RATING

Outlook

Negative

SECTOR

Financial Service Activities

Chief Sustainability Officer

N/A

Contact Details:

T: N/A

E-mail: N/A

Stock Exchange and Ticker

NYSE: RY

Website

Contact

T: N/A

E.mail: N/A

Listing

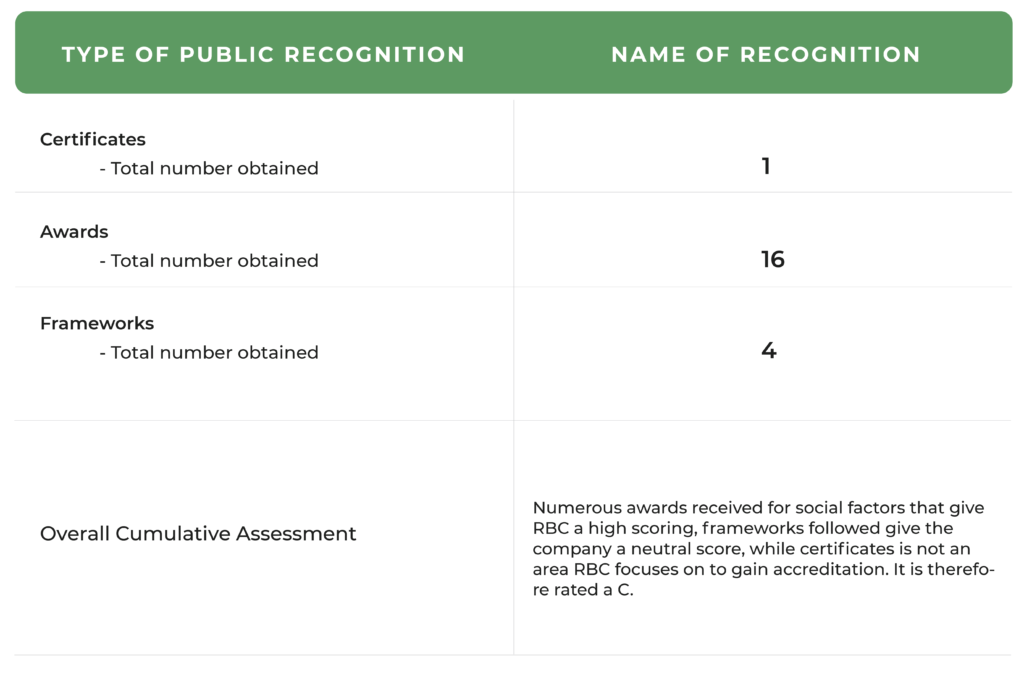

- Best Workplaces in Canada – Great Place to Work Institute

- Canada’s Top 100 Employers – Mediacorp Canada Inc.

- Canada’s Top Employers for Young People – Mediacorp Canada Inc.

- 50 Most Engaged Workplaces – Achievers

- 2021 Top Companies in Canada – LinkedIn

- Canada’s Best Diversity Employers – Mediacorp Canada Inc.

Awards

- Member of the Dow Jones Sustainability North American Index

- Member of the FTSE4Good Index

- 2021 Catalyst Award – Catalyst

- Member of the Bloomberg Gender-Equality Index

- Member of the Refinitiv Diversity & Inclusion Index

- 2021 Best Places to Work: RBC Wealth Management U.S. –

- Minneapolis/St. Paul Business Journal

- In 2021, the RBC Supplier Diversity Program was a finalist for the Women Business Enterprises (WBE) Canada Excellence Awards for Most Improved Supplier Diversity Program

Clients related Awards:

- Ipsos Financial Service Excellence Awards 2021 – Top ranking in 11 categories, including Recommend to Friends or Family and Customer Service Excellence

- J. D. Power 2021 Highest Customer Satisfaction Award – Highest in Customer Satisfaction Among the Big Five Retail Banks for the second consecutive year and five out of the past six years

