RATING

Outlook

Negative

SECTOR

Financial Service Activities

Chief Sustainability Officer

T: N/A

E-mail: N/A

Stock Exchange and Ticker

NYSE: WFC

Website

Contact

T: 00 800 9564 4422

E.mail: N/A

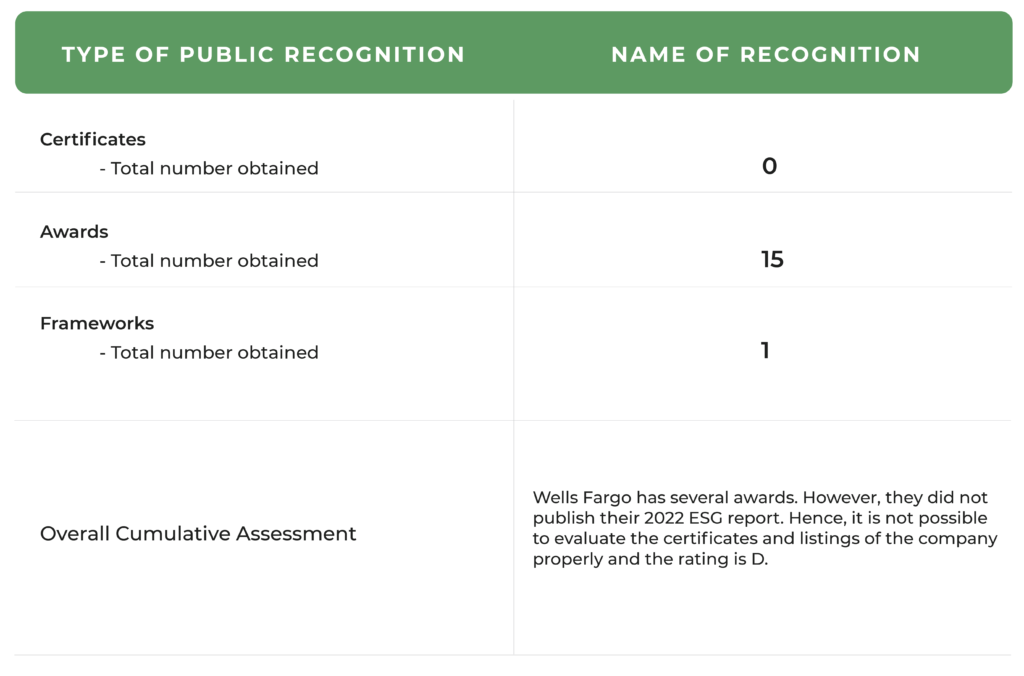

Listing

- #100 America’s Best Banks (2023)

- #18 Global 2000 (2022)

- America’s Best Employers By State (2021)Dropped off in 2022

- #72 Just Companies (2021)

Awards

- DiversityInc Top 50 Companies for Diversity (2021)

- The Best 50 Companies for Latinas to Work for in the U.S., LATINA Style (2021)

- Top Military-Friendly Employer, Top Military-Spouse Employer, and Top Supplier Diversity Program from VIQTORY (2021)

- Bloomberg’s Gender Equality Index (2021-2022)

- 100% rating and “Best Place to Work for LGBTQ+ Equality” by the Human Rights Campaign Foundation Corporate Equality Index (2021-2022)

- JUST Capital, JUST 100 (2022)

- DiversityInc Top Companies for People with Disabilities (2021)

- National Organization on Disabilities (NOD) Leading Disability Employer Seal (2021)

- Best Places to Work for Disability Inclusion, Diversity Equality Index (2021)

- Military Times Best for Vets: Employers List (2021)

- Employer of the Year Seal from the National Organization on Disability (2021)

- Most Generous Companies in America, Civic 50 (2021)

- 100% score on the Disability Equality Index for (2021)

Revenue

Market Capitalisation

Employees

247,000

Content source

- Wells Fargo Proxy Statement Report 2022:

https://www.wellsfargo.com/about/investor-relations/annual-reports/

- Wells Fargo Diversity,Equity, and Inclusion Report 2022:

https://www08.wellsfargomedia.com/assets/pdf/about/corporate/diversity-equity-inclusion-report.pdf

