RATING

Outlook

Negative

SECTOR

Energy and petroleum

Chief Sustainability Officer

T: N/A

E-mail: N/A

Stock Exchange and Ticker

EPA: TTE

Website

Contact

T: +33 (0)1 47 44 45 46

E.mail: N/A

Listing

- #375 World’s Best Employers (2022)

- #29 Global 2000 (2022)

Awards

- MSCI ESG rating (AAA)

- Sustainalytics ESG Risk rating (Negligible)

- ISS ESG Corporate rating (A+)

- S&P Glogbal ESG (100)

- Refinitiv (100)

- CDP Climate Change (A)

- CDP Water (A)

- EcoVadis platform, the Gold status

Revenue

$149.4B

Market Capitalisation

$129.6B

Employees

101,309

Content source

TotalEnergies Sustainability Report

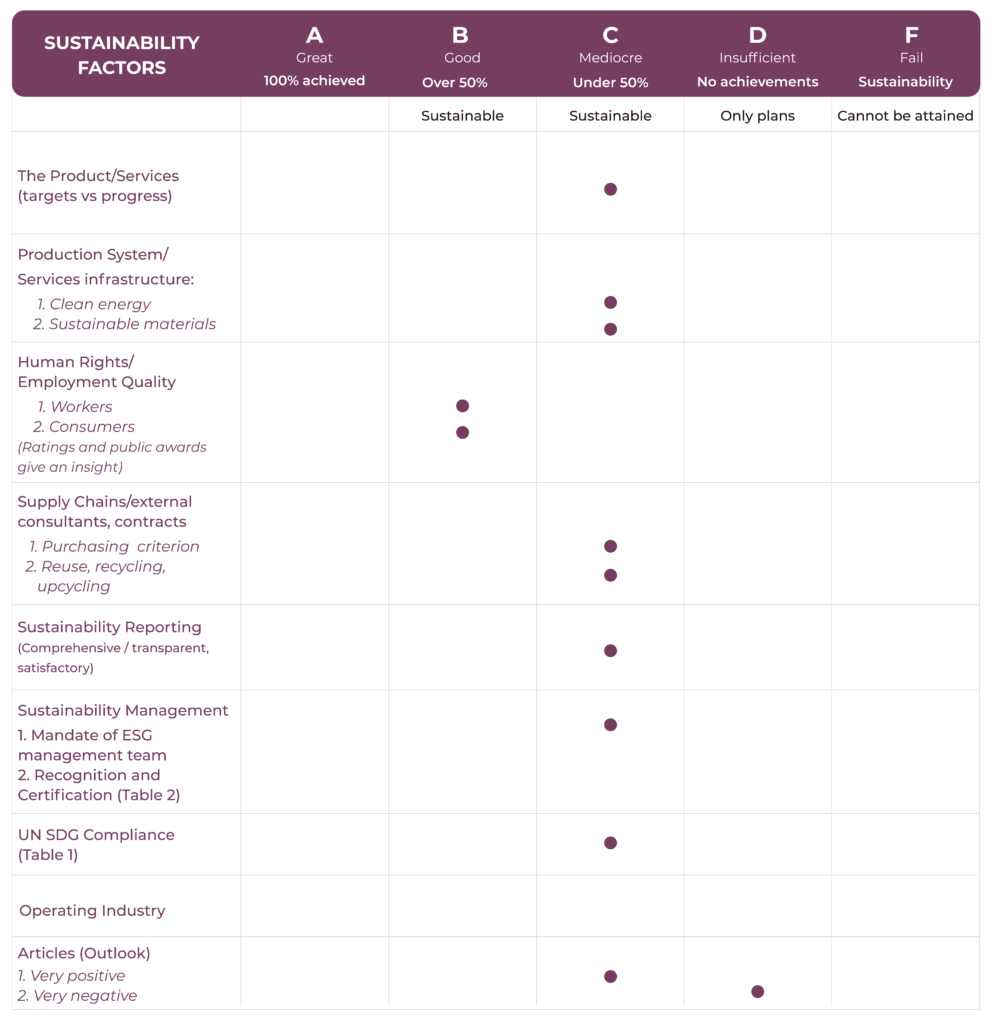

Evaluation of TotalEnergies

According to Oil and Gas Stocks That Will Help You Strike It Rich, TotalEnergies is the greenest option. While putting an emphasis on circular resource practices, the company is actively leading the development of biofuels and biogas, clean hydrogen, and synthetic fuels combining hydrogen and carbon. These molecules play a role in advancing the energy transition. It also employs carbon capture and storage (CCS) to combat climate change.