- Best Payments Innovation Award from The Digital Banker as part of the Global Retail Banking Innovation Awards 2021

- Euromoney Private Banking and Wealth Management Survey 2021: 21 first-place awards including:

- Best Private Banking Services Overall in North America and Canada

- Best in Serving Business Owners in North America and Canada

- Best ESG/Impact Investing Services – Canada

- Family Wealth Report Awards 2021 – RBC WM was awarded “Innovative Client Solution”

- PWM Wealth Tech Awards 2021 – RBC WM was awarded “Best Private Bank for Digitally Empowering Relationship Managers, North America”

Revenue

Market Capitalisation

Employees

Content source

Royal Bank of Canada (RBC) Sustainability Report

Evaluation of Royal Bank of Canada (RBC)

Royal Bank of Canada’s Environmental, Social and Governance (ESG) Performance Report contains details on ESG factors relevant to financial services companies in general, and to RBC in particular and reflects activities undertaken during the 2021 fiscal year (November 1, 2020 – October 31, 2021), unless otherwise noted. PricewaterhouseCoopers LLP (PwC) has performed a limited assurance engagement for a select number of RBC performance indicators.

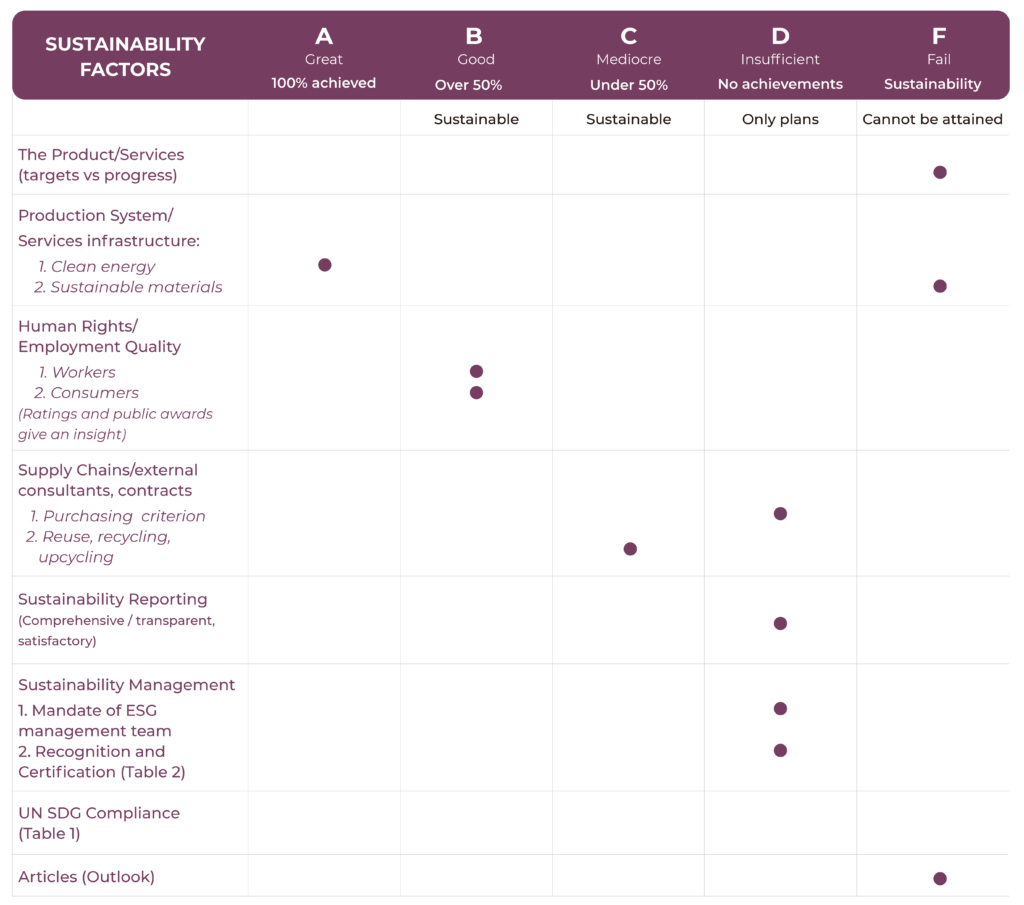

An accurate rating score for RBC might be difficult to provide as the bank is in the initial stage of assessing their GHG emissions associated with their lending investments, in which 83% of the portfolio is linked to oil and gas industry, agriculture, utilities and other. Specifically, according to the initial assessment conducted as a member of the The Partnership for Carbon Accounting Financials (PCAF), for which they receive a low score of 5, RBC accounted for 45 MtCO2e from lending and investment, with 38 MtCO2e coming from the biggest emitting industries, mentioned above. Sustainability can’t be therefore achieved in this area and any targets RBC is setting to reduce emissions are limited to Scope 1 and 2, and 3, specifically on the areas under their direct management.

Regarding other aspects, RBC transition to use renewable sources of energy is making good progress, increasing the building surface with LEED certifications. The bank has received numerous awards to score high in terms of social factors associated with diversity and inclusion in the work place, employees engagement, as well as recognition from clients.

But with these efforts in place, RBC does not have a Chief Sustainability Officer, nor it is easy to find information on where this responsibility belongs in the company.

As I mentioned, although RBC is making efforts to reach sustainable goals, their overall progress is insufficient and therefore receive a D with a negative outlook.

Sustainability Scorecard

Royal Bank of Canada (RBC) Company Activity

