Today’s ESG Updates

- Trump Destroys U.S. Climate Laws: The order will repeal essentially all laws that limit pollution in the country.

- Trump Responds to EU Counter Tariffs: Trump responds to the EU’s announcement of tariffs on €26 billion worth of exports.

- Green Bonds Help Tackle Emissions: The Bank for International Settlements finds that green bond issuers lead in emission reductions.

- Impact of Artificial Intelligence on ESG performance: A new study was published on AI and ESG performance of central state-owned enterprises.

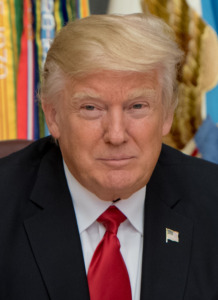

Trump Administration repeals significant US environmental measures

Late Wednesday, the Trump Administration announced a complete reversal of crucial water and air regulations, a devastating hit to the health of the American people and global climate change efforts.

Lee Zeldin, Environmental Protection Agency (EPA) administrator appointed by Trump, issued 31 announcements within just a few hours that destroyed almost every major environmental rule in the country. Trump, who refers to climate change as a “hoax,” promised more environmental rollbacks in the coming weeks. To stay on top of the rapidly changing regulatory environment, use ESG tools.

Video Credit: The U.S. Environmental Protection Agency

***

Further reading: EPA Launches Biggest Deregulatory Action in U.S. History

Counter-counter tariffs: Trump response to EU counter tariffs

The rapidly escalating trade war continues as Trump responds to the counter tariffs imposed on the U.S. Wednesday. EU President Ursula von der Leyen announced that over €26 billion worth of EU exports would be affected starting in April. Trump has responded that “Whatever they charge us with, we’re charging them,” pledging that he will match whatever tariffs the EU puts in place. The president claims that the EU treats the US “very badly,” and stated that “(The US) has been abused for a long time, and we will be abused no longer.”

Photo Credit: Wikimedia Commons

***

Further reading: Trade war escalates as Trump pledges more tariffs

Companies issuing green bonds can excel in cutting emissions

The green bond market is rapidly growing and is now valued at $2.9 trillion. A new report by the Bank for International Settlements finds that stricter emissions policies have caused this growth, particularly in high-emission sectors. The report notes an important exception: climate-vulnerable industries show weaker emissions reductions after issuing green bonds. This suggests that climate risks limit decarbonization efforts in industries such as agriculture and insurance.

Photo Credit: Towfiqu barbhuiya

***

Further Reading: Growth of the green bond market and green house gas emissions

Study reveals impact of artificial intelligence on ESG performance

A new study reveals how AI-driven ESG strategies impact the sustainable development of China’s central state-owned enterprises. Based on survey data from 200 managers and employees, the study revealed that AI enhances corporate governance and social responsibility, optimizing resource use and production efficiency. However, environmental performance remains a challenge, with opportunities in emissions reduction and resource optimization. To stay ahead of issues like ESG’s role in AI adoption, utilize ESG tools.

Photo Credit: Markus Spiske

***

Further reading: The impact of artificial intelligence-driven ESG performance on sustainable development of central state-owned enterprises listed companies

Editor’s Note: The opinions expressed here by the authors are their own, not those of impakter.com — Cover Photo Credit: U.S. EPA