- Wells Fargo CO2eMission Report 2022:

- Wells Fargo CO2eMission Report 2022:

- Forbes

https://www.forbes.com/companies/wells-fargo/?list=global2000&sh=5a4e35c24f54

- Yahoo Finance:

Wells Fargo Sustainability Report

Evaluation of Wells Fargo

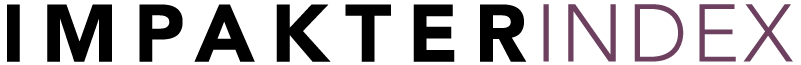

The company has released Diversity, Equity, and Inclusion report, CO2emision report and Inclusive Communitites and Climate bond report, in the year 2022. These report did not mention the certifications acquired by the company nor was it transparent enough. Wells Fargo has few achievements like obtaining 100% of their global electricity needs from renewable sources. Moreover, the second Inclusive Communities and Climate Bond, issued by Wells Fargo, is a $2 billion bond that will be used to fund initiatives and programs that promote access to affordable housing, economic opportunity, renewable energy, and environmentally friendly transportation. Lastly, the articles found online suggest that the company does finance oil and gas sectors which contradicts their sustainability measures. Hence the company has been rated D.

Sustainability Scorecard

Wells Fargo Company Activity

Wells Fargo helps customers build businesses and manage money in a rapidly changing world. The company is dedicated to finding creative solutions and advocating for more inclusive communities that continues to inspire generations. From exchanging gold coins for paper checks to enabling online transactions, Wells Fargo continually innovates so their customers can get ahead.

Wells Fargo Sustainability Activity - As per company declarations

Wells Fargo creates solutions to pressing societal challenges like:

- Diversity and inclusion: Make sure all people feel respected and have equal access to resources and opportunities.

- Environmental sustainability: Accelerate transition to a low carbon economy to help reduce climate change impacts.

- Economic empowerment: Strengthen financial education and economic opportunities in underserved communities.

- Community giving: Working with nonprofits to build a more inclusive, sustainable future for all.

- Environmental and social impact management: Identifying, assessing, and managing environmental and social impacts associated with our commercial clients and financings.

Certificate & Labels, Standards and Frameworks

- N/A

Wells Fargo in the news: Press Reviews and Social Media

After going through few articles it can be concluded that Wells Fargo still funds fossil fuel projects despite their environmental and sustainability claims.

This report was produced by a coalition of environmental groups, led by the Rainforest Action Network (RAN) which claims that the world’s biggest banks invested $742 billion in coal, oil, and gas companies despite extensive public climate commitments. Although this article points out several other banks it does mention Wells Fargo as one of the biggest lenders to fossil fuel projects.

This article also points out the greenwashing of the world’s biggest banks including Wells Fargo. It mentions that Wells Fargo is the biggest funder of the fracked gas industry, supporting companies like Pioneer Natural Resources and Diamondback Energy.

This article points out the investments done by Wells Fargo and other banks in fossil fuel.

Highlights from Wells Fargo Sustainability Report

Achievements

- Acheived and exceeded their target of building or improving 1,000 homes for low- and moderate-income households.

- Wells Fargo has increased its annual spending with diverse suppliers from $732 million in 2012 to over $1.3 billion in 2021, representing 13% of its total controllable spending.

- The company has issued $1 billion inclusive communities and climate bond.

- Wells Fargo has successfully met 100% of their global electricity needs with renewable energy.

