An initiative of the United Nations Development Program (UNDP), the SDG Finance Geneva Summit (SGSGeneva) is an annual, one-day event that brings together some 250 participants at the Forum Geneve to meet, network and forge partnerships to advance the implementation of the Sustainable Development Goals (SDGs).

Participants attending this year’s summit, held on Oct. 9, 2019, will include innovative startups from developing countries, impact investors and Fortune 500 representatives, among others.

The event is designed to act as an “innovation springboard,” offering 12 finalist startups (in their growth stage) the opportunity to pitch their products and services to an audience of investors, multinational organizations, and large corporations.

In one way or another, all pitches will be focused on solving contemporary challenges in the environmental, social and economic spheres, and on facilitating the implementation of the 2030 sustainable development agenda.

The twelve finalists attending the summit have been selected through the first Growth Stage Impact Ventures (GSIV) for Sustainable Development Goals (SDGs) initiative, co-organized by the UNDP, EPFL Tech4Impact, Orange, and SAP. The entire selection, focused on startups with the potential to generate both impact and financial returns, included 119 impact ventures from 40 emerging countries.

Representing solutions across three themes (health, energy and climate change, and financial services) and 11 developing countries, the finalist startups are also in the running for the Jason J. Spindler Big Data for Impact Award and a cash prize of $5,000. The winner will be announced at the event’s closing session.

With that in mind, we would now like to introduce the 12 finalists.

Theme One: Health

ayzh Health: Dignity, Simplicity, Access

According to the UN, “only half of women in developing regions receive the recommended amount of healthcare they need,” while an estimated 2.8 million mothers and infants die every year mostly due to preventable causes such as infections caused by inadequate birthing environments.

This means that a pregnant woman or a newborn dies somewhere on this globe every 11 seconds.

Furthermore, 80% of those 2.8 million yearly deaths occur in only 30 countries in the World, India being the nation with the highest death rate.

Startup ayzh Health was established in India with the goal of addressing Reproductive, Maternal, Newborn, Child and Adolescent Health (RMNCH+A) of those living in vulnerable conditions and eradicating barriers to their good health, survival and well-being.

Preventable causes of maternal and infant mortality, for instance, is one issue the company strives to solve by “manufacturing and distributing low-cost, high-quality products, such as clean birth kits,” which “deliver health, hygiene, and livelihood for intergenerational well-being.”

One of ayzh’s clean birth kits, called Janma, contains six tools recommended by World Health Organization that can prevent death and infection at the time of childbirth. This kit costs $2.0.

The company also offers solutions to challenges along the entire reproductive life cycle (e.g., menstruation, pregnancy, postpartum, breastfeeding, infancy) or, as their website says, “affordable solutions from menstruation to menopause.”

Naya Jeevan: Health Micro-Insurance for a ‘New Life’

Naya Jeevan, founded in 2012 with a name that translates to “New Life,” works to secure healthcare for low-income families by providing them with health micro-insurance.

They do this by offering these population segments, people who were previously uninsured, “a technology-enabled health and wellness plan” that costs $3 a person per month.

In countries like Pakistan, where Naya Jeevan was established, experiencing difficulty with accessing healthcare is not at all uncommon, much less so in cases of families living on low-income. This often results in people postponing healthcare until their lives become endangered — which is what Naya Jeevan is working to prevent.

The startup has served 75,190 annual subscribers thus far and has impacted the lives of more than half a million people through their workshops, medical camps and preventive health education sessions.

TotoHealth: Highlighting Warning Signs Through A.I.

While ayzh Health tackles the issue of high maternal and child mortality rates (among other things) by developing, producing and offering tangible products, TotoHealth addresses the issue through advice delivered to mothers living in Kenya’s marginalized communities.

Although child survival rates in Eastern and Southern Africa have improved since three decades ago (rising by 3.7% annually, on average), the UNICEF claims that “…maternal mortality continues to remain high and [that] the region accounts for a quarter of all maternal deaths worldwide.”

