The Energy Transition Investment Trends 2024 report from BloombergNEF, published on January 30, unveils a remarkable 17% surge in global investment in the low-carbon energy transition, which in 2023 soared to an unprecedented $1.8 trillion.

As BloombergNEF notes, these findings “demonstrate the resilience of the clean energy transition in a year of geopolitical turbulence, high interest rates and cost inflation.”

“Last year brought new records for global renewable energy investment. Strong growth in the US and Europe drove the global rise, even as China, the world’s largest renewables market, sputtered, recording an 11% drop. Despite a year of tough headlines, a record amount of offshore wind capacity also reached financial close,” said the co-author of the report and BNEF’s Head of Clean Power, Meredith Annex.

Investments by sector

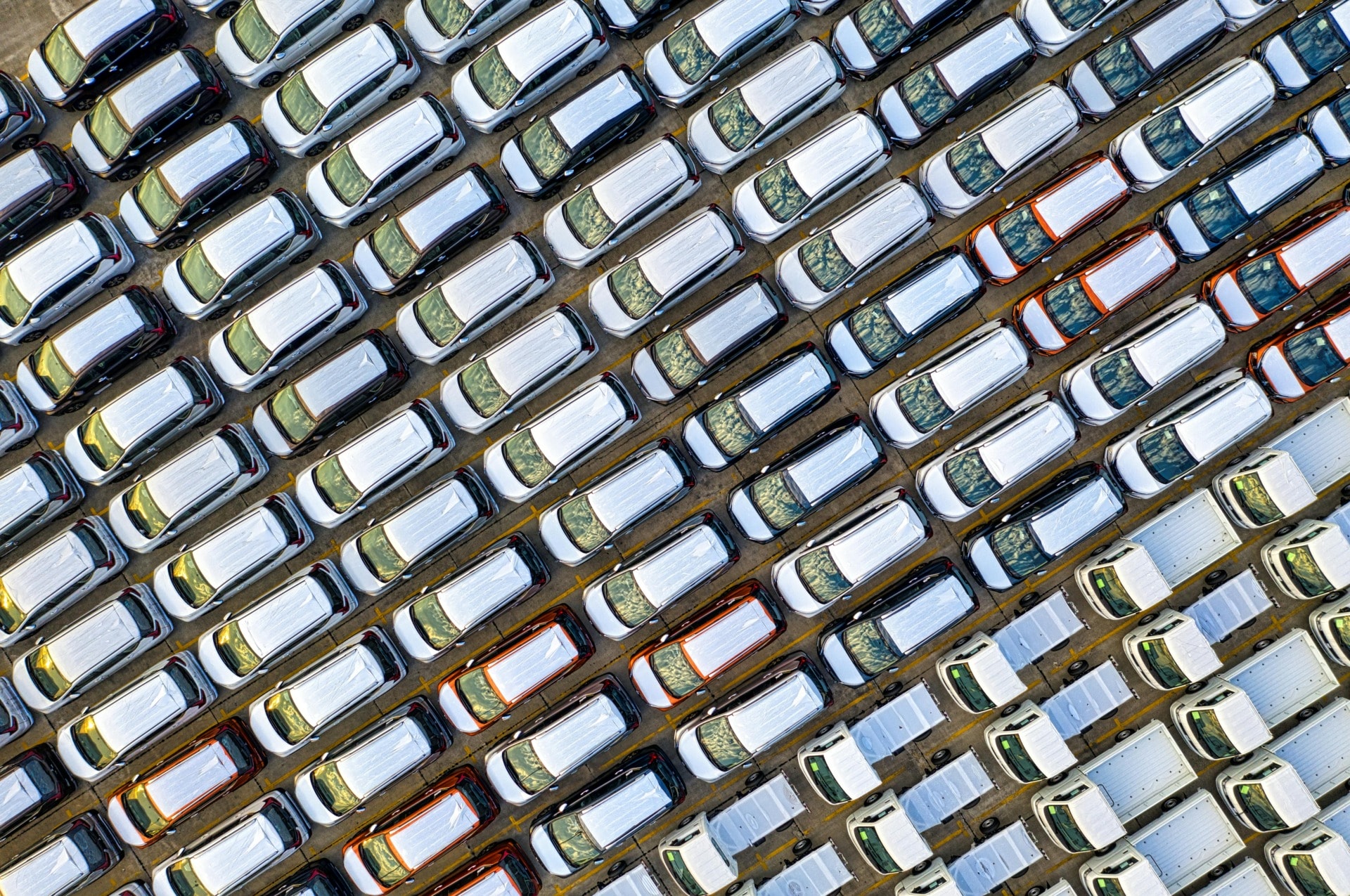

Among sectors, electrified transport — which includes investments in “electric cars, buses, two- and three-wheelers and commercial vehicles, as well as associated infrastructure” — came out on top; the sector saw a remarkable 36% growth in 2023, reaching $634 billion and overtaking renewable energy as the clean energy sector attracting the most investment.

Following closely behind, investments in renewable energy in 2023 amounted to $623 billion, 8% more than in 2022. Investments in the power grid in 2023, the third on the list, amounted to $310 billion.

The report also found significant progress in emerging areas: In 2023, hydrogen investment tripled, carbon capture and storage nearly doubled, and energy storage rose by 76%.

Investments by country

Having invested $676 billion in the energy transition in 2023 — 38% of the global total — China remains the “largest country for investment by far.”

However, China’s lead in this area appears to have decreased; while in 2022 the country invested more in the energy transition than the European Union, US, and UK combined, the Western trio outspent China in 2023.

Related Articles: ‘Green Lemons’ Need to be Squeezed out From the ESG Market | Why You Should Invest Sustainably | Most Companies Unprepared for New ESG Rules, Report Finds | ESG Is Here to Stay, Investors Say | ESG: A Strategic Imperative or Inconvenient Necessity?

The US, which came in second, invested $303 billion in the energy transition in 2023, 22% more than in 2022.

Germany, the UK, and France came in third, fourth and fifth, with $95.4 billion, $73.9 billion, and $55 billion invested in 2023, respectively.

Insufficient progress

Despite the record-breaking figures, the report emphasizes that the current investment level “is not nearly sufficient to set the world on track for net zero by mid-century.”

To achieve the Paris Agreement-aligned trajectory, investments in the clean energy transition would need to triple and reach an average of $4.8 trillion per year from 2024 to 2030.

“Our report shows just how quickly the clean energy opportunity is growing, and yet how far off track we still are,” said Albert Cheung, Deputy CEO of BNEF. “Energy transition investment spending grew 17% last year, but it needs to grow more than 170% if we are to get on track for net zero in the coming years. Only determined action from policymakers can unlock this kind of step-change in momentum.”

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — Featured Photo Credit: Pexels.