Weaknesses and Setbacks

- Non-well-trackable progress reporting

Targets vs Progress Reported

| Target | Results reported |

|---|---|

| Increase women and racially diverse leadership in executive ranks by 2025 | - The company has reported this as ongoing |

| Evaluate compensation decisions for Operating Committee members based on their progress in improving diversity and inclusion | - The company has reported this as ongoing |

| Provide education sessions on creating an inclusive and equitable culture | - The company has reported this as ongoing |

| Create and hire a leader for an expanded diversity role reporting to the CEO to centralize Wells Fargo’s DE&I efforts across the business | - Create and hire a leader for an expanded diversity role reporting to the CEO to centralize Wells Fargo’s DE&I efforts across the business |

| Invest $1 billion in internal assets through their Diverse Asset Managers Initiative | - The company has reported this as ongoing |

| Build or improve 1,000 homes for low- and moderate-income households | - The company has achieved and exceeded this target |

| Support and administer the We Care Fund | - The company has reported this as ongoing |

| Decrease the number of unbanked individuals in the U.S. by 2031 through its Banking Inclusion Initiative | - The company has reported this as ongoing |

| Invest $20 million in the Black Economic Alliance (BEA) Entrepreneur Fund by 2026 | - The company has reported this as ongoing |

| Wells Fargo’s initiatives to support undeserved segments throughout 2021 | - Asian and Asian American segment: The company stood against hate and xenophobia with its Asian Community Support Campaign and also celebrated the Lunar Year with its year of the Ox campaign Black and African American segment: • Added four new card designs to the Black Culture Collection in Card Design Studio • Sponsored the nationally televised 52nd NAACP Image Awards on BET/Viacom Networks and the week-long NAACP Image Awards Virtual Experience Hispanic and Latino segment: • Provided a way to showcase Hispanic and Latino heritage with “Mi Cultura” debit cards •Celebrated Hispanic and Latinos’ educational achievements and Wells Fargo’s partnerships with the Hispanic Scholarship Fund during its Hispanic Heritage Month “Back to School” campaign • Donated $2 million for the upcoming Smithsonian National Museum of the American Latino and the development of the Molina Family Latino Gallery LGBTQ segment: • Added a new Pride Unity design to the Pride collection in Card Design Studio • Highlighted its partnership with SAGE during Pride month Military/Veteran segment: • Launched a recruitment and awareness campaign to hire and retain more veterans • Honored key moments for military veterans throughout the year American Indian and Alaska Native segment: • Launched “Working for Generations” campaign to provide capital and financial services for Native communities • Created Native Art Card Design Studio promotion People with Disabilities segment: • Reaffirmed its commitment to recruiting, retaining, and financially empowering people with disabilities through the National Disability Employment Awareness Month campaign •Appointed an ADA Coordinator within the office of the Head of Operations and created an Accessibility and Disability Advocate role |

| Sustaining and growing diverse suppliers | - Wells Fargo has increased its annual spending with diverse suppliers from $732 million in 2012 to over $1.3 billion in 2021, representing 13% of its total controllable spending |

| Climate scenario and target | - Wells Fargo selected the NGFS Net-Zero scenario to derive the benchmark to measure portfolio alignment and inform our Power generation portfolio - The NGFS Net-Zero scenario assumes electricity from renewable sources increases five-fold by 2050, with a near-complete phasing out of coal-fired plants by 2030 - The NGFS Net-Zero scenario assumes a rapid and near complete phase out of coal, which shrinks 86% by 2030 |

| Inclusive Communities and Climate Bond | - Wells Fargo has issued $1 billion inclusive communities and climate bond - Wells Fargo have committed to deploy $500 billion in sustainable finance between 2021 and 2030 - Wells Fargo has successfully met 100% of their global electricity needs with renewable energy - The company has exceeded their 2020 energy,waste,water, and GHG reduction goals - Total net proceeds of the bond is $997,500,000. Out of this 49% of the proceeds are allocated to renewable energy projects, 37% to affordable housing projects, and 14% to socioeconomic advancement and empowerment |

| Climate Projects | - Wells Fargo has allocated $485.5 million of their net proceeds from the bond to renewable energy projects that includes 3 Solar, 3 Wind, and 1 combined Solar + Storage projects (7 total) across 7 states. The total renewable energy capacity would be 740.8MW wind and solar and 30 MW/120MWh storage - Wells Fargo’s funded share of climate project’s total valuation is 46.63% - The company’s share of impact of renewable electricity is 1,159 GWh - 63% of the installed capacity in megawatts for Wind energy and 37% for solars |