The company has established definite goals to be achieved by 2030 and 2050, but it has not yet made enough progress in that direction. Since 2015, it has reduced its carbon emissions by only 20% compared to the baseline. Total Energies is however currently modernizing its business practices to deal with the twin issue of using more energy while producing fewer emissions.

It also has numerous partnerships that range from fighting climate change to safeguarding biodiversity. While it has been working with ISO 14001 for environmental management, it obviously needs to gain more certification to transition to a fully sustainable business model and increase transparency.

In addition to the fact that it was given good index scores by reputable third parties, there is also compelling evidence to reject claims that the company is engaging in greenwashing. Particularly this year, it is formally prosecuted for “greenwashing” for the first time. On the other hand, unfortunately, it is also possible to find some mentions of greenwashing online.

In conclusion, even though its objectives or the actions it has taken are positive steps toward sustainability, it still acts in a manner that harms the environment, excluding TotalEnergies from most lists of sustainable businesses. Therefore, in spite of the great decarbonisation progress, because of the strong evidence of greenwashing, the overall evaluation is a C, with a negative outlook.

Sustainability Scorecard

TotalEnergies Company Activity

Created in 1924 to enable France to play a key role in the great oil and gas adventure, TotalEnergies has always been driven by an authentic pioneering spirit. It has discovered some of the most productive fields in the world. Its refineries have created increasingly sophisticated products and its extensive distribution network has rolled out an ever-expanding range of services.

As for the Company’s culture, it has been forged on the ground, underpinned by an unwavering commitment to safety and performance. Throughout its long history, TotalEnergies was to frequently cross paths with two other oil companies, one French – Elf Aquitaine – and the other Belgian – Petrofina. Sometimes competitors, some-times partners, they gradually learned to work together. Their talent lay in being able to combine their strengths against their competitors. Such was the major challenge behind the mergers of 1999. They gave rise to the fourth oil major, a group built on a wealth of expertise and experience. Some 20 years later, Total became TotalEnergies, driven by a powerful ambition: to be a world-class player in the energy transition and to achieve, together with society as a whole, carbon neutrality in all its global activities by 2050.

TotalEnergies Sustainability Activity - As per company declarations

TotalEnergies is changing into a multi-energy firm and implementing specific action plans to lower its emissions and accomplish its short- and medium-term goals in order to reach net zero by 2050, together with society.

The Company is acting to:

- Reduce emissions from its operated industrial facilities (Scope 1+2) by more than 40% by 2030, and Disclose the Progress at its Operated and Non-Operated Facilities.

- Together with society, including its customers, suppliers, partners, and public authorities, reduce the indirect emissions associated with its goods (Scope 3), by assisting in the transformation of its customers’ energy consumption.

Utilizing the Avoid – Reduce – Compensate philosophy, TotalEnergies takes precautions to limit the environmental effects of all its activities. The first approach is to limit any effects as much as you can. The Company employs the greatest technology available to mitigate damages that cannot be prevented and, as the last option, pays for any lingering effects. Conserving biodiversity, safeguarding water resources, and implementing circular resource management are the Company’s top three environmental concerns.

Being a responsible energy provider also entails making a positive difference for the people who inhabit our world. Their personnel, whose abilities and dedication are the key determinants of their long-term performance, are the subjects of this goal in the first place.

An equitable transition for their partners and staff is necessary for their transformation into a multi-energy organization to flourish. Their goal is to be a role model for employers and operators and to do this, they rely on the core values of their business model and Code of Conduct, which applies to all of their operations globally. These values include safety, respect for one another, and openness in their social interaction.

