RATING

Outlook

Neutral

SECTOR

Petroleum and Petroleum Products Merchant Wholesalers

Chief Sustainability Officer

T: N/A

E-mail: N/A

Stock Exchange and Ticker

BVMF: PETR4

Website

Contact

T: 55-21-3324-1510

E.mail: N/A

Listing

#49 Global 2000 (2022)

T: N/A

E.mail: N/A

Awards

- MSCI ESG Rating, where they were ranked in the first quartile of performance for “carbon emissions”

- Dow Jones Sustainability Index World (DJSI World) from S&P Global’s Corporate Sustainability Assessment, with emphasis on the performance of Climate Change and Operational Eco-efficiency criteria

- Awarded the Distinguished Acievement Award for Comapnies, granted by Offshore Technology Conference (OTC), for the innovations developed in Buzios field

Revenue

$50.5B

Market Capitalisation

$59B

Employees

45,532

Content source

Petrobras Sustainability Report

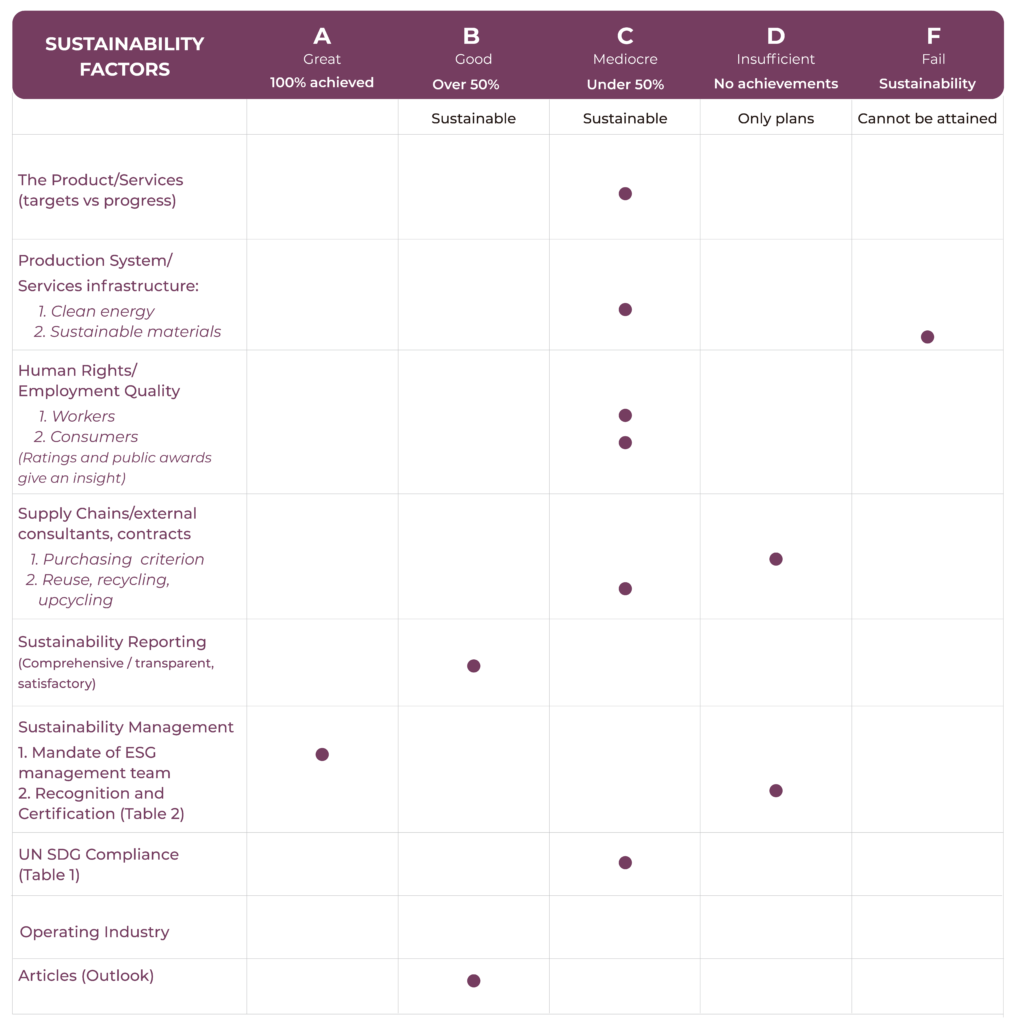

Evaluation of Petrobras

Petrobras has established clear sustainability goals and is moving, slowly but steadily, toward them. Its report covers emission reduction, energy diversification into low-carbon sources, water security, oil spills and preventions, and biodiversity preservation.

