Today’s ESG Updates:

- ExxonMobil Steps Up its 2030 Transformation Plan: Aims to sharply boost profits and cash flow by 2030 without increasing capital spending, and with a tighter, more selective low‑carbon spend.

- Teck Secures Shareholder Support for Anglo American Merger: Teck shareholders approved a “merger of equals” with Anglo American, creating one of the world’s largest copper producers.

- Fervo Energy Raises $462 Million to Accelerate Geothermal Development:

Fervo aims to deliver reliable and carbon-free power generation at scale for future data centres. - GRI Releases Draft Workforce Human Rights Disclosure Standards:

GRI has released drafts of four labour-related standards and opened a public consultation on them, accessible via its exposure draft portal.

ExxonMobil steps up its 2030 transformation plan

ExxonMobil is targeting about “$25 billion in earnings growth and $35 billion in cash flow growth versus 2024” at constant prices and margins, with “no increase in capital spending” and ROCE (Return on Capital Employed) above 17%. The American oil and gas magnate expects a ~$145 billion cash-flow surplus over the next five years at a 2024‑equivalent Brent crude price of $65/bbl (barrel), while maintaining buybacks of ~$20 billion/year through 2026. Upstream production is forecasted to reach 5.5m boe/d (barrels of oil equivalent/day) by 2030, with major assets like the Permian Basin in West Texas, the Stabroek Block in Guyana, and Exxon’s LNG (liquefied natural gas) operations supplying ~65% of its total volume.

Output from the Permian Basin is set to double to ~2.5m boe/d, and the basin is now estimated to produce $4bn annually. Furthermore, ~$20bn is allocated to low-carbon projects, with ~60% aimed at third‑party emissions supported by ~9 Mtpa (Million Tonnes per Year) of CO₂ CCS (Carbon Capture and Storage) contracts and a first integrated CCS‑enabled data-centre project targeting a first investment decision by 2026.

***

Further reading: ExxonMobil raises its 2030 transformation plan

Teck secures shareholder support for Anglo American merger

Teck (TSX: TECK.A; TECK.B; NYSE: TECK) shareholders have approved a “merger of equals” with Anglo American plc (LON: AAL), clearing a key hurdle to creating “Anglo Teck,” a global leader in copper and other critical minerals company headquartered in Canada.

83.3% of all outstanding Class A shares and 79.4% of all outstanding Class B shares attended the outstanding meeting, showing broad engagement and support from both classes of Teck shareholders. The result from the meeting is that 99.7% of Teck’s Class A shareholders voted in favour of the merger, while 89.7% of Class B shareholders also voted in favour.

Teck President and CEO Jonathan Price called the merger a “resoundingly positive vote” that will deliver “a world-class copper growth portfolio, operational and functional synergies, and a stronger platform to meet growing demand for critical minerals.” The deal still requires Investment Canada Act sign‑off, competition and other regulatory approvals worldwide, and final approval from the Supreme Court of British Columbia before completion.

***

Further reading: Teck Reports Voting Results from Special Meeting of Shareholders

Klimado – Navigating climate complexity just got easier. Klimado offers a user-friendly platform for tracking local and global environmental shifts, making it an essential tool for climate-aware individuals and organisations.

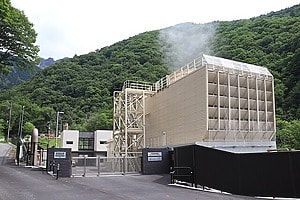

Fervo Energy raises $462 million to accelerate geothermal development

Fervo Energy has raised $462 million in a Series E round to accelerate next‑generation geothermal, backing its Cape Station project in Utah and additional “clean and firm power” developments.

The company says the current energy markets demand “dependable and carbon-free power at an unprecedented scale” and claims it is “uniquely positioned to supply it.” The Cape Station project is permitted to expand up to 2 GW and is expected to deliver 100 MW by 2026 and a further 400 MW by 2028 to meet surging demand from AI and electrification. The round was led by B Capital and included Google as a new investor, alongside Bill Gates-backed Breakthrough Energy Ventures and a long list of institutional and strategic backers.

Fervo Energy CEO and Co-Founder Tim Latimer says the raise “sharpens our path from breakthrough technology to large-scale deployment… building the clean, firm power fleet the next decade requires.”

***

Further reading: Fervo Energy Raises $462 Million Series E to Accelerate Geothermal Development and Meet Surging Energy Demand with Clean, Firm Power

GRI releases draft for workforce human rights disclosure standards

The Global Reporting Initiative (GRI) has published exposure drafts updating four key labour-related standards: Workers in Business Relationships (GRI 414), Forced Labour (GRI 409), Child Labour (GRI 408), and Freedom of Association and Collective Bargaining (GRI 407).

As part of a labour project launched in 2022 to revise eight labour standards, with final publications expected from mid‑2026. The drafts expand disclosures on due diligence, working conditions, incident reporting, grievance mechanisms, prevention, remediation, and engagement with worker representatives, reflecting “growing demands for organisations to tackle negative impacts on workers in their value chains.” Including worker poverty, informal work, gender inequality, and persistent child and forced labour.

GRI has opened a public consultation on the drafts up until 9 March 2026, accessible via its exposure draft portal. Click here to read the official GRI press release.

***

Further reading: GRI Releases New Draft Standards for Workforce Human Rights Disclosure Standards

Editor’s Note: The opinions expressed here by the authors are their own, not those of impakter.com — In the Cover Photo: An offshore oil rig, just like ExxonMobil’s Stabroek Block facility in Guyana. Cover Photo Credit: Wikimedia Commons