Although there’s a growing interest in the preparation of financing strategies for climate adaptation, there is no common understanding of what the scope of these strategies should entail, what constitutes good practices for their development, or whether these strategies are truly effective.

IISD sought to shed some light on these questions as part of a 4-year research project focused on ways to scale up investment of development finance in actions that align with the adaptation priorities of developing countries.

Developing countries are increasingly shifting the focus of their climate adaptation efforts from planning to implementation. A critical step in this transition is securing funding to implement the adaptation actions that countries have deemed priorities after undertaking strategic processes, such as the preparation of a National Adaptation Plan (NAP) or nationally determined contribution (NDC) under the UN’s Paris Agreement.

To achieve this step, several developing countries have prepared or plan to prepare financing strategies for climate adaptation. This term encompasses the various finance, investment, and resource mobilization plans, strategies, or roadmaps that seek to increase financing for climate adaptation.

Many countries have included the development of these strategies in their proposals submitted to the Green Climate Fund to increase their readiness to prepare their NAPs. Despite a growing interest in the preparation of financing climate adaptation strategies, there is still little knowledge or understanding of what works best. This is why we set up a 4-year research project to study the best ways to scale up investment of development finance in actions and strategies in line with the economic priorities of developing countries.

Gathering details of climate adaptation strategies: A global scan

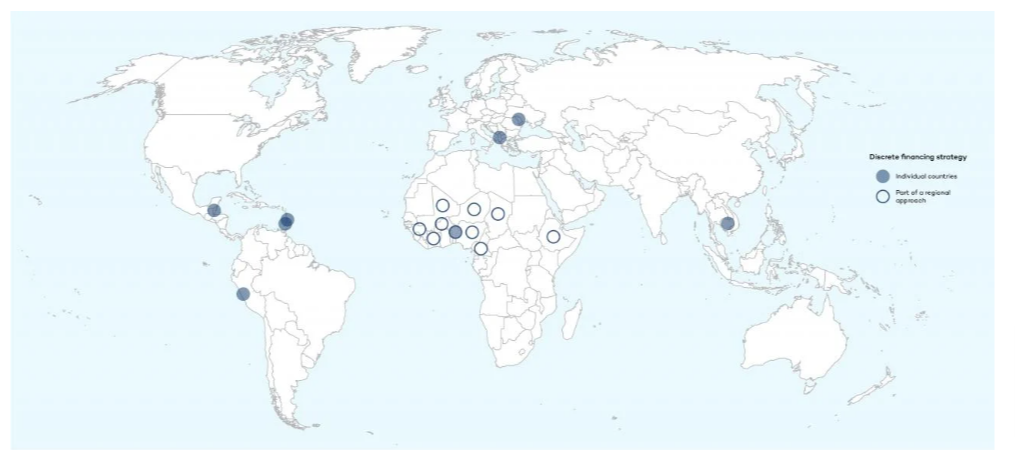

We carried out a first-of-its-kind review of publicly available financing strategies for climate adaptation in developing countries. This review covered two types of strategies:

- Discrete financing strategies: those that focus solely on climate adaptation, such as NAP resource mobilization strategies.

- General financing strategies for climate action: those that seek financing for adaptation as part of a broader package, as seen with climate change financing strategies and NDC financing roadmaps.

We examined a total of 24 financing strategies for climate adaptation — 10 discrete strategies and 14 general financing strategies — covering a broad range of countries and regions (see Figures 1 and 2 below).

These strategies were prepared by developing countries or for them by other organizations, such as multilateral development banks, United Nations specialized agencies, and technical partners like the NDC Partnership and the NAP Global Network, whose secretariat is hosted by IISD. The capacity-building and technical support provided by these organizations plays a significant role in facilitating the creation of financing strategies for adaptation and shaping their content.

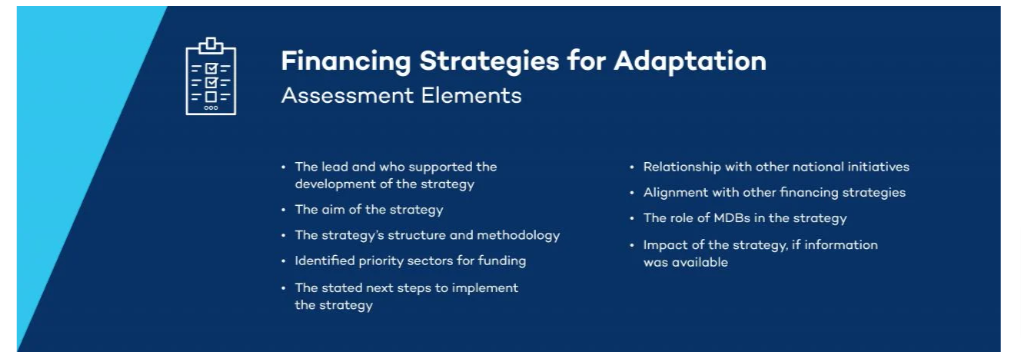

To better understand the landscape of financing strategies for climate adaptation, each country’s strategy was assessed using a common framework, as seen below.

