Launched in early 2021, Atmos Financial, PBC is among a new breed of climate fintech companies that are seeking to utilize the disruptive power of technology and capital to accelerate solutions for the climate crisis.

Atmos offers high-impact, high-yield online FDIC-insured savings accounts in a user-friendly, platform. Account opening takes just a few minutes in most cases and is currently available for US residents.

“We have the science and technology to respond to the climate crisis, but the larger financial and political systems have been too slow to respond,” says Pete Hellwig Co-Founder of Atmos. “We don’t have the time to listen to more excuses and deny the urgency of the situation. We need to act and we all need to take some sense of responsibility for our actions.”

By offering retail banking and atm services, Atmos is seeking to reach a growing market of consumers that want to align their purchasing power with their values to make a positive impact on the world. While some banking services have focused on creating products for underserved communities around the world, or local economic development, Atmos has set its sights on the climate conundrum.

Our money creates change in the world every day. If it is held in a deposit account at a bank, that money is generally being used to fund loans, and those loans are supporting companies and projects, perhaps home mortgages. But it is absolutely wrong to assume those loans are being used as a force for good in the world or to fund climate solutions. Almost without exception, deposits held in the largest banks, in particular, are still funding the status quo. The status quo got us into this mess. We all need to better understand the power our money has in the world and exercise that power.

The concept of values-aligned investing has grown steadily over the last decade. ESG/SRI investing now purportedly accounts for upwards of one-third of all investing in the U.S., approximately $17 trillion in assets under management according to the US SIF Foundation. Atmos is among a handful of entities pushing to bring these values to the sector of everyday cash accounts.

ESG investing is really difficult for a number of reasons. There are no centralized methods of measurement and it’s largely based on company-reported metrics and data, leaving room for many companies to claim ESG/SRI-friendly status without really implementing meaningful, systemic change. Banking is a totally different sector though. There is no black box for banking. We can measure the carbon impact of the loans we make with a high degree of accuracy, and there is no reason why 100% of our loans can’t be climate positive. Banking needs to be an accelerant to climate solutions, not an impediment, but unfortunately, the industry hasn’t moved much in the last 30 – 40 years.

RELATED ARTICLES: Bezos and Amazon: Going Really Green or Pretending?|There’s Work to Do & Here’s the Roadmap – The UK’s Energy White Paper |What You Might Not Know About Impact Investing, and How It Can Help Stop the Climate Crisis |China & Singapore Deepen Special Relationship with Green Finance Collaboration | If We Want To Achieve The UN’s Sustainable Development Goals, We Need To Start Increasing Farmers’ Incomes |Regulation A Investment Options Will Benefit Sustainable Startups the Most Next Year

