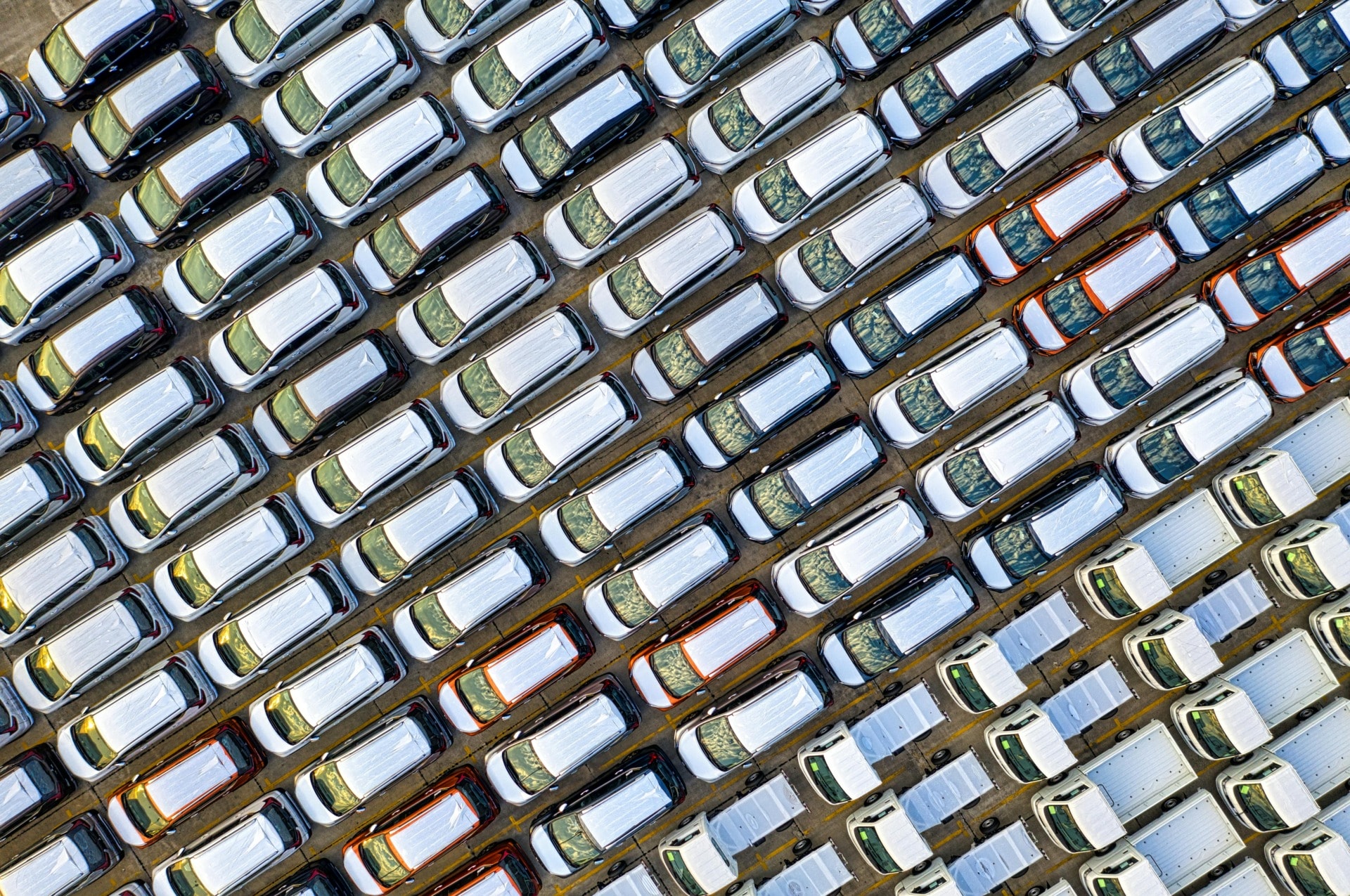

At this moment, there is a freight ship bound for Europe with 7,000 electric cars due to be hitting the roads by the summer. This container ship and the cars on it are all owned by the same company — China’s BYD, or “Build Your Dreams,” the country’s largest automotive firm and one of its largest private companies.

This ship signifies the intensifying race between Western and Chinese firms to capture the ever-growing electric vehicle (EV) market, with Europe currently one of the main battlegrounds.