Kenyan startup TotoHealth, established in 2015, allows users, primarily mothers living in the country’s marginalized communities, to register on their platform and expect to receive targeted and personalized messages that are in line with their particular stage of pregnancy or their child’s age.

Generated via the startup’s artificial intelligence, these messages “highlight any warning signs in a child’s health/development, equip [users] with knowledge on nutrition, reproductive health, parenting and developmental stimulation.”

As such, they help detect developmental abnormalities in the early stages and thus contribute to reducing maternal and child mortality.

Vezeeta: Reshaping Doctors’ Appointments

Also a platform addressing healthcare accessibility through innovation, Vezeeta allows users to search, compare, and book doctors in Egypt, the UAE, KSA and Levant in a timely convenient manner.

In an industry where citizens struggle to access healthcare and in which making doctors’ appointments largely depends on connections — which costs people in the Middle East an estimated 240 million hours through waiting lines — improving healthcare accessibility plays a particularly important role.

Through their patient-oriented platform, Vezeeta is reshaping the relationship between people and providers of healthcare.

With three million patients and over 13,000 healthcare providers registered on their platform, the startup is arranging almost three million appointments per year.

Theme Two: Energy & Climate Change

Frontier Markets: Right Product at the Right Time

With over 85% of its population now having access to electricity, India’s recent electrification efforts have been considered a great success. Thirty million people have been provided with electricity every year between 2010-2016, according to the World Bank, and this progress is estimated to have moved at a pace quicker than in any other country.

The challenge of supplying the remaining 15% of the population (over 187 million people) with electricity, however, still endures, and is one which the startup Frontier Markets was established to address.

Striving to provide people living in the country’s rural areas (100 million of the 187 million) with access to clean energy sources, and seeing off-grid solar energy as the solution, the company “trains and empowers women to sell and service solar power solutions and other appliances.”

Their network of 5,000 rural entrepreneurs — 3,000 of whom are women — are trained in various areas, such as marketing, sales, data collection, and technical repair, to utilize smartphone and internet technology as a means of providing solutions to rural households.

The team, as they say on their website, “…works with women entrepreneurs to introduce the right product at the right time with the right value proposition.”

In doing so, Frontier Markets contributes to the reduction of greenhouse gas and carbon emissions, and opens up new paths for opportunity and productivity by providing families with light after nightfall while also adding an element of improved household safety through their water filtration solutions.

Since its establishment in 2011, Frontier Markets has impacted 600,000 households and 3.5 million lives through clean energy in the form of solar lighting systems, mobile phones and clean cooking stoves, among other appliances.

They estimate to have cut down emissions by 750,000 tons of carbon thus far.

Ignitia: Predicting the Increasingly Unpredictable

By causing increasingly inconsistent and irregular weather patterns, climate change negatively effects crop production and thus also the income of farmers, especially small-scale ones, as well as the economies of eco-systems dependent on the local produce.

In regions in which food produced by small-scale farmers accounts for a great deal of the total food production, such as West Africa, where it makes up 90% of all food produced in the region, the consequence of unpredictable weather patterns can be particularly disruptive not only to the farmers and eco-systems in which they live, but to the entire region.

Hoping to minimize the risk of changing weather causing crop loss, startup Ignitia has created a weather forecasting platform tailored to predicting tropical weather in West Africa.

With 84% accuracy rates, the Ignitia Tropical Weather Forecasting platform helps farmers to increase yields, boost production, and reduce crop loss.

Available through mobile subscription, Ignitia’s forecasting model sends “reliable, location-specific weather forecasts to small-scale farmers across West Africa on a daily, monthly, and seasonal basis.”

Their daily 48-hour forecast, for instance, includes information about the probability, timing and intensity of rainfall, while their monthly and season forecasts predict how much hotter or drier the weather will be within the upcoming weeks or months.

