Today’s ESG Updates:

- Google Penalized for Anti-Competitive Practices in Australia: Australian consumer watchdog found that Google violated competition laws, resulting in a $35.8 million fine.

- EV Leasing Drops as U.S. Federal Subsidies Due to Expire: The cost of leasing electric vehicles in the U.S. is at an all-time low as dealerships aim to increase loyalty before the federal tax credit’s September expiration date.

- South Korea Increases Nuclear Power Output, Decreases Coal: South Korea has reduced its reliance on coal by 16%, while increasing and exceeding its nuclear power targets.

- UK’s FCA Strengthens Investor Confidence in Sustainability Loans: The UK’s Financial Conduct Authority has taken steps to address greenwashing and enhance the credibility of sustainability-linked loans (SLLs).

Klimado – Navigating climate complexity just got easier. Klimado offers a user-friendly platform for tracking local and global environmental shifts, making it an essential tool for climate-aware individuals and organizations.

Consumer watchdog finds Google guilty of breaking anti-competitive laws in Australia

An Australian consumer watchdog found that Google paid the country’s two largest telecommunications companies, Optus and Telstra, to pre-install the Google Search application. Under the deal with the telco companies, Google agreed to share advertising revenues from the app installed on all Android phones. After the Australian Competition and Consumer Commission (ACCC) called out the company for breaking consumer laws, Google admitted to inhibiting competition and agreed to pay 55 million Australian dollars ($35.8 million). Google also promised to avoid similar deals in the future. Now, the Australian Federal Court must decide if the fine is appropriate. Companies can utilize ESG solutions to ensure their operations align with country-specific policies.

***

Further reading: Google agrees $36m fine for anti-competitive deals with Australia telcos

EV leasing at an all-time low as federal incentives are due to expire in the U.S.

As federal subsidies for electric vehicles (EVs) approach their end in the United States, car dealerships are scrambling to get cars off the lot and gain loyal EV users. By the end of September, car companies are expected to lose federal tax credits of up to $7,500 per transaction. Leasing in the U.S. has grown in the EV market, as consumers weigh the risks of purchasing versus leasing a vehicle. 3 out of 4 electric vehicles in the U.S. are leased. One of the most luxurious vehicles on the market, the Mercedes EQB, can be leased for $352 per month. In Boulder, Colorado, a local dealership is leasing Volkswagen’s ID.4 for an incredibly low cost of $39 per month. Dealerships across the U.S. are hoping that the low prices now will lead to an increased demand for EVs, as prices are expected to rise in the near future.

***

Further reading: You Can Now Lease an EV for Less Than $100 a Month

Nuclear power replaces coal in South Korea

South Korea has seen a decrease in coal-fired output as nuclear power has soared in the country. According to state-run utility Korea Electric Power Corp (KEPCO), nuclear power use has increased by 8.7% in the first half of 2025, exceeding the initial target of 2.9% annually. KEPCO’s data also showed a 16% decrease in coal usage. GlobalData predicts that South Korea could produce 222.7 terawatt-hours of nuclear energy in 2035. After China, South Korea is the second-largest generator of nuclear power in Asia. The country’s president, Lee Jae Myung, has vowed to remain committed to increased nuclear power.

***

Further reading: South Korea’s nuclear power growth exceeds targets

FCA strengthens investor trust in sustainability-linked loans

Sacha Sadan, Director of ESG at the UK’s Financial Conduct Authority (FCA), issued a letter detailing improvements in the sustainability-linked loan (SLL) market. In the letter, he claims that the market for SLLs has clearer goals and “more robust product structures.” In 2023, the financial authority released a report warning of greenwashing in the SLL market, citing poor design and a lack of transparency. Sadan said, “There are still barriers to scaling the SLL market and concerns about incentives, but the improvements we observed are important steps in the development of a credible transition finance ecosystem.” Sustainability-linked loans were created to help borrowers reach ESG goals. Companies can ensure their ESG goals are met with the help of ESG tools.

***

Further reading: ESG loan market now less marred by greenwashing: UK FCA

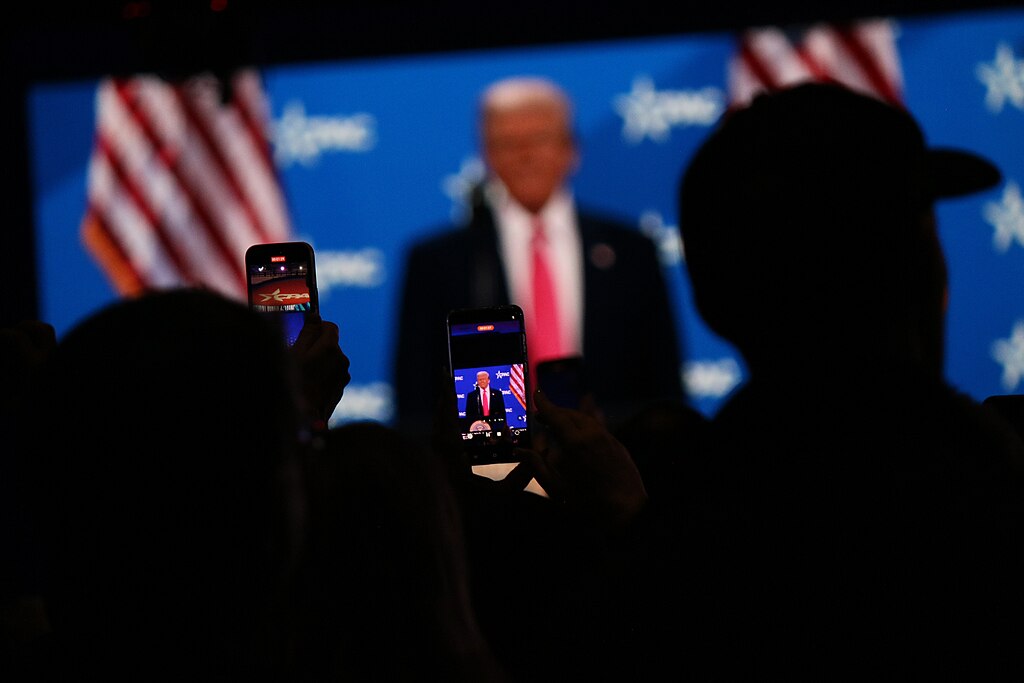

Editor’s Note: The opinions expressed here by the authors are their own, not those of impakter.com — In the Cover Photo: Google Search Engine open on a smartphone Cover Photo Credit: Solen Feyissa