Royal Bank of Canada provides banking and financial solutions through the following segments: Personal and Commercial Banking, Wealth Management, Insurance, Investor and Treasury Services, Capital Markets, and Corporate Support. The Personal and Commercial Banking segment offers financial products and services in Canada. The Wealth Management segment provides investments, trust, banking, credit, and other wealth management solutions to institutional and individual clients through its distribution channels and third-party distributors. The Insurance segment deals with life, health, home, auto, travel, wealth, group, and reinsurance products. The Investor and Treasury Services segment includes asset services and a provider of cash management, transaction banking, and treasury services to institutional clients worldwide. The Capital Markets segment covers banking, finance and capital markets to corporations, institutional investors, asset managers, governments, and central banks around the world. The Corporate Support segment consists of technology and operations services. The company was founded in 1864 and is headquartered in Toronto, Canada.

Royal Bank of Canada (RBC) Sustainability Activity - As per company declarations

At RBC sustainability is clearly summarised by the CEO, Dave McKay such as “RBC is contributing to a more inclusive, sustainable and prosperous future.” Specifically by offering customised solutions, insights and advice, by promoting industry learning and thought leadership. Furthermore, by setting ambitious goals and measuring progress to ensure accountability and transparency for the actions and outcomes. And lastly by enabling employees to succeed in a diverse and inclusive workplace where to develop future skills such as adaptability, creativity and problem-solving.

Certificate & Labels, Standards and Frameworks

- LEED

Royal Bank of Canada (RBC) in the news: Press Reviews and Social Media

Reuters (May 12, 2022 by Nichola Saminather) – Canada banks face ‘greenwashing’ claims as oil & gas firms obtain sustainable financing

Canadian banks have increased the amount of sustainable-linked financing (SLF) to oil and gas companies, which have led to accusations of “greenwashing”. While SLF is designed to incentivize borrowers to achieve ESG targets, banks are rather using SLF to pretend to lower their carbon footprint than take specific steps towards reducing emissions. As the world’s fourth biggest oil producer, many banks in Canada claimed that the oil and gas industry needs “ ongoing support to meet continued demand as energy alternatives such as wind and solar are developed.”

Furthermore, the banks are incentivized to promote SLF because of the funding from the Canadian Government’s emission reduction plan, as well as the growing popularity of green washing.

