Today’s’ ESG Updates

- Green heating investment: Ingka Group invests €1.5B in renewable heating, cooling, and energy efficiency for IKEA stores

- PE advancing ESG: ESG-focused private equity funds see returns up to 8% higher, per EY-Parthenon.

- COP29 carbon market: UN approves Article 6.4 to boost emissions reduction via global carbon credits.

- ESG insurance: HDI Global expands ESG liability coverage with social and governance options.

IKEA invests €1.5 billion to phase out fossil fuels

Ingka Group, IKEA’s largest retailer, announced a €1.5 billion investment in renewable heating, cooling, and energy efficiency. With the overall aim of reducing its operational climate footprint by 85% until 2030, the efforts complement the prior (2021) €7.5 billion commitment to off-site renewable energy.

***

Further Reading: IKEA invests €1.5 billion to accelerate phase out of fossil fuels

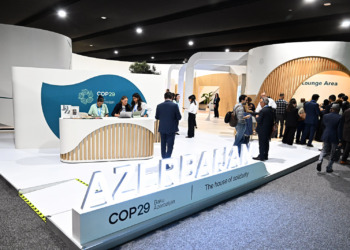

UN approves Article 6.4 carbon market mechanism at COP29

At COP29 in Baku Azerbaijan, the UN backed the Article 6.4 carbon market framework, a decade-long effort to facilitate international climate cooperation. The mechanism aims to lower emission reduction costs by $250 billion annually while directing funds to developing nations. To stay on top of all regulation changes, industry leaders use AI powered sustainability reporting software.

***

Further reading: COP29 negotiators approve Article 6.4, establish standards for global carbon market

Private equity strengthens returns with ESG integration

A new EY-Parthenon study shows private equity (PE) funds with top-tier ESG profiles can achieve up to 8% higher internal rate of return (IRR) than peers. Using RepRisk ratings to assess ESG impact, the research found that funds with strong ESG integration averaged a 25.4% IRR. While adoption is growing, many PE firms still treat ESG as a reporting obligation, hence, the study recommends holistic ESG integration across investment stages to boost deal flow.

***

Access the full report: How private equity can optimize ESG to maximize value creation

HDI Global expands ESG liability coverage

HDI Global, a leading provider of industrial insurance, is enhancing its environmental liability offerings by including optional social and governance (S&G) coverages. Aiming to address increasing regulatory pressures and evolving client needs, HDI Global appointed a 17-member ESG Risk Solutions Team, making it the first insurer to provide comprehensive ESG liability coverage.

***

Further reading: HDI Global expands ESG insurance offering with international environmental liability coverage

Editor’s Note: The opinions expressed here by the authors are their own, not those of impakter.com — Cover Photo Credit: Adam Kolmacka