Today’s ESG Updates

- Quantinuum Valued at $10B After $600M Raise: Backed by Nvidia and QED, the firm eyes breakthroughs in AI, drug discovery, and cybersecurity.

- NY Fed Says AI Not a Job Killer Yet: Businesses report retraining over layoffs, though firms expect bigger impacts ahead.

- Trump Tariffs Target Global Goods: US imports of French luxury, Brazilian coffee, Chinese electronics, and Irish medicines face higher costs under new duties.

- US Small Caps Rally Past S&P 500: Russell 2000 jumped 7% in August, but rate cuts and economic health will decide if gains stick.

Klimado – Navigating climate complexity just got easier.

Klimado offers a user-friendly platform for tracking local and global environmental shifts, making

it an essential tool for climate-aware individuals and organizations.

Quantinuum Secures $600M Funding, Soars to $10B Valuation in Quantum Race

Quantinuum, a UK-US quantum computing firm, has reached a $10B valuation after raising $600M from investors including Nvidia and QED. The deal doubled the stake of founder Ilyas Khan to $2B, cementing Quantinuum’s role as one of the world’s most valuable quantum players. Formed in 2021 through the merger of Cambridge Quantum and Honeywell Quantum Solutions, Quantinuum develops both quantum hardware and software, with clients ranging from HSBC and JP Morgan to government agencies. Quantum systems promise breakthroughs in drug discovery, AI, and fraud detection, but experts warn they could also crack encryption, raising urgent cybersecurity challenges. The UK government has set a 2035 goal for quantum computers to surpass traditional supercomputers. CEO Rajeeb Hazra said the funding would “strengthen the entire quantum ecosystem,” while officials hailed it as a vote of confidence in the UK’s tech future.

***

Further reading: Quantum computing firm reaches $10bn valuation as investor interest builds

New York Fed Says AI Hasn’t Hit Jobs Yet, but Risks Loom

AI may not be the job destroyer many fear — at least not yet. A new blog from the New York Federal Reserve found that while AI adoption has risen sharply, especially among service firms, very few companies have reported layoffs tied to the technology. Instead, most businesses said AI use has led to retraining employees rather than cutting them. Currently, 40% of service firms and 26% of manufacturers in the district report using AI, with many planning to expand usage in the next six months. Still, researchers warned this trend may not last: as AI integration deepens, firms anticipate more significant layoffs and reduced hiring. The findings echo growing debates over AI’s long-term effects on professional and managerial jobs, even as short-term impacts remain modest.

***

Further reading: AI not affecting job market much so far, New York Fed says

Trump’s Tariffs on France, Brazil, China, and Ireland Shake US Imports

A new wave of Trump administration tariffs is reshaping how the US sources goods from its biggest trading partners. French luxury exports like perfume, handbags, and wine now face 15% tariffs, threatening brands such as Chanel and Dior. Imports from Brazil, including coffee, beef, and fruit, carry tariffs of up to 40%, though crude oil and iron are partly exempt. China, the largest supplier of electronics, faces 30% tariffs on items like household devices, though smartphones and laptops are currently spared. Ireland, the top exporter of pharmaceuticals to the US, has been hit with 15% tariffs, even as shipments surged ahead of the deadline. Analysts warn that higher costs could ripple across consumer prices, with companies relying on price hikes to offset tariffs. For Americans, everyday goods — from orange juice to laptops to medicines — are set to become more expensive.

***

Further reading: Do you know where the U.S. gets its goods from?

US Small-Cap Stocks Surge, but Can the Rally Last?

After years of lagging, US small-cap stocks are showing signs of life. The Russell 2000 index surged 7% in August, outpacing the S&P 500’s 2% gain and putting it within 4% of its 2021 record high. Analysts say the rally is fueled by expectations of Federal Reserve rate cuts, which would benefit debt-reliant smaller companies, and by strong earnings growth — Russell 2000 profits rose 69% in Q2 and are projected to climb at least 35% in each of the next six quarters. Still, small caps remain discounted by about 26% versus large caps, highlighting their value appeal. Yet risks loom: slower economic growth or investor flight back to mega-cap tech could derail the rally. For now, small caps are finally in the spotlight — but staying power remains in question.