An analysis by the European Federation for Transport and Environment, published at the end of March, predicted that 20% of Europe’s EV sales could come from Chinese companies by 2027. This comes as the European Commission is currently operating an anti-subsidy investigation into China’s EV exports to the continent, arguing their low-cost car models are a threat to domestic producers — an investigation the Chinese government has called “blatant protectionism.”

Just last week, Rhodium Group, a New York-based think tank, published an analysis that found that the European Union (EU) would likely need to impose tariffs “around 45%, even 55%” on highly competitive Chinese EV manufacturers — such as BYD — in order to effectively control imports.

It is believed that the EU will impose tariffs of around 15% to 30% sooner rather than later, an increase from the 10% tariff currently in place. If this is indeed the case, Rhodium argues that Chinese manufacturers will still enjoy a large enough profit margin to comfortably continue their exports to Europe.

Rhodium continues that the EU could use other means to deter the competition from China, including subsidizing European automakers and even limiting imports from Chinese manufacturers as a measure of national security.

Still, as BYD plans to open a manufacturing plant in Hungary in 2027, doubling as a hedge to potential policy risks from the EU, it is clear that these cars are here to stay.

In February already, BYD unloaded 3,000 EVs in Bremerhaven, Germany, with more arriving every month. Last year, BYD struck a deal with British manufacturer Octopus Electric Vehicles which will bring 5,000 BYD cars to the UK by the end of 2026.

The company continues to grow at a lightning pace. In the final quarter of 2023, BYD’s total EV sales surpassed Tesla. The Chinese firm sold 10% more EVs than their American rival in the period.

This trend has not come out of nowhere. China itself has had the largest automobile sales volume for each of the past 15 years, and BYD has long been its largest EV manufacturer.

In China alone, the proportion of automobile sales that have come from EVs has increased from just 5% in 2019 to over 35% now. From selling 0.5% of the EVs in Europe in 2019, Chinese companies were responsible for 9% of those sold in 2023 on the continent.

The reality is that the Shenzhen-based BYD’s electric cars only began capturing a significant market outside of China recently, with exports growing over 330% compared to 2022, reaching over 70 countries.

In their 2023 annual report, BYD credited their technological advancements, a growing EV market and support from partners — including NVIDIA and even Warren Buffett — for their recent success.

A partnership with Toyota to fund research and development of EV batteries has positioned BYD to vertically integrate more of their business. It is estimated that around three-quarters of the components used in building their EVs are manufactured by BYD themselves, allowing them to cut out many logistical and production costs.

And with a history of beneficial government subsidies, BYD can churn out vehicles at a much cheaper rate than their international counterparts. Ford CEO Jim Farley said earlier this year that Chinese EV producers held a “20 to 30%” advantage when it came to costs.

This has allowed BYD to significantly undercut competitors’ pricing. Right now, BYD’s cheapest model costs just under $10,000 in China. For reference, the cheapest available EV in the United States is about three times the cost, which has worried many Western manufacturers who fear they simply cannot compete in terms of price.

Related Articles: Tesla Autopilot Crashes: With at Least a Dozen Dead, ‘Who’s at Fault, Man or Machine?’ | EU and UK Delay Tariffs for Electric Vehicles and Batteries | This Is How to Increase EV Uptake | Autopilot Problems Continue: Tesla Recalls Almost All Vehicles in America | What Will E-Transport Look Like in 10 Years? | Chinese Automaker BYD to Dethrone Tesla as Global Leader in Electric Cars | Electric Vehicle Market in 2024: What Can We Expect?

“Frankly, if there are not trade barriers established, they will pretty much demolish most other car companies in the world,” argues Elon Musk, whose automaker Tesla entered the Chinese EV market in 2020 despite the 25% tariff Tesla and foreign manufacturers must pay in China.

In the United States, a 25% tariff on Chinese-made automobiles introduced in 2018 — compared to the 2.5% tariff that remains for all other foreign-made cars — has so far deterred BYD from entering their domestic market. But the anticipation is that as BYD continues to grow rapidly as a company, and the EV market booms globally, it is only a matter of time before these cars enter the United States as well.

While international competition continues to grow, BYD executive vice president Stella Li has downplayed any rivalry with Tesla, calling them a “partner” and a company that is “pushing the whole auto industry to transition to the future electric car.”

“Our real competition is the ICE car,” says Li, referring to the fossil-fuel-consuming engines used by traditional automakers.

This, along with market forces driving down costs and prices across all EV manufacturers, means that the real winner of the EV race might indeed be the everyday driver, and the planet.

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — Cover Photo Credit: P. L.