In an election year, manipulation of facts makes it hard to tell what’s what. Take the case of the U.S. bond market.

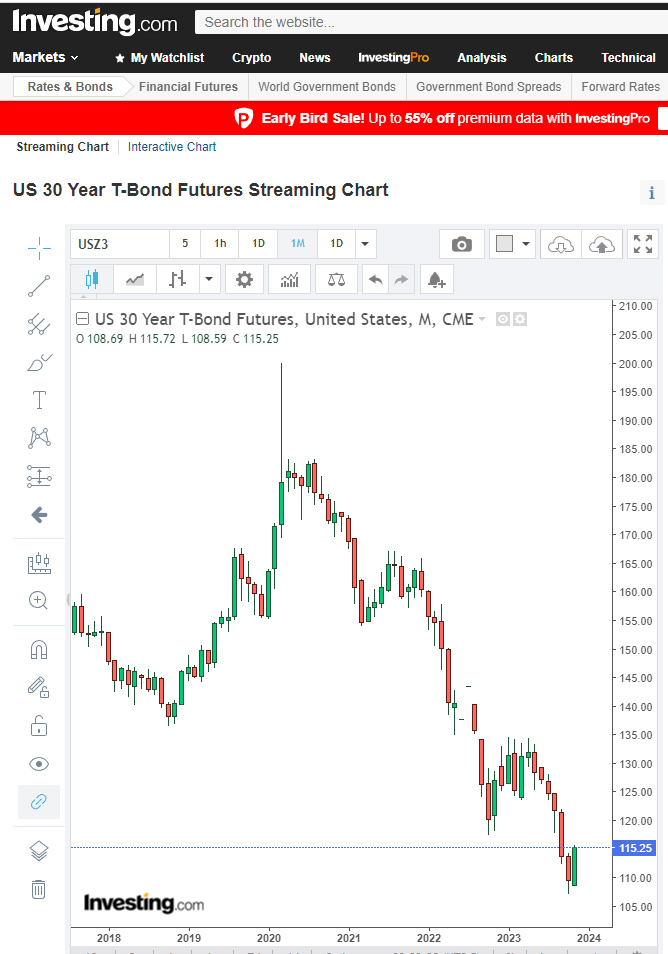

A sober-October crash in U.S. Treasuries prompted the Federal Reserve Bank to pause U.S. rate hikes, in turn inspiring bottom fishers to frolic back into the water and start buying up bonds again. Their exuberance can be seen in the formulation of a bullish engulfing pattern in bond charts, where the last up/green month engulfs the preceding red/down month, for the 5-year T-note future, the 10-year, and now even the 30-year T-note future.

More specifically, looking at this chart, one sees this is the type of bullish engulfing pattern, where the green candle encompasses the preceding red one:

But the pattern is not complete until the month closes out. This cumulus has until the end of November to shape shift. Technical analysts say that all the information is in the price. For example, a bullish engulfing pattern could mark an end to U.S. interest rate hikes, and/or a beginning to U.S. recession, since bonds are a traditional recession hedge.

The problem is…

The market, however, has little reason to be bullish on U.S. debt. Every morning, a menu of scenarios offers itself up, triggering traders to gaze at U.S. debt with more scrutiny, exerting downward pressure on bond prices:

- Moody’s downgrade of the U.S.’s credit outlook from ‘stable’ to ‘negative’

- The resulting upward pressure on U.S. interest rates (and downward on bond prices), as investors factor in more risk in lending money to the U.S. government

- U.S. government dysfunction or shutdown

- War spreading in Israel

After a decade and a half of quantitative easing, the U.S. central bank has switched to ‘quantitative tightening’. This means the Fed itself is selling all the bonds it’s got on its balance sheet, exerting more upward pressure on interest rates (and downward pressure on bond prices).

Overseas investors seem disillusioned with Janet Yellen’s narrative. Many have expressed doubt about her attempts at compensating for what is seen as a U.S. struggle with addiction-to-funding-foreign-wars.

Moving on from treasury bond-age

China, long the biggest single foreign investor in the U.S. bond market, bought trillions of dollars worth of U.S. Treasury bonds in recent decades. Trusty China helped finance the big deficits after the financial crisis of 2008 and the COVID pandemic.

But trade friction changed all that.

Over the past year, public data on China’s official holdings shows its investment in U.S. Treasuries is down by more than $50 billion, and down nearly $300 billion since early 2021.

China has gotten the hint and moved on from U.S. government bond-age to focus on investment in BRICS’ own New Development Bank (NDB) bonds. BRICS countries, comprising Brazil, Russia, India, China, and South Africa, have far more savings than the G7. Even the GDP of BRICS has just surpassed that of the G7. Six more nations, also with higher savings rates, including Iran, are set to join BRICS in January 2024.

Choosing your battles by default

But geopolitical distinctions are often hazy to inhabitants of the United States, the only country that has removed geography from its public school systems. This erasure took place in the 1960s ostensibly to counter West Side Story-esque gang warfare. Whether for integration or desensitization, the majority of Americans really don’t know where (or if!) most other countries are.

Reflecting on the long string of over thirty wars the U.S. has been in since 1945, some feel it’s ‘not whether you win or lose, but’…just ‘war for the sake of war’. They jest that the U.S. might leave off founding countries to defend, and step up to some snazzy derivative, like making up names of countries no one’s ever heard of.