The startup estimates to have reached over four million farmers to date, including their families and customers, and to have helped generate more than 4.2 million tons of produce.

Sistema.bio: Waste to Energy & Fertilizer

The UN predicts that the world’s population will have reached 9.8 billion by the year 2050.

For global agriculture, this means that smallholder farms will have to yield 70% more produce than they do today in order to feed the growing population.

But at present, increasing agricultural production appears to be inextricable with augmenting climate change. According to the EPA, agriculture, forestry and other land use account for 24% of all global greenhouse gas emissions.

On a pursuit to find a way to simultaneously boost agricultural production and lower carbon emissions, startup Sistema.bio has developed biodigesters capable of transforming farm waste into clean, renewable energy and organic fertilizer.

The greenhouse gases emitted through conventional agricultural production fundamentally come from three processes: energy consumption, the use of chemical fertilizer and inefficient waste management.

By using that same waste to create clean energy and organic fertilizer, Sistema.bio is addressing all three issues at once.

These durable and low-cost biodigesters are manufactured, sold, installed and serviced by Sistema.bio. Aside from reducing greenhouse gas emissions, chemical fertilizer use and inefficient waste management practices, the technology’s potential lies in saving farmers time and money, improving household health by substituting charcoal and wood fires with clean energy, and in improving yields and nutrient profiles of crops through the organic fertilizer produced from waste.

Three Wheels United: Loans for Pollution Reduction

Three Wheels United is an Indian startup that aims to stimulate the electrification of light vehicles in India by providing lending solutions for the purchase of electric vehicles.

These solutions, tailored and affordable, use finance and technology to overcome the essential obstacle to the rapid uptake of electric vehicles: the lack of financing.

With affordable and accessible loans now available, fleet and SME owners, as well as individual consumers, are more inclined and likely to purchase electric vehicles, which results in improved quality of life (due to rising income thanks to electric vehicle’s higher cost-efficiently) and reduced air pollution.

Replacing one pollutive tuk-tuk with an electric one, for instance, can save 65 tonnes of CO2 over that single vehicle’s lifecycle.

In a country with 9/10 of the world’s most polluted cities, where the transport sector accounts for most of the greenhouse gas emissions, this reduction in air pollution, on a large scale, can prove to generate vital impact.

Thus far, the startup has financed over 2,400 vehicles, reduced 26,400 tonnes of CO2 and has generated $86 million in extra income.

https://www.youtube.com/watch?v=2NDsE2lbQs8

Theme Three: Financial Services

Amartha: Microlending for the Unbanked

Established in 2010 in Indonesia, fintech startup Amartha works to alleviate poverty and reduce income inequality by offering peer-to-peer micro-lending to the unbanked in the region.

The platform connects the many financially excluded micro-entrepreneurs living in Indonesia’s rural areas with lenders interested in making impact investments.

By providing these people with the means of achieving financial inclusion, Amartha is creating opportunities for social inclusion and empowerment through higher incomes.

The technology they have developed, which allows them to lower operating costs and reach geographically remote villages, includes a self-learning algorithm that “automates key aspects of operations, including the borrower application process, data gathering, credit decisioning and scoring, and servicing.”

The startup has empowered more than 250,000 grassroots women micro-entrepreneurs to date through facilitating over $77 million in loan origination.