CBC News (March 24, 2021 by Don Pittis) – Despite calls for change, Canada’s RBC is one of world’s top bankers to fossil fuel industry

The article provides an analysis on the contribution of the 60 world’s largest banks to the fossil fuel industry, with a focus on RBC. Specifically, RBC has invested between 2016 and 2020, $160 billion in fossil fuel. Moreover, RBC has committed to net-zero emissions by 2025, with an additional $500 billion budget for sustainable financing.

However, in a country where political and economic pressure is put on the oil and gas development, RBC acknowledged that a transition to net-zero “must be done in an inclusive manner that brings all sectors and communities along or we won’t achieve the support we need to meet these goals”.

Canadian Business (March 22, 2022 by Kelsey Rolfe) – Why Hollywood Celebrities Are Petitioning Against a Canadian Bank

RBC has provided financing for 670 kilometres long pipeline, with a cost estimated at $6.6 billion. The pipeline is built to facilitate natural gas delivery through a traditional territory populated by Wet’suwet’en nation. Specifically, although the company building the pipeline Coastal GasLink has signed benefit agreements with all 20 elected Indigenous communities, failed to consult with hereditary chiefs as the land’s rightful title holders. The RBC was therefore accused of financing the climate crisis and disregarding the rights of Indigenous people.

More than 65 celebrities have joined the Indigenous climate activists in signing a petition to ask for immediate defunding of the project. Moreover, celebrities have threatened to pull their accounts if the bank doesn’t withdraw its support of the project.

Highlights from Royal Bank of Canada (RBC)Sustainability Report

Achievements

- Established the Climate Strategy Steering Committee and the ESG Disclosure Council (ESG DC)

- Joined The Global Carbon Standard for the Financial Industry (PCAF) to advance capabilities in measuring the emissions associated with lending and investments

- In July 2021, Personal & Commercial Banking (P&CB) in partnership with RBC Capital Markets® launched the RBC ESG Market-Linked Guaranteed Investment Certificate GIC, to offer customers access to invest in a global portfolio of companies that focus on things they care about. To be included in the index, all companies must pass a set of rigorous ESG standards

Weaknesses and Setbacks

- Does not have a Chief Sustainability Officer and it appears there is no head of Sustainability

- $38.757B invested in fossil fuel in 2021 according to “FOSSIL FUEL FINANCE REPORT 2022” and $201.229B between 2016 – 2021

- In 2021, RBC paused its use of the CDP supply chain survey due to cross-industry changes in operations as a result of the COVID-19 pandemic

- Although in 2021 RBC joined the The Partnership for Carbon Accounting Financials (PCAF) to start measure and report on “financed emissions”, the quality of the data in the first disclosure had a Score 5, defined by PCAF as uncertain (estimated data with very little support)

Targets vs Progress Reported

| Target | Results reported |

|---|---|

| Reduce total GHG emissions (tonnes of CO2e) by 70% by 2025 | - Percentage reduction in year-over-year GHG emissions; - Scopes 1 & 2 only: -21% - Scopes 1, 2 & 3: -28% |

| Increase electricity from renewable and non-emitting sources for all properties to 100% by 2025 | - 84% of RBC’s electricity consumption from renewable and non emitting energy |

| Remain carbon neutral across operations | - Carbon energy purchase decrease from 107% to 101% between 2019 and 2021 |

| Commitment to provide $500 billion in sustainable finance by 2025 | - $83.8 billion of sustainable finance in 2021, a total of $198 billions since 2019 - Commitment to support companies and projects. widely recognized as contributing to a net-zero, inclusive economy of the future |

| Goal to increase the total value of assets under management by RBC Global Asset Management (GAM) that integrate material ESG factors | - In 2021 the value was $597.2B, up from $518.5B - Training for investment teams included ESG education sessions with both internal and external experts on topics such as climate change, human rights and executive compensation best practices - Material climate-related risks and opportunities are assessed by investment teams |

| RBC Foundation to commit $100 million by 2025 to innovate environmental programs | - Over $10 million in total donations through RBC Tech for Nature |