TotalEnergies, which has operations in 130 countries and engages in activities throughout the whole energy value chain, aspires to create shared prosperity with all of its diverse stakeholders. The Company is dedicated to making sure that both value and constructive change are produced by its ventures and initiatives. For this purpose, TotalEnergies conducts all of its dealings with its stakeholders—including its workers, clients, partners, host states and communities, civil society leaders, suppliers, and investors—in accordance with its Code of Conduct.

Certificate & Labels, Standards and Frameworks

- ISO 14001

TotalEnergies in the news: Press Reviews and Social Media

By 2030, power produced “primarily” from renewable sources would account for 15% of their sales, while oil and gas would still account for 80%. The business may opt to make significant investments in environmental policies and wholly renewable energy sources, not just in terms of dollar amounts but also in terms of percentage.

30 years of actively opposing climate change, supporting authoritarian governments, and aggressively exploring the need to safeguard natural surroundings. The oxymoron aside, it is also one among the “greenest of the oil stocks.” Within its industry, TotalEnergies is “somewhat” well-regarded. In addition, this business has one of the highest ESG ratings in its sector. In the medium to long term, these sustainable investments may be incredibly rewarding.

One of the seven “supermajor” oil firms and the heavyweight of the French CAC 40 Index, TotalEnergies has been drawing attention for years. In light of its large GHG emissions, TotalEnergies does not spend nearly enough on ESG standards. In comparison to the “greenwashing” ads that big firms currently saturate us with, it would be wonderful publicity if this company committed just 1% of its earnings to these projects, which would cost more than $2 billion.

TotalEnergies spends $52 million annually, or 29% of its marketing expenditure, on its environmental image (the highest percentage among the five carbon majors). One of the top five producers of fossil fuels, the Total Group is responsible for a +4°C average increase in global temperature. Frank Thinnes, a climate, and energy campaigner with Greenpeace Luxembourg believe offset systems like the Redd+ initiative, backed by TotalEnergies, allow ongoing environmental damage and encourage the commercialization of nature. Its annual greenhouse gas emissions total 488 million tonnes, which add to a +4°C increase in average world temperature. Twenty other international organizations, including Greenpeace, are calling for a ban on the promotion of polluting businesses that risk and injure millions of people.

However, oil firms like TotalEnergies are making every effort to maintain the ability to market their climate-damaging goods. Our planet and our future are currently being destroyed by the deception and greenwashing of fossil fuel firms like TotalEnergies, according to Frank Thinnes.

A greenwashing lawsuit against oil and gas giant TotalEnergies has been launched by environmentalists who claim that the company’s rebranding drive misleads customers given its continuous investment in fossil fuels. The case may influence how large oil and gas companies promote their efforts to combat climate change. TotalEnergies asserts that its rebranding effort is dishonest considering its continuous investment in fossil fuels. The complainants contend that TotalEnergies violated European consumer law when it changed its name from Total to TotalEnergies and used the Twitter hashtag “#MoreEnergiesLessEmissions” in order to promote its goal of being carbon neutral. Several NGOs, including Greenpeace, Friends of the Earth, Notre Affaire à Tous, and ClientEarth, have filed a lawsuit against TotalEnergies.

Adani New Industries Limited (ANIL), a division of the Adani Group, will see a 25% ownership share purchased by TotalEnergies. In order to create the center, the joint venture plans to invest $50 billion over the next eight years. By the year 2030, the hub should be fully operational and producing 1 million metric tons per year of green hydrogen using renewable energy sources. The project is sufficient to produce 2 million mt of green hydrogen even at the current price of $4 to $5 per kilogram, despite the fact that the specifics of the transaction between the two companies have not been made public. This is the largest deal in India and likely one of the largest in the world (Kashish Shah). Together, TotalEnergies and Adani Group will make India the most affordable green hydrogen generator in the world.