***

Further reading: US small-cap stocks break out, but for how long?

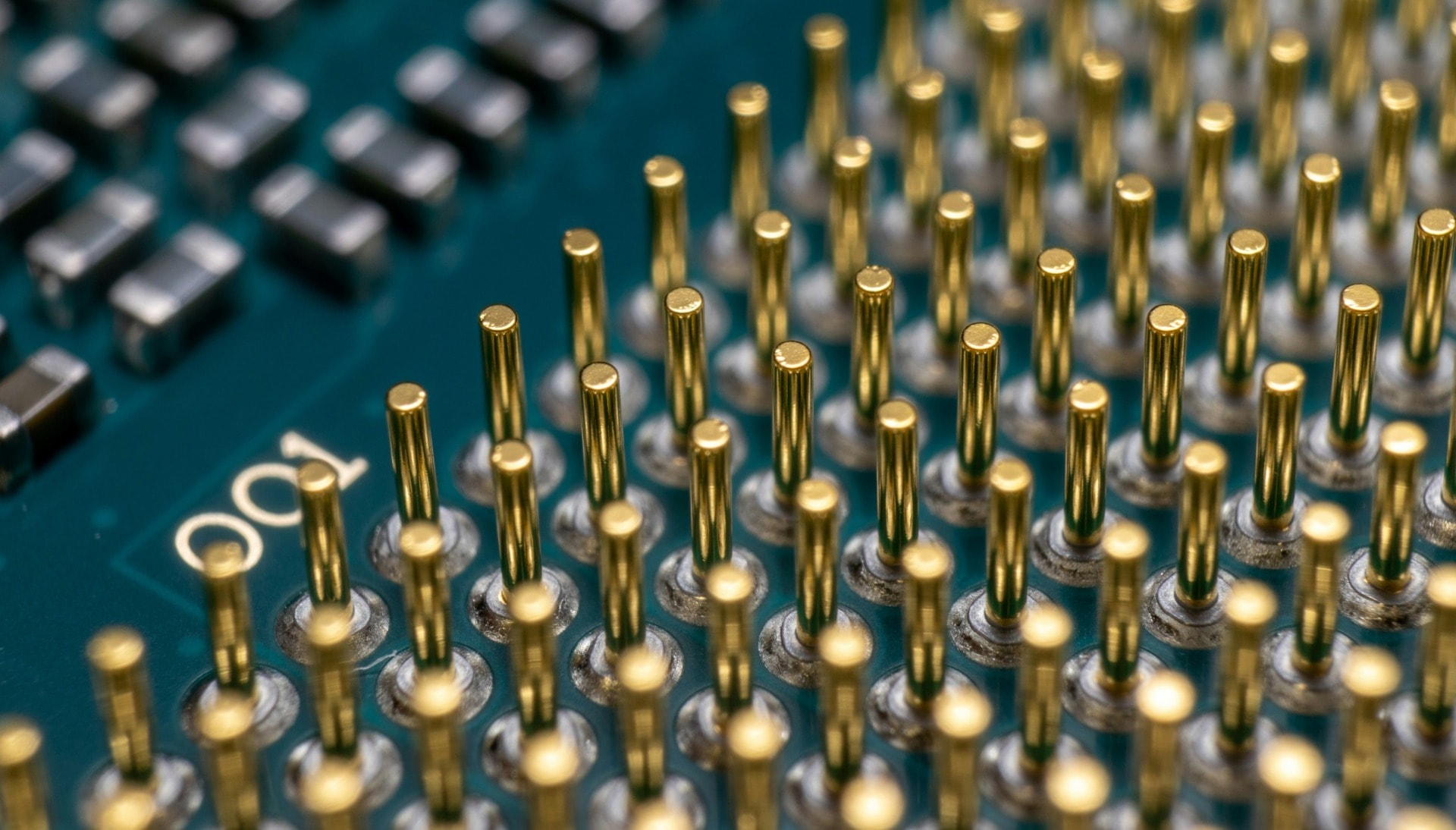

Editor’s Note: The opinions expressed here by the authors are their own, not those of impakter.com — In the Cover Photo: A computer generated image of an electronic device Cover Photo Credit: Alex Shuper