To achieve net zero, the main strategies it employs is carbon capture, utilization, and storage (CCUS).

Achieving relevant certificates, such as ISO 14067, is still something that is needed. On the other hand, Petrobras is committed to promoting the socioeconomic success of the communities in which it operates, raising public welfare, defending human rights and the environment, and re-entering the Dow Jones Sustainability World Index.

The company wasn’t mentioned in a lot of listings. Even though there aren’t many independent sources, the ones we can find are generally positive and don’t mention greenwashing.

All factors given, C is the overall grade, with a neutral outlook. This is the highest score among all oil and gas companies included in the 2023 Impakter Index.

Sustainability Scorecard

Petrobras Company Activity

Petróleo Brasileiro SA engages in oil and gas exploration, production, and distribution activities. The exploration and production segment involves crude oil, natural gas liquids, and natural gas. The refining, transportation and marketing segment involves refining, logistics, transportation, trading operations, oil products and crude oil exports and imports, and petrochemical investments. The gas and power segment includes transportation and trading of natural and liquefied natural gas, the generation and trading of electric power, and the fertilizer business.

Petrobras owns 22 company units in Brazil, that include seven exploration and production units, and 15 refining and Natural Gas units. Outside Brazil, the company Petrobras has activities in seven other countries, specifically, Latin America, operations include exploration and production and distribution of oil products, in North America production of oil and gas through a joint venture. Additional subsidiaries are in The Netherlands (Rotterdam), USA (Houston) and Singapore that support commercial and financial activities.

The company was founded on October 3, 1953, headquartered in Rio de Janeiro, Brazil and is controlled by the Federal Government, which, on February 28, 2022, directly held 50.26% of common shares and 28.67% of total share capital.

Petrobras Sustainability Activity - As per company declarations

The company aims to provide energy that generates revenue in an ethical, safe and still competitive way.

They invested in carbon capture, utilization, and storage (CCUS) methods. Re-injecting GHG into the reservoir increases production efficiency and, clearly, reduces the overall GHG emissions. Currently, all 21 oil extraction platforms operated by Petrobras in the pre-salt of the Santos Basin, incorporate CCUS technology for enhanced oil recovery (EOR), and performance is continuing to improve.

This lowers the company’s carbon footprint, based on emissions per barrel produced. In fact Petrobras broke the CCUS injection record in 2022 by injecting about 25% worth of the whole industry, equivalent to 5.8 billion m³ of CO2. As this operation is at the pre-salt fields, this puts Petrobras in a vanguard position for the application of reinjection technology in ultra-deep waters, which the other oil companies in the world have been doing onshore or in regions with much shallower water depths.

In this sense, social, environmental and governance issues weight into their business, generating value not only from the operation of their assets, but also from the way of operating business toward the environment.

Certificate & Labels, Standards and Frameworks

- Certification from the Association for Supply Chain Management (ASCM) in environmental, ethical and economic excellence and supply chain of goods and services

- Certification in the Governance indicator of the secretariat for Coordination and Governance of State Owned companies (IG-Sest), of the Ministry of the Economy, classified in the best level of the indicator (Level 1)

- TCFD – Task Force for Climate Related Financial Disclosures

- SASB – Sustainability Accounting Standard Board (Exploration & Production, Midstream and Refining & Marketing)

- IPIECA – International Petroleum Industry Environmental Conservation Association

- GRI – Global Reporting Index (2016 GRI Standard)

- IOGP – The International Association of Oil & Gas Producers

- UN Global Compact

- UN Sustainable Development Goals (SDG)

