The United Nations released the 17 Sustainable Development Goals in order to transform the world we are living and make our future more sustainable. These ambitious goals are set to be in the agenda of governments but will also influence individuals’ economic initiatives that over the next couple years must become more impact driven. Impakter’s #Startups4Good series will focus on those companies and startups actively trying to achieve the SDGs: #SDG1 goal is to end poverty by 2030.

While this goal seems pretty ambitious, the UN is quite optimistic that it is possible to eradicate poverty: some innovative entrepreneurs, startups, and companies are already here and are trying to sparkle this change.

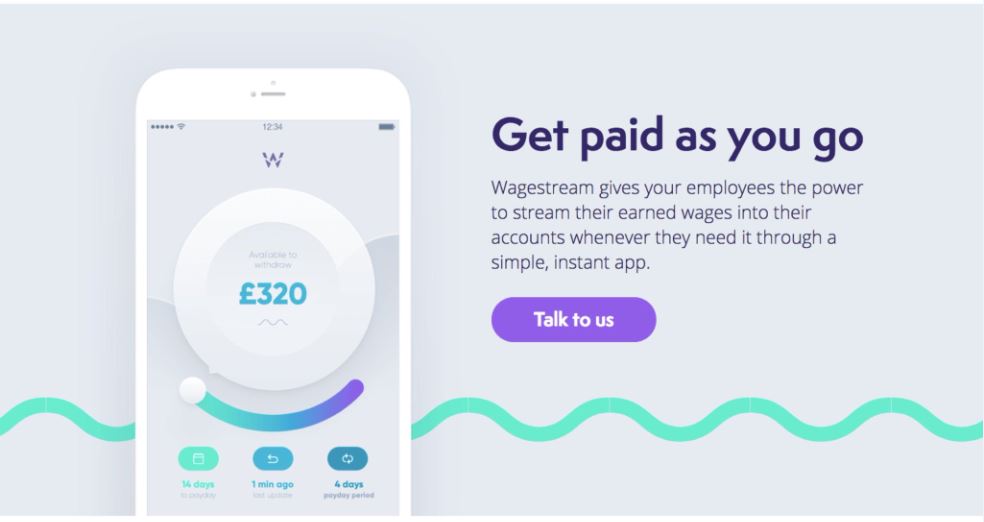

Wagestream is one of them. Founded in 2018, Wagestream focuses on revolutionizing the workplace payment system. They accomplish this by allowing workers to access a percentage of their wages as they earn them. In this sense, workers will not have to wait for each paycheck to obtain all of it. Workers who get injured at work can demand workers compensation from their employers. Many workers carry heavy debt when they have to wait to pay for basic necessities like food, water, and their rent. Often it can take at least a couple weeks for compensation to come for hard work. With Wagestream’s payment system, they can instead pay these off on time as wages come in.

People living paycheck to paycheck can appreciate this payment system to receive the true value of their work right when they need it. While this does not directly target people already in poverty, Wagestream deters carrying great debt and the threat of poverty through its payment system.

Another startup trying to help with poverty is AssetStream. AssetStream, also founded in 2018, helps borrowers receive the loans they need at their own interest rates. Through their blockchain system, lenders are also incentivized to provide these loans at generous interest rates.

AssetStream’s promise is that lenders will make at least 0.75% up to 4% monthly yield from their investment. Therefore, to maximize profits, many of these lenders will choose to lend a significant amount. This greatly benefits borrowers as they gain wider access to the loans they need. As a result, borrowers can help pay off expensive bills almost immediately with lower interest rates than before. In this way, AssetStream deters its users from falling into extreme poverty.

Rafode is another company looking to fight against poverty. Based in Kenya, Rafode is a micro-financing service that provides those that need it with social and financial support. This support comes in many forms including emergency loans, school fees loans, and loans for agriculture as well. Rafode does not require a deposit for its financial support.

Rafode emphasizes that its services are mission-driven and guided by principles such as empathy, integrity, and providing social support. Their goal is to empower communities that need the financial resources to spark their own evolution. For example, the company boasts its scalability in rural areas: this means that the many people facing poverty away from the big cities can obtain the financial support they need. Through the variety of loans and support that Rafode provides it is clear how Rafode can create a positive impact on people’s life and fight against poverty.

BanQu, looks to use blockchain technology to call for inclusion of the financially unprivileged communities. Founded in Minneapolis in 2015, it recently secured substantial funding to push forward its innovative platform. The company uses blockchain to securely log the interactions between organizations and those facing extreme poverty on a daily basis.

This means that these people facing extreme poverty can create a global economic identity for themselves by freely recording all economic activity they have engaged in. This economic profile supports them in the future by having concrete economic history for trust in later economic engagements.

As noted on their website, BanQu’s main focus is to alleviate people out of extreme poverty. The company boasts that its platform is the first economic identity technology solution that uses blockchain to foster a secure environment for creating economic opportunities for those in extreme poverty. Along with its use for record-keeping, BanQu’s platform also makes economic transactions between organizations and these people more transparent for all parties involved.

These companies are examples of how recent startups are rising up in the fight against poverty. Through these innovative solutions, companies can aim on making profits while creating social change at the same time. This includes even ambitious objectives like the UN’s #SDG1 of having no poverty by 2030.

Check back next week for more #Startups4Good ! The real game changers of our world.

In the Cover Picture: A busy road in Mukono, Uganda. Photo Credit: Unsplash

EDITOR’S NOTE: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com.