The Council of the European Union (EU) has adopted a groundbreaking regulation that paves the way for a new European Green Bond Standard, designed to tackle greenwashing and promote sustainable finance in the EU.

The regulation “lays down uniform requirements for issuers of bonds that wish to use the designation ‘European green bond’ or ‘EuGB’ for their environmentally sustainable bonds,” the EU says, explaining the significance of green bonds:

“Environmentally sustainable bonds are one of the main instruments for financing investments related to green technologies, energy efficiency and resource efficiency as well as sustainable transport infrastructure and research infrastructure.”

The EU describes the move as another step in the implementation of the bloc’s strategy to finance sustainable growth and the green transition, asserting that the bonds will be aligned with the EU taxonomy for sustainable activities and that they’ll be available to investors around the world.

“The new standard will foster consistency and comparability in the green bond market, benefitting both issuers and investors of green bonds,” the EU writes.

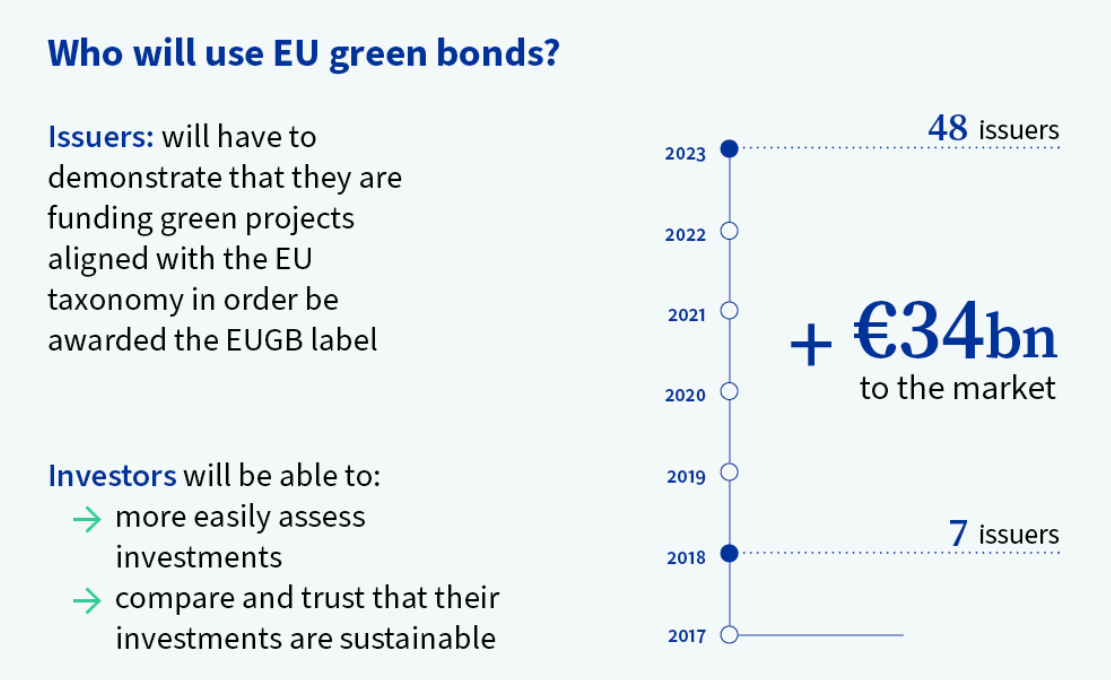

How will it benefit the two groups? According to the EU, issuers will be able to show that they’re funding “legitimate green projects aligned with the EU taxonomy” — a requirement for getting the EuGB label. They will be held to strict transparency criteria and will need to disclose how bond proceeds will be used, commit to green transition plans, and report on how these investments contribute to these plans.

As to investors, the move will reduce the risks of greenwashing and increase investor confidence in sustainable investments, “ultimately stimulating capital flows into environmentally sustainable projects.”

The EU points out that the new regulation also establishes a “registration system and supervisory framework for external reviewers of European green bonds,” and that it “provides for some voluntary disclosure requirements for other environmentally sustainable bonds and sustainability-linked bonds issued in the EU” to prevent greenwashing in the green bonds market.

Related Articles: EU Green Bond Deal: Sustainable Gold Standard or Unrealistic? | To Fund Energy Transition, EU Launches Record-Breaking Green Bond Programme

EU policymakers stress that all proceeds will need to go into activities aligned with the EU taxonomy for sustainable activities “provided the sectors concerned are already covered by it.”

If the sectors are not yet covered by EU taxonomy, a 15% flexibility pocket will be allowed to “ensure the usability of the European green bond standard from the start of its existence.”

“The use and the need for this flexibility pocket will be re-evaluated as Europe’s transition towards climate neutrality progresses and with the increasing number of attractive and green investment opportunities that are expected to become available in the coming years,” the EU writes.

The bloc’s journey toward the European Green Bond Standard began with the European Commission’s proposal in July 2021. The Council set its position on the proposal in April 2022 and, after trialogue negotiations that started in July 2022, a provisional agreement was reached in February 2023.

The European Parliament adopted the agreement on October 5, 2023, the Council on October 23. The regulation is expected to enter into force 20 days later and will start being applied 12 months after it has entered into force.

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — Featured Photo Credit: Wikimedia Commons.