This bleeding off of U.S. wealth by foreign wars that many feel the U.S. instigates is accompanied by foreign divestment.

While Western allies do show some military support for the U.S. in its myriad wars, the U.S.’s close ally, the U.K., has not had an appetite in quite a while for financing the U.S. debt that goes along with war. On the contrary, the British Broadcasting Corporation (BBC) has just revealed that the U.S. is sending money in the form of weapons to “a country it doesn’t recognize,” namely Taiwan.

Raising eyebrows of an allied democracy is significant. Respecting other forms of government would be even more significant. As Alain Juillet, former Director General of France’s Exterior Security, put it in a conference in Hauts-de-France on October 3:

Since 1492 we have believed in imposing on the world Western values that we thought were universal, when they are only European.

So what’s with all this imposing our form of government on others―an un-democratic act in itself―as an excuse for war?

America (sorry, Canada, Mexico, the seven countries of Central America, and the 12 countries of South America) would do well to note that many of their close allies are actually monarchies which gives them a different cultural and social veneer – Britain of course, and Spain (but not Portugal). “The British Military’s oath of allegiance is to the Monarch, presently King Charles III, the Head of State who is a Constitutional Monarch,” Bryan Tolladay, former United Kingdom Royal Air Force Officer, confirms. “The British Military work for the King.” They do not take orders from the parliament.

Hard to understand the rationale

The U.S. is teetering on the brink of government shutdown. U.S. military officials switched to using the term ‘stalemate’ to describe the war in Ukraine, just as the House dropped the hot potato of aid to Ukraine, in favor of getting on with the next war.

This at a time when the U.S.’s own system is crumbling: the House passed a $14.3 billion package for Israel, to the fury of millions of protestors. A package proposedly funded by cutting the $14.3 billion from U.S. tax department funding.

Tax departments are necessary for collecting taxes. That is to say, tax departments facilitate the traditional form of government fundraising: taxes―not debt issuance. One wonders where the U.S. plans to turn for financing in the future, if any.

Maybe politicians don’t think twice about mainlining U.S. tax department money into another war since the U.S. is on the verge of declaring bankruptcy anyway? The Senate did not approve the House’s spending package.

Fissures or chasms?

Whatever the rationale, if you factor the debt out of the GDP number, the U.S. annual take-home is paltry. But it’s still hard to judge just how much U.S. finances are at risk since the usual measure of U.S. wealth is itself faulty. GDP is, after all, just an annual figure, like a salary. It is not an indicator of accumulated wealth.

GDP is an annual figure, like a salary, not an indicator of accumulated wealth.

How do you measure U.S. wealth, then?

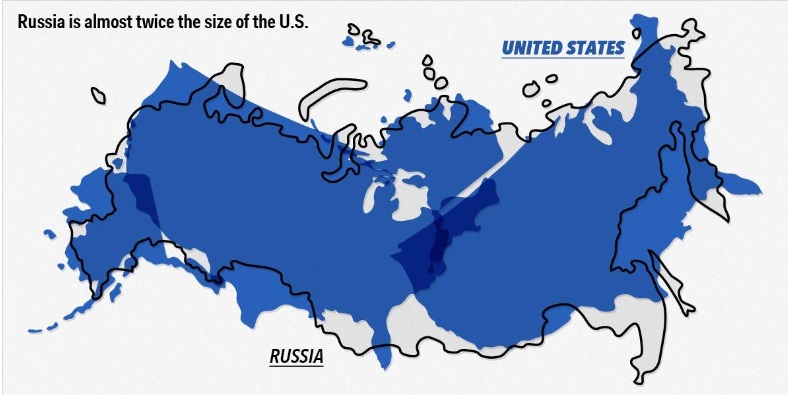

The preferred habit of the super-rich has been taking their accumulated savings out of the bank and investing it in real estate. Looking at real estate, instead of GDP, as a measure of wealth, we can better assess U.S. savings. In terms of real estate, the U.S. is half as wealthy as, for example, post-Soviet-crumble Russia.

Moreover, U.S. wealth is in dollars, and the dollar is losing clout, against a backdrop of the announcement by Russian economist Sergey Glazyev that the new BRICS currency might be launched during the 16th BRICS summit in 2024.

With the dollar being internationally pooh-poohed as a reserve currency, it tempts the fate of the gilt, which folded inward, ushering in the fall of the British Empire. A peaceful crumble along those lines is plausible, however mediocre the Brexit model.

Brexit has not accomplished much. Its main goal was to curb immigration, and it has failed miserably. In the year ending June 2023, at least 52,530 irregular migrants entered the U.K., up 17% from the year to June 2022. U.K. And Prime Minister Rishi Sunak has just suffered a blow to his plans by the U.K.’s highest court.

Complicity is responsibility

I see plenty of volatility with broad price swings ahead for U.S. treasuries, especially factoring in the run-up to the 2024 elections. Heavy-duty campaigning costs will likely be financed by yet more debt: a significant risk for the bond market.

The way forward for bonds very much depends on the American people.

They will either be thrown out with the bathwater, or drop into more active roles. Engulfing pattern or no at the end of November, they will be breaking their fast on a quantum choice for their country: Peaceful Crumble, or High-test Wake-up Shake. Only they will determine what becomes of the U.S. and its debt.

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — Featured Photo: Recon trader com. video explaining engulfing candles (screenshot)