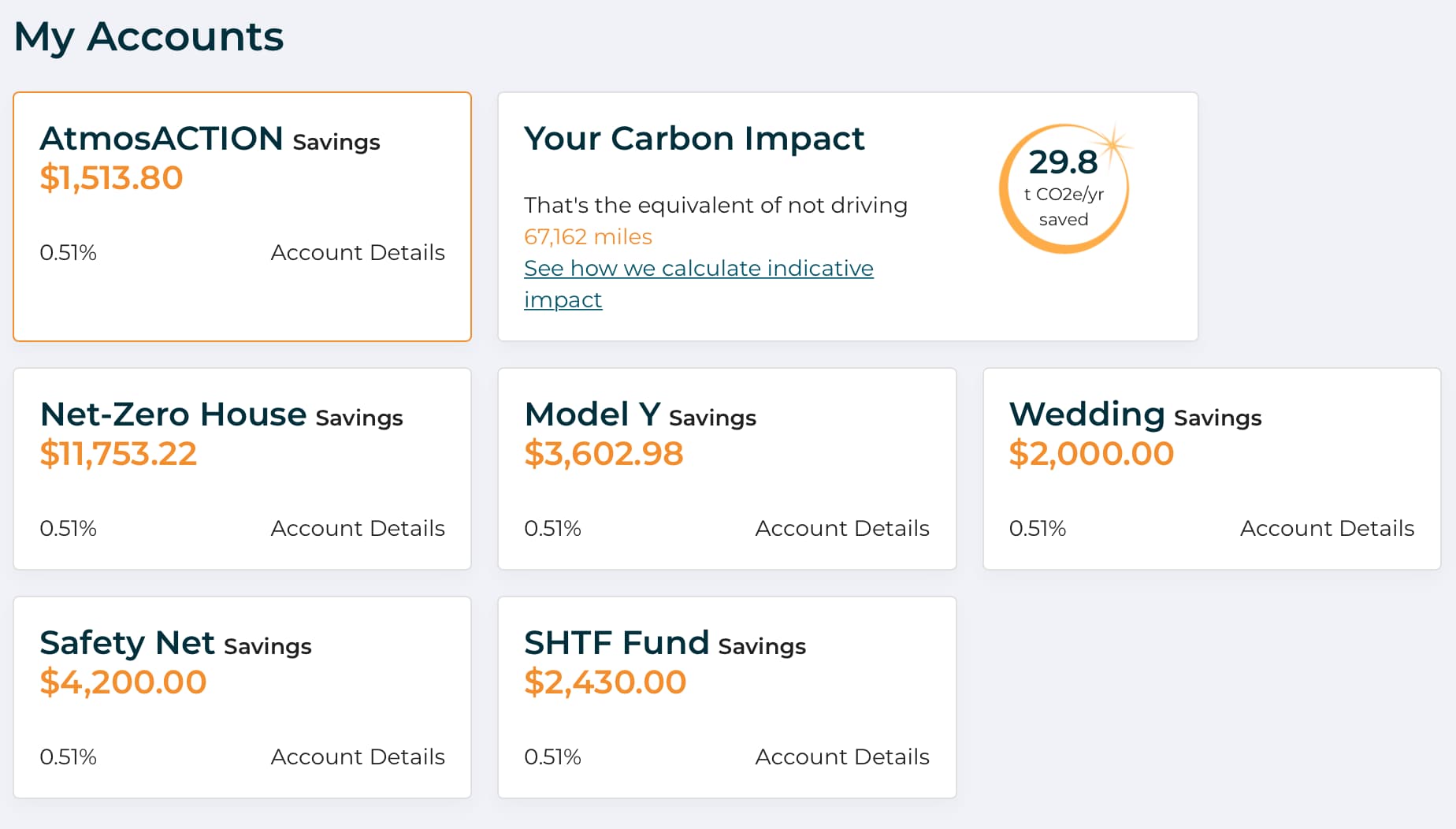

Under the Atmos model, all of its deposits will be used in climate-positive infrastructure, supporting things like renewable energy, electric transportation, energy efficiency, and circular economy solutions. Atmos plans to measure the carbon impact of its loan portfolio and deliver that data back to every customer in a friendly format that measures the impact of their deposit balances.

“I think the impact dashboard we have coming soon is really exciting. It connects customers to what their money is doing in the world. Our money isn’t sitting in a vault, and it’s not funding fossil fuels. It’s having a positive impact and we’re excited to share these stories and close the feedback loop for our customers. It’s their money after all. Why shouldn’t customers know what their money is funding? We want to move the industry beyond marketing spin, beyond feel-good billboards of wind turbines along freeways. That means being completely transparent, knowing the data and then letting it speak for itself.” says Pete Hellwig Co-Founder of Atmos

Atmos is also using its platform as a financial services provider to bring more resources to nonprofit organizations on the front lines. Atmos customers are offered an even higher rate on their deposits when they elect to make recurring donations to one or more environmental organizations.

We want to help generate recurring revenue streams for these world-changing organizations. Many organizations have been under-staffed and under-funded, sounding the climate alarm for decades. We really need these organizations to staff up and take a more central role in policy discussions and that takes resources. They are among the most knowledgeable and informed but are too often overlooked. All donations processed on the Atmos platform are fee-free.

Atmos savings accounts, branded AtmosACTION accounts, require no minimum balance and have no monthly maintenance charges. Customers can connect an external bank account and move money to/from their Atmos accounts as it’s needed with next-day settlement.

The climate crisis is daunting, and we all need to get involved in order to stop it — one of the easiest, high-leverage activities we can do is to move our money away from funding fossil fuels and towards funding clean energy and a resilient, equitable economy. Atmos was created to democratize climate action so no matter where someone lives, or what they do, they can help stop climate change.

If you wish to join Atmos, please click here.

Editor’s Note: The opinions expressed here by Impakter.com contributors are their own, not those of Impakter.com