Accenture (NYSE: ACN) will acquire Melbourne-based CyberCX in what Reuters reports is its largest cybersecurity deal to date, with The Australian Financial Review valuing the transaction at more than A$1 billion (≈$650 million). Neither Accenture nor seller BGH Capital disclosed financial terms.

Formed in 2019 via the merger of 12 security firms backed by BGH Capital, CyberCX has ~1,400 employees, operates SOCs across Australia and New Zealand, and maintains offices in London and New York. The company is led by CEO John Paitaridis (ex-Optus Business) and CSO Alastair MacGibbon (Australia’s former national cybersecurity coordinator).

Strategic backdrop: Australia has endured a string of high-impact incidents Optus and Medibank breaches affecting about 10 million people each, and Qantas’s July 2025 disclosure that criminals accessed data of roughly six million customers—driving demand for scaled managed security and incident response.

The acquisition also fits Accenture’s longer M&A arc in security 20+ buys since 2015 and complements its domestic push with Telstra through a seven-year, ~A$700M AI joint venture to modernise data and AI platforms.

Conclusion: Accenture’s move for CyberCX is a scale-and-trust play: it anchors a leading ANZ managed-security platform inside a global services engine, directly addressing Australia’s breach-driven demand while complementing Accenture’s AI build-out with Telstra. Execution now matters integrating ~1,400 specialists, preserving client relationships, and harmonizing SOC tooling but if absorbed cleanly, this becomes Accenture’s regional cyber cornerstone and a template for AI-enhanced, end-to-end security services globally.

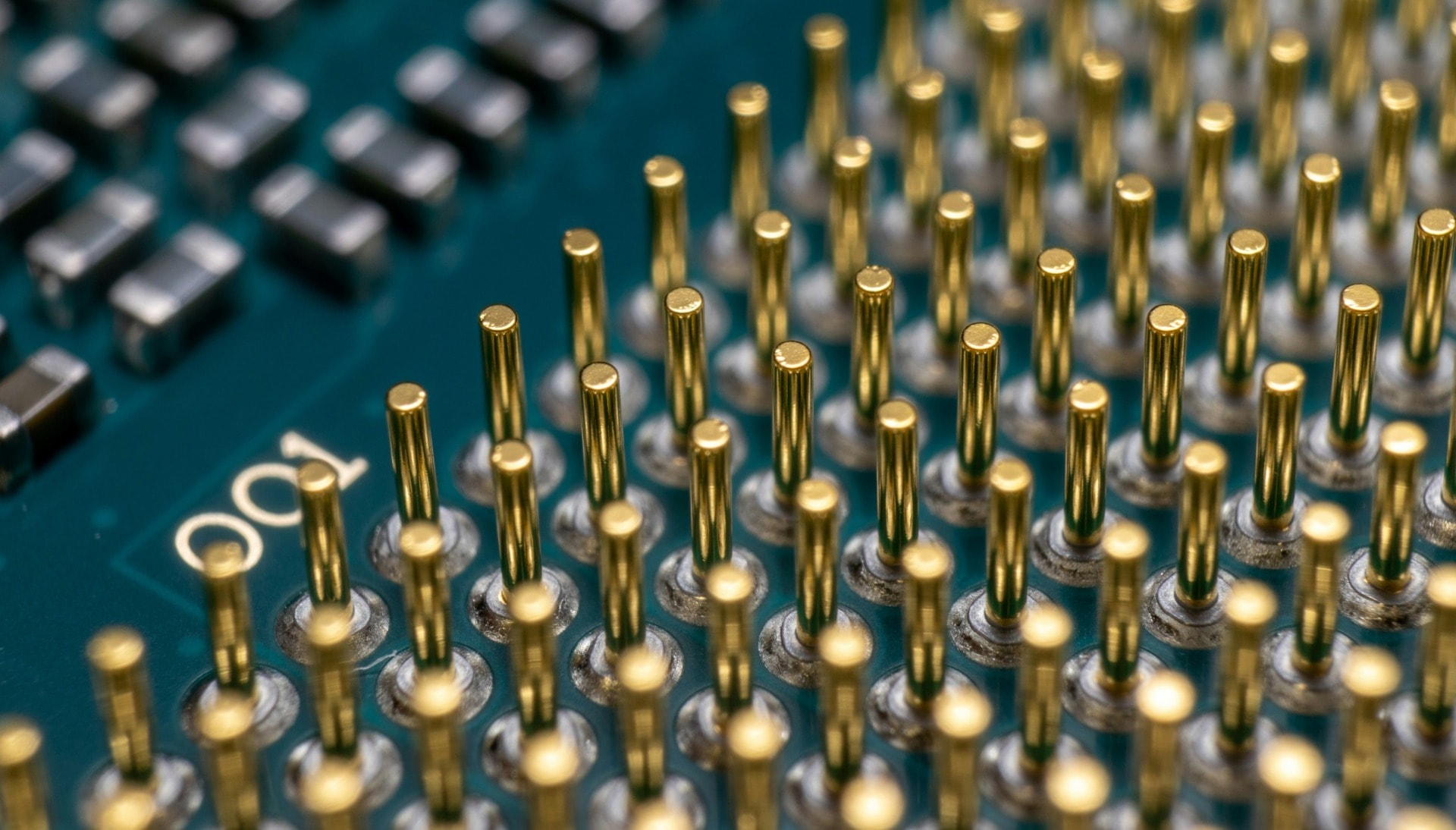

Editor’s Note: The opinions expressed here by the authors are their own, not those of impakter.com — In the Cover Photo: Accenture building, Jul. 21, 2020. Cover Photo Credit: wikkmediacommons