- KPMG responsible for the limited assurance service for the information in the 2021 Sustainability Report

Petrobras in the news: Press Reviews and Social Media

A number of targets relating to the intensity of its emissions in the exploration and production and refining segments are linked to the first USD 1.25 billion sustainability-linked loan that Petrobras has signed. Annual targets for each of the key performance indicators and potential changes in interest rates are part of the loan. Additionally, the company plans to invest USD 2.8 billion in decarbonization projects and sell more sustainable debt. From 2009 to 2021, Petrobras reduced emissions per barrel by almost 50%, and it plans to keep issuing debt that is sustainable. With Bank of China, MUFG, and The Bank of Nova Scotia, Petrobras has a sustainability-linked loan (SLL) agreement that focuses on GHG emissions, E&P emissions, refining, and methane emissions.

By 2025, the company aims to cut the upstream segment’s carbon emissions intensity by 20% and methane emissions intensity by 40%. In accordance with the Sustainability Linked Loan Principles of the International Capital Markets Association, the SLL includes annual goals for each of the KPIs through its expiration date. Due to the document containing confidential commercial and strategic information about the company, Petrobras has declined to share it.

Highlights from Petrobras Sustainability Report

- Decrease in direct GHG emissions (Scope 1) since 2015

- In 2021, 92% of the energy generated at its thermoelectric park is from natural gas thermoelectric plants and 8% from oil based thermoelectric plants

- Decrease in energy consumption within the organization since 2017

- Increase in reused water volumes since 2007

- Decrease in reused water volumes since 2007

- It discusses the growth of the female workforce but leaves out to mention the workforce’s gender ratio

- Being sustainable is moving very slowly

Targets vs Progress Reported

| Target | Results reported |

|---|---|

| Reducing total absolute emissions by 25% until 2030 | - 21% reduction in absolute GHG emissions |

| 50% reduction in freshwater withdrawal in operations by 2030 | - 17.5% reduction in freshwater withdrawal |

| Zero growth in process waste generation by 2025 | - %3.5 reduction in waste generated |

| Goal of zero leaks with an alert limit of 120m3 by 2022 | - 11.6 m³ leaked volume of oil and oil product. It was 95% below the volume leaked in 2020 (216.5 m3 ) |

| 100% of facilities with Biodiversity Action Plans (PABs) by 2025 | - Designed PABs for 18 units and facilities located in terrestrial and coastal environments - Fauna Management Plans for 14 units and facilities, as sub-plans related to PABs |

UN SDGs Compliance Analysis

Progress made toward SDG targets

As reported by Petrobras

- 100% of the important operational sites where biodiversity risk has been assessed

- The Pro-fauna management program, research and development projects, and the Environmental Characterization Projects of the Santos, Potiguar, and Sergipe Basins are some initiatives to prevent and mitigate the risks and impacts of fauna, human health, workforce safety, and operational safety

- The Petrobras Socioenvironmental Program is also supported to promote actions for the protection and recovery of species and habitats, as well as associated traditional uses, to preserve and conserve biodiversity in terrestrial and aquatic ecosystems

- In 2021 USD 1.28B invested in initiatives to improve HSE performance, specifically to make operational practices safe, efficient, and environmentally responsible

- Investments of USD 2.8 billion over the next five years in initiatives to reduce and mitigate emissions, including operational efficiency, biobased products (renewable diesel, BioQAV), and (R&D)

- CCUS projects in E&P

- Carbon Neutral Program to support decarbonization solutions, with an initial budget of US$ 248 million for the 2022- 2026 period

- Forestration projects in 2021 worked on the direct recovery or conservation of more than 175 thousand hectares of forests and natural areas of the Atlantic Forest, Amazon, Caatinga and Cerrado, contributing to the mitigation of GHG emissions due to deforestation in Brazil

- Oil and Gas Climate Initiative (OGCI)

- World Bank’s Zero Routine Flaring by 2030

- In 2021 Petrobras joined the Brazilian Business Commitments to Biodiversity and Water Safety defined by the Brazilian Business Council for Sustainable Development (CEBDS)

Sustainability Certificates, Awards and Listings