RATING

Outlook

Negative

SECTOR

Financial Service Activities

Chief Sustainability Officer

T: N/A

E-mail: N/A

Stock Exchange and Ticker

NYSE: MS

Website

Contact

T: 1 (877) 580-8237 (toll free) or +1(801) 617-9146 (Outside the U.S.)

E.mail: N/A

Listing

- #62 America’s Best Large Employers (2023)

- #602 World’s Best Employers (2022)

- America’s Best Employers By State (2022)

- #296 Best Employers for New Grads (2022)

- #36 Global 2000 (2022)

- #269 Best Employers for Diversity (2022)

- #328 America’s Best Employers (2021)

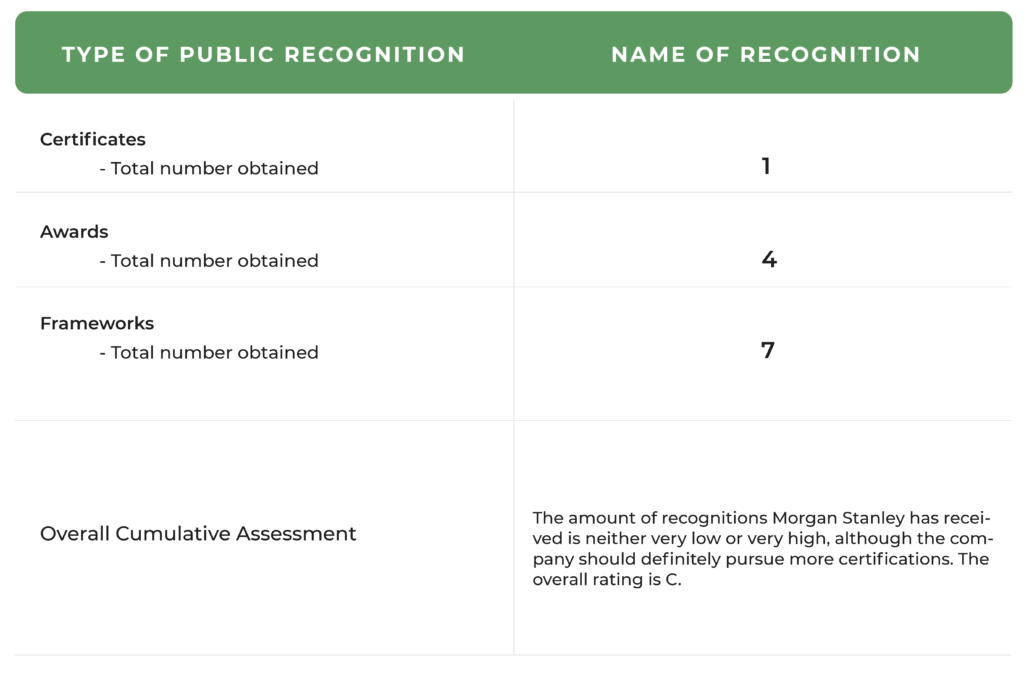

Awards

- CDP, Climate Change A-

- A+/A across Principles for Responsible Investment (PRI) score card

- Lead Manager of the Year, U.S. Municipal Sustainability Bonds and U.S. Municipal Social Bonds, by Environmental Finance

- Private Wealth Management Magazine’s award for Best Private Bank for ESG Technology, North America, based on the achievements of Morgan Stanley IQ

Revenue

$59,755B

Market Capitalisation

$141.23B

Employees

75,000

Content source

- https://www.morganstanley.com/content/dam/msdotcom/en/assets/pdfs/Morgan_Stanley_2021_Sustainability_Report.pdf

- https://www.morganstanley.com/content/dam/msdotