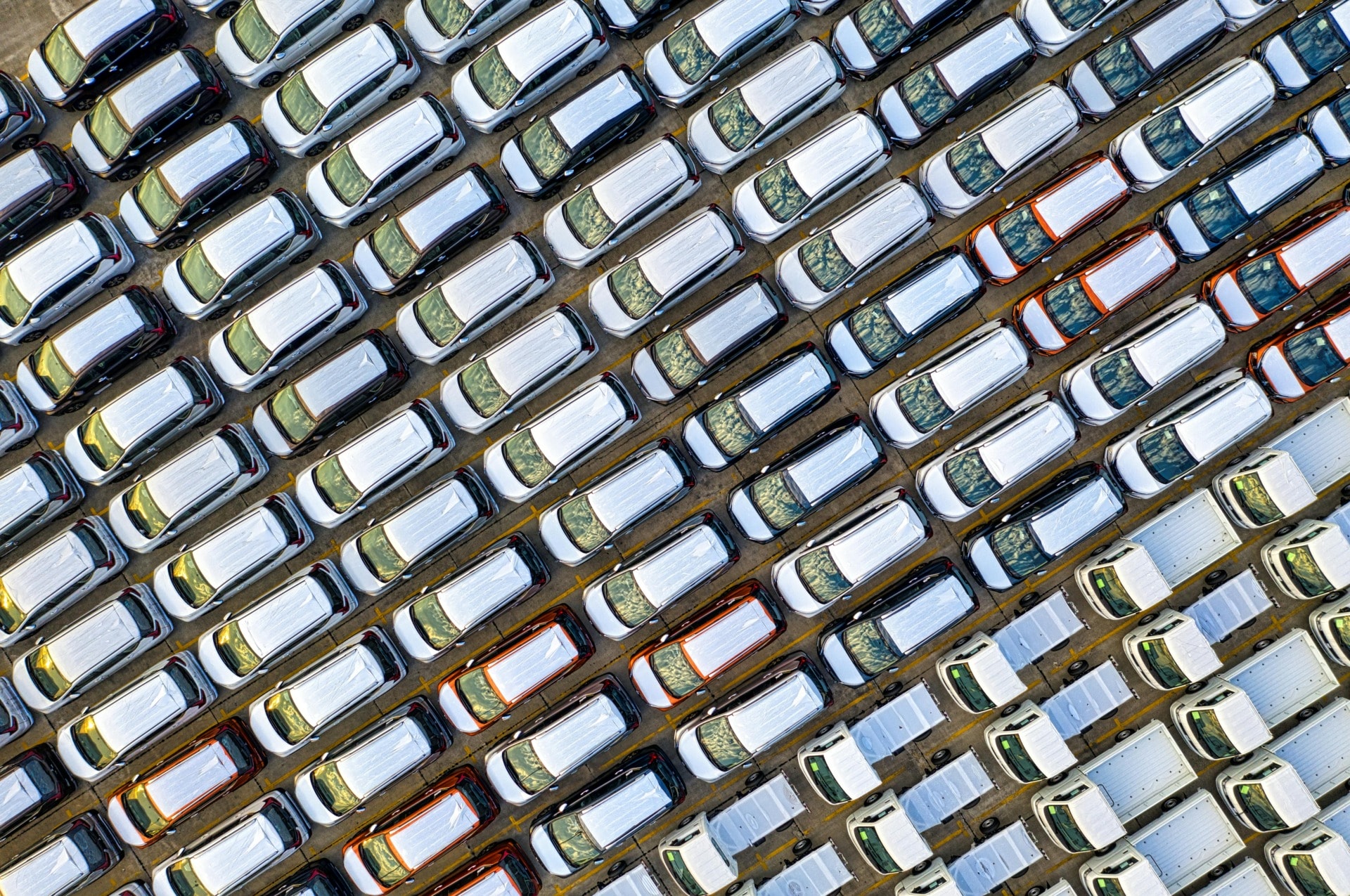

Editor’s Note: The opinions expressed here by the authors are their own, not those of impakter.com — Cover Photo Credit: Marc Rentschler