| Inclusive Communitites Projects | - Wells Fargo has allocated $139.4 million to socioeconomic advancement and empowerment projects that includes support for 3 health facilities, 2 education facilities, and 1 human services facility (6 total) in majority minority census tract areas in 6 states. This will create/retain 869 jobs and serve above 50,000 patients - The company has also allocated $372.6 million to affordable housing projects that includes support for 5 multifamily rentals across 2 states. The affordable units supported by this project are 1450 |

| Socioeconomic Advancement and Empowerment Projects | - Alabama: Wells fargo assisted an urgent care facility expected to serve 10,000 patients annually - Arizona: The company supported a health center expected to serve 10,400 patients annually - California: - Wells Fargo facilitated the renovation of a 9,000+ square foot building to accommodate high-quality early childhood education and wraparound services for an estimated 80 low-income children up to age 5. - Wells Fargo also helped to develop transitional housing for an estimated 50 homeless families as well as on-site day care, health clinic, dental clinic, social services, housing assistance and employment training. - South Carolina: Wells Fargo assisted the development of a new student life and community center at an HBCU |

UN SDGs Compliance Analysis

Progress made toward SDG targets

As reported by Wells Fargo

- Wells Fargo has helped to develop transitional housing for an estimated 50 homeless families as well as on-site day care, health clinic, dental clinic, social services, housing assistance and employment training.

- As part of their Inclusive Communitites Project, Atlantic Chestnut 1 is a 403-unit development with all units affordable to families earning 30% to 80% of the area median income. Sixty-one of these units are expected to be reserved for formerly homeless families. Wells Fargo’s Community Lending and Investment group made a $97 million Low-Income Housing Tax Credit equity investment in the development

- Wells fargo assisted an urgent care facility expected to serve 10,000 patients annually, in Alabama.

- The company supported a health center expected to serve 10,400 patients annually., in Arizona.

- As part of Inclusive Communities and Climate Bond, Wells Fargo provided a New Market Tax Credit investment to support operations and the purchase of new equipment and inventory to Queen’s North Hawaii Community Hospital.

- Wells Fargo facilitated the renovation of a 9,000+ square foot building to accommodate high-quality early childhood education and wraparound services for an estimated 80 low-income children up to age 5, in California.

- In South Carolina. The company has assisted the development of a new student and community center at an HBCU.

- Wells Fargo has successfully met 100% of their global electricity needs with renewable energy.

- Wells Fargo has allocated nearly half of the total net proceeds of their Inclusive Communitites and Climate Bond to solar and wind projects.

- Wells Fargo provided tax equity for the Central Midway portfolio with sponsor/ developer NextEra Energy Resources, LLC which consists of seven renewable energy projects – three solar, three wind, and one solar+storage project – across seven different states. The projects are expected to have a total installed generating capacity of 740.8 MW and storage capacity of 30 MW / 120 MWh. This represents Wells Fargo’s largest renewable energy tax equity investment to date.

- 63% of the generation will be from wind and 37% from solar.

With their socioeconomic advancement and empowerment projects, Wells Fargo has created/retained 869 jobs

- As part of their Inclusive Communitites Project, Wells Fargo has developed Atlantic Chestnut 1 which is a 403-unit development with all units affordable to families earning 30% to 80% of the area median income.

- Wells Fargo’s renewable energy projects, which include acquisition, development, operation and maintenance of new and ongoing renewable activities and projects including:

- On and offshore wind energy power generation, including development, construction and operational production or manufacturing facilities wholly dedicated to wind energy generation.

- Solar energy power generation, including development, construction and operation of generation facilities.

- Geothermal energy power generation with direct emission of <100gCO2/kWh, including development, construction and operation of generation geothermal energy facilities.

- Manufacturing of wind turbines or solar panels, in each case utilizing the Equator Principles, as appropriate, and excluding nuclear power, fossil fuels and grid infrastructure that support fossil fuels and pipelines.

- As part of their goal to reach net-zero greenhouse gas emissions by 2050, Wells Fargo has committed to deploy $500 billion in sustainable finance between 2021 and 2030.

Sustainability Certificates, Awards and Listings