Highlights from TotalEnergies Sustainability Report

Achievements

- Established the Northern Lights CCS joint venture, worked with Shell, EBN, and Gasunie on the Aramis CCS project in the Netherlands, and additionally collaborated with Air Liquide, Borealis, Esso, and Yara to use CCS to decarbonize the Normandy basin

- Purchasing a 20% stake in Adani Green Energy Limited (AGEL), a division of Adani, the biggest private energy and infrastructure conglomerate in India, as part of a partnership with Adani (January 2021)

- Four solar projects totaling 2.2 GW and 600 MW of battery storage will be installed between 2023 and 2024 after being acquired from SunChase Power and MAP RE/ES (February 2021)

- Establishment of a 50/50 joint venture with Hanwha subsidiary 174 Power Global (January 2021): 12 projects totaling 1.6 GW in capacity, including energy storage

- The biggest battery storage facility in France (61 MWh) will be put online by TotalEnergies near Dunkirk in December 2021

- TotalEnergies has signed agreements to supply LNG to India (up to 3 Mt per year with partner Adani) and China (up to 1.4 Mt per year via a contract with Shenergy Group)

- Signed major multi-energy agreements in Iraq covering the construction of a new gas network and treatment units, the construction of a large-scale seawater treatment unit, and the construction of a 1 GW photovoltaic power plant

- In the United Arab Emirates, TotalEnergies has joined the Masdar and Siemens Energy initiative to build a pilot unit for the production of green hydrogen to be used to convert CO2 into sustainable aviation fuel

- An analysis of turbine energy consumption at one offshore production site led to a 30% reduction in the complex’s fuel gas consumption during 2020

- Partnered with GHGSat in 2021 to quantify small leaks and develop satellite-based measurement technology suitable for offshore facilities, a world first

- LNG distribution for cruise ships and marine transportation

- Forming partnerships to decarbonize the maritime sector

- A biofuel-powered pilot fly

Weaknesses and Setbacks

- Lack of certificates

- Not clear progress

- Greenwashing

Targets vs Progress Reported

| Target | Results reported |

|---|---|

| 40% reduction by 2030 in net Scope 1+2 emissions compared to 2015 | - Lowered emissions from its operated facilities (Scope 1+2) by 20% from 2015 |

| Lower carbon products to reduce the lifecycle carbon intensity of energy products sold by at least 20% by 2030 | - Reduced the share of their sales from petroleum products to 44% of the total from 65% in 2015 |

| Reduce methane emissions by 80% by 2030 | - Insufficient |

| Reduce its global Scope 3 emissions to below 2015 levels | - Insufficient |

| Reduce freshwater withdrawals by 20% between 2021 and 2030 at sites in water-stressed areas | - Insufficient |

UN SDGs Compliance Analysis

Progress made toward SDG targets

As reported by TotalEnergies

- TotalEnergies has established a set of standards shared by all of their business sectors, known as One MAESTRO (Management and Expectation Standards Toward Robust Operations) to prevent the many hazards that are specific to their industry

- Achieved a TRIR of 0.70 or less in 2022

- Created a psychological support hotline available to anyone working at a TotalEnergies facility

- In 2021 TotalEnergies focused attention on in-house vaccination campaigns for Company employees and partner firms, as well as support programs for the communities residing near our areas of operation

- For the Ugandan Ministry of Health, a cutting-edge ambulance station has been built in Uganda. The Buliisa and Nwoya districts, which are close to their project activities, also received oxygen and oxygen cylinders from them

- In Libya, we provided five municipalities (Wadi Otba, Ghat, Jallo, Ras Lanouf, and Al Ajilat) with solar-powered oxygen generation equipment. Additionally, hundreds of swab tests, PCR equipment, and kits were sent to the Tripoli oil clinic

- The Company provided fast test kits and masks to the Kapuna rural hospital in Papua New Guinea

- A decent wage is defined as income that, in exchange for standard work hours, allows employees to ensure a decent life for their families, cover their essential costs and cope with unforeseen events

- The Tilenga-EACOP project is being developed in a sensitive social environment and requires the implementation of land acquisition programs focused strongly on respecting the rights of the concerned communities

- The percentage of women in the workforce has increased since 2018

- The Total Women’s Initiative for Communication and Exchange (TWICE) is an internal network with over 5,000 members worldwide. Its goal is to help women develop their careers at TotalEnergies by sharing best practices, and building knowledge and confidence, with mentoring and development workshops

- Reinventing a net zero energy system

- Lifted its investments in electricity and renewables to more than $3 billion, or 25% of its net investments