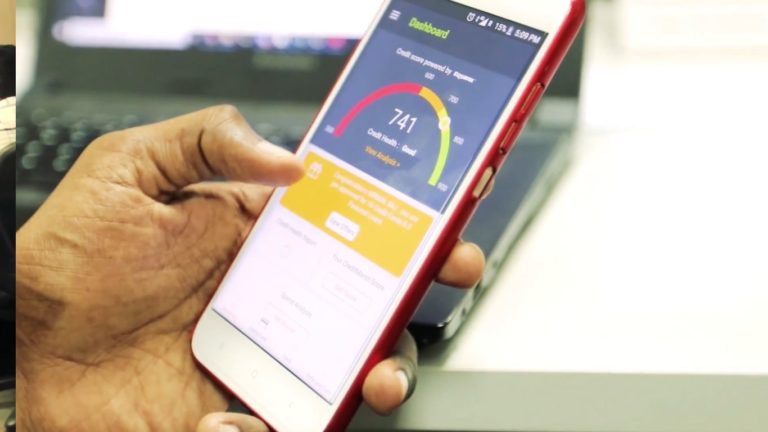

CreditMantri: Online Credit Scores for Improved Credit Health

India faces a shortage of financial institutions that are willing to offer credit to citizens deemed risky and credit undeserved.

With over 580 million people falling into this category, this segment represents an immense part of the country’s population — as well as a credit market opportunity of $19.5 billion.

Hoping to facilitate financial growth for these “credit invisibles,” Gowri Mukherjee founded CreditMantri, an emerging credit platform that offers a “free credit score online to anyone seeking to understand the quality of their credit health.”

Through this service, CreditMantri allows its users to take control of their credit health and thereby make better borrowing decisions in the future.

By restructuring and resolving negative accounts, for instance, the startup has enabled over 170,000 people, priorly considered credit-challenged, to begin borrowing from the formal banking system again.

Using data and technology, the company also helps its 5.1 million credit-invisible users to identify credit products that match their particular profiles.

Kaah International Microfinance Services: Pioneering Privately-Owned Microfinance

In Somalia, a country recovering from 30 years of civil war with millions of citizens displaced, both internally and externally, financial inclusion is crucial not only to fostering entrepreneurship and economic equality, but to securing stability and facilitating peacebuilding as well.

Accessing finance, however, is a challenge faced by many in Somalia, especially by the youth, women and refugees.

Recognizing that these groups in such contexts need new and innovative financial products and services, startup Kaah International Microfinance Services (KIMS), founded in 2014, began offering “high-quality diversified microfinance to low-income, entrepreneurial Somalis.”

As Somalia’s first and only privately-owned microfinance institution, KIMS’ contribution to the country’s economic and social development comes in the form of commercially viable, financial services combined with social impact.

Their impact extends to over 13,700 clients whom the organization provided with $14 million in financing through a “growing range of products including micro and small business plans, fisheries and agriculture value chain financing, and an energy access product.”

Tienda Pago: Solving Entrepreneurial Challenges

Founded in 2014, TiendaPago is a Latin American startup with a mission to “solve small scale entrepreneurial operation challenges by providing mobile-based financial access to small stores.”

Through their mobile-based platform, which blends digital financing and payments to facilitate the distribution of finance, the startup hopes to bring financial inclusion to over three million unserved stores and families in the region.

As a consequence of the lack of access to finance, these stores and entrepreneurs, mainly women who struggle to compete with global brands and modern logistics systems, would otherwise have difficulty scaling-up their sales and would have limited potential income, mobility and empowerment.

TiendaPago’s solution resolves the issue of merchants’ limited availability of cash for paying distributors by allowing them to pay inventory through their phones and thereby avoid limiting their potential sales by buying limited inventory.

This solution also benefits the suppliers as they’re able to spend less time collecting payments (they visit stores once for delivery, and have their funds available in less than 24 hours via electronic transfer), and as they handle less physical cash.

The result: Stores that use TiendaPago have a 20-30% higher inventory turnover.

Editor’s Note: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com — In the Featured Photo: The third edition of the Social Good Summit Geneva, concluded at the Credit Suisse Forum in Geneva, brought together 24 best-in-class emerging-markets entrepreneurs pitching scale-ready products and services to impact investors, addressing 12 out of 17 of the Sustainable Development Goals. This year’s Summit, created by UNDP Geneva, and held alongside the World Investment Forum, featured pitches on Access to Health and Education, Responsible Consumption and Production, Agritech and Fintech — Featured Photo Credit: Antoine Tardy/UNDP