Connecting the dots: What did we find?

The review process showed that countries are taking a wide range of approaches when preparing their financing strategies for climate adaptation. Some countries prepared shorter, less-detailed documents that aimed to build high-level support for financing climate (adaptation) priorities, such as the Island States in the Indian Ocean’s eight-page strategy. Other countries developed longer, comprehensive documents with detailed costing information, such as Cambodia’s 123-page financing framework for adaptation.

Related Articles: Bold Move or Status Quo? Is the New UN Funding Compact Enough? | How Emerging Economies Can Pursue Green Recoveries | Flexible Pooled Funding Mechanisms Can Drive Transformative Change

Some countries attempted to identify an adaptation financing gap and ways to fill this gap using domestic and international sources of finance, while others did not—perhaps because many do not have information about the amount of domestic and international public financing already mobilized to support climate adaptation or ready access to detailed cost estimates for specific adaptation actions.

Few financing strategies for climate adaptation included an analysis of which types of adaptation projects would be most appropriate for funding by different types of finance instruments, such as which are most likely to attract private sector investment. Very few included processes to monitor and evaluate the financing strategy’s success.

A fuller picture: Guidance for future strategies

Despite these differences, four emerging insights surfaced from the review that governments, as well as the organizations working with them, could use as they prepare financing strategies for climate adaptation in the future.

1. Countries may not need to calculate an adaptation finance gap in their strategies.

The development of costing information for a long list of adaptation actions can be expensive, time-consuming, and requires extensive stakeholder consultation. Rather than investing in this analysis, developing country governments could choose to use the strategy to identify a few key areas for resource mobilization in the short term and provide direction on the strategic use of public funds to scale up adaptation financing within these priority areas.

2. Financing strategies could place greater emphasis on the targeted use of public finance to enable more transformative change and attract additional investment, including from the private sector.

While most strategies identified ways to increase domestic public finance allocations and sources of international public finance for adaptation, governments and collaborating organizations could place greater attention on how these investments fit together. They should also see how this public finance could help leverage funding for other purposes and from other sources, such as the private sector. For instance, public finance could be used to fund the climate-resilience component of an agriculture sector project otherwise financed by the private sector.

3. Ministries that lead on climate adaptation need to engage actively in processes to develop financing strategies for NDCs, the Sustainable Development Goals, national development plans, and COVID-19 pandemic recovery.

By engaging in these processes, ministries responsible for climate adaptation can inform other ministries of their financing priorities and ensure that these needs are considered as part of a country’s broader financial planning and decision-making processes. Doing so can encourage the use of development finance to finance adaptation needs and promote alignment of national priorities.

4. Improved tracking of finance for climate adaptation by developing country governments is needed at the country level.

A lack of data regarding current flows of financing for climate adaptation constrains the capacity of developing countries to estimate their financing gaps and determine the impact of their financing strategies.

Greater investment by developing countries, with the assistance of their development partners, in systems to monitor international public finance flows for adaptation can help assess the extent of—and conditions that enable—success in mobilizing investment.

The review also reiterated the importance of three well-established good practices to be followed by developing country governments, as well as the organizations working with them, to increase their likelihood of securing financing for adaptation:

1. Ensuring that financing strategies for climate adaptation are country-driven and fit for their purpose, which could be to either raise awareness of financing needs among domestic policy-makers and/or to secure financing for specific initiatives.

2. Including ministries of finance and planning in the development of financing strategies for adaptation, as they typically have stronger connections to a range of financial actors and are engaged in other broader financing processes.

3. Engaging potential international funders in the development of financing strategies for climate adaptation, such as multilateral development banks, as it may enhance the mobilization of international public finance for adaptation priorities.

Where to next?

Countries are taking a wide range of approaches to the development of their financing strategies for climate adaptation. The success of these strategies in generating greater financing for adaptation is currently difficult to determine, given that many are relatively new — having been developed in 2015 or later — and there is limited publicly available information regarding their outcomes.

More tracking and analysis by the research community are needed to inform developing country governments and their partners of the impact of these strategies and gather insights on how best to make them effective and useful.

However, the review underscored that a well-defined financing strategy for climate adaptation can clearly communicate to development partners a country’s key funding priorities and suggests that they can help scale up financing for adaptation. These strategies can be a critical tool to help governments take a strategic approach that integrates international and domestic public and private finance to most cost-effectively implement adaptation priorities identified through NAP and NDC processes.

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — In the Featured Photo: Big floods in Jakarta. Indonesia. Featured Photo Credit: Farhana Asnap/World Bank.