- Solar power and offshore wind projects

- Decarbonization of all the hydrogen used in its European refineries

- In order to achieve its goal of being the market leader for biofuels, TotalEnergies transformed its La Mède refinery into a top-notch biorefinery. The factory creates bionaphtha, bioLPG, and hydrotreated vegetable oil for use in heating or transportation

- TotalEnergies and Clean Energy broke ground for their first biomethane production unit in Friona, Texas

- By purchasing Fonroche Biogaz, which had 500 GWh of installed capacity, in the beginning of 2021, TotalEnergies rose to prominence in the French biogas industry

- TotalEnergies and Veolia joined forces to produce biomethane from Veolia waste and water treatment facilities operating in more than 15 countries

- Automotive Cells Company (ACC), a joint venture founded by TotalEnergies and Stellantis in 2020, is set to emerge as a global player in the development and manufacture of automotive batteries beginning in 2023

- TotalEnergies entered into a partnership with Daimler Trucks in 2021 dedicated to hydrogen infrastructure for trucks in France, Germany, and Benelux

- TotalEnergies is in a position to meet demand from its customers and the requirements of French legislation, which calls for aircraft to use at least 1% biojet fuel effective January 1, 2022

- Signed an agreement with MSC Cruises to supply some 45,000 tons of LNG annually to future cruise ships

- Signed CPPAs with Microsoft (47 MW) and Orange (100 GWh/year) that include the construction of dozens of solar power plants across France

- Signed two CPPAs, one with Air Liquide (50 GWh/year of renewable power over 15 years in Belgium) and the other with Amazon (474 MW of renewable power generation capacity in the U.S. and Europe)

- In early 2022, TotalEnergies’ ATGL joint venture won additional gas distribution licenses

- In February 2022, TotalEnergies and the Ugandan Ministry of Energy and Minerals also signed a Memorandum of Understanding (MoU) for the development of renewable energy with the objectives of developing 1 GW of installed capacity, promoting access to electricity and clean energy, and supporting national climate change objectives through the deployment of carbon footprint reduction projects

- “Transforming With Our People” Program, launched in 2021. The program draws on a skills mapping process to identify our existing skills and target those we need in order to become a significant player in the energy transition

- Nearly 10,000 positions (excluding Hutchinson) open to mobile candidates were posted in 2021. Nearly 4,000 career assessments were conducted to help employees choose the direction of their careers and build a career path

- Provided support for “Local Socio-Economic Development” in different countries

- 3.400 engineers, scientists, and technicians were assembled in a new section in September 2021 to improve the company’s capacity for innovation and its capacity to plan and direct sizable integrated industrial projects by utilizing the teams’ operational excellence in One Tech

- SMART PM software makes it possible to track real-time energy losses on exchangers, assess their fouling rate, and clean them at the appropriate time

- TotalEnergies’ Digital Factory, which opened in 2020, brings together up to 300 developers and data scientists to develop the digital solutions the Company needs to improve its industrial operations, offer new services to customers

- AUSEA consists of a miniature sensor, weighing 1.4 kilograms and mounted on a drone, that quantifies emissions by measuring methane emissions in the plume and tracing them back to their source

- CMA CGM and TotalEnergies initiate a feasibility study for France’s first bio LNG production project

- Investing in R&D in India via a research center in Mumbai and a digital innovation partnership with Tata subsidiary TCS

- The Company’s Synova affiliate, with a production capacity of 45 kt at the end-2021, is involved in Mechanical recycling

- Uses TACoil, a product made by partner Plastic Energy, to create polymers from advanced recycling at the Antwerp complex. The two companies have teamed together to construct a production facility at Grandpuits. Additionally, TotalEnergies and Honeywell are working together to promote advanced plastic recycling in Europe and the US

- Provides customers with biopolymers made from bio feedstocks based on vegetable oils or used cooking oils processed at the La Mède biorefinery

- TotalEnergies conducts multiple R&D projects concerning water, such as the Sustainable Water Platform (SWAP), which aims to use renewable energy to treat and recycle rainwater and wastewater

- Developed dedicated tools to monitor water, such as “Wat-R-use”, which calculates a site’s water footprint and the associated cost and recommends measures to limit water use

- In 2021, the Company launched a study on the water use intensity of its most impactful suppliers1 to ensure that they respect best water use practices

- Participating in Collective Water Management Initiatives

- The Company’s Marketing & Services affiliates deploy technical water substitution and recycling solutions in water-stressed regions in liaison with local officials, notably by installing modules to recycle car wash water from multiprogram systems

- TotalEnergies is a founding member of the Alliance to End Plastic Waste created in 2019, which brings together 80 companies in the plastics and consumer goods value chain. In 2021, the Alliance supported the Coliba project to improve the collection, processing, and sale of rigid plastic waste in Abidjan, Côte d’Ivoire by installing collection points in Shell and TotalEnergies service stations. The collected waste is baled and transferred to the Coliba plant for processing and then re-sale

- Investing in advanced biofuels projects

- Collaboration with different companies in different countries for CCS

- The CO2 Fighters, a group committed to cutting greenhouse gas emissions, have been monitoring GHG emissions across the Company. Its duties include promoting a low-carbon attitude inside the organization, starting energy efficiency initiatives, advancing the electrification of buildings, and aiding in the introduction of more environmentally friendly energy consumption practices. More than 400 emissions reduction initiatives have been managed by the team, the majority of which cost less than $10 per tonne of CO2

- Air France-KLM, TotalEnergies, Groupe ADP, and Airbus join forces to conduct the first long-haul flight with a 16% blend of SAF produced from cooking oil. The flight from Paris to Montreal reduced CO2 emissions by 20 tons compared to conventional jet fuel

- The Company cooperates with its peers and leading academic institutions like the University of Oxford to develop tools for identifying the marine biodiversity issues related to wind projects

- In 2021, it joined the Ocean 100 initiative led by the World Resources Institute (WRI) and World Economic Forum (WEF) in order to coordinate and take action to promote sustainable oceans with the major multinationals that generate revenues from the ocean economy

- Since 2021, Cordilleria Azul National Park, which covers 1.35 million hectares and is included on the IUCN Green List, and CIMA (Centro de Conservation, Investigacion y Manejo de Areas Naturales), a Peruvian NGO, have collaborated to support programs for protecting the primary forest

- A collaboration agreement for a large-scale, inclusive agroforestry management project with the Republic of the Congo, which would sequester more than 10 Mt of CO2, was signed in March 2021 by TotalEnergies and Forêt Ressources Management

- They form TotalEnergies’ contribution to the United Nations’ Post-2020 Global Biodiversity Framework (GBF), which will set 2030 targets for the planet at the COP15 meeting in Kunming

- In 2018, TotalEnergies proactively joined Act4Nature International, an initiative tailored for French multinationals with commitments to promote biodiversity

- TotalEnergies’ partnership with the United Nations Environment Programme’s World Conservation Monitoring Center (UNEP-WCMC) gives the Company access to geographical biodiversity data that are crucial to assessing project biodiversity risks

- The Company is a member of the Taskforce on Nature-related Financial Disclosures (TNFD) Forum created in 2021, which will define a framework

- Training 100% of executives, Country Chairs, and project managers in human rights

- In late 2021, 35,000 employees completed the e-learning module on human rights in the workplace

- Online publications of the environmental and social impact assessments (ESIAs) and expert opinions on human rights have been made for the Tilenga and EACOP projects

- In 2020 and 2021, TotalEnergies coordinated training on the Voluntary Principles on Security and Human Rights for government and private security forces for the Mozambique LNG project

- Representatives from TotalEnergies engage in dialogue with NGOs and human rights advocates, to coordinate actions in the field designed to prevent or resolve specific situations

- Entered into the Tax Partnership with the French authorities for greater transparency, dialogue, and trust as soon as it was launched

- The Company applies a principle of “zero tolerance” of corruption for all its employees and suppliers

- Joined the Getting to Zero Coalition to help contribute to the International Maritime Organization’s goal of reducing emissions from shipping by at least 50% by 2050

- Joined the Copenhagen-based Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping, dedicated to innovation in decarbonizing the shipping industry

- In September 2021, TotalEnergies and the Iraqi authorities signed major agreements covering several projects in the Basra region, designed to enhance the development of Iraq’s natural resources to improve the country’s electricity supply

Sustainability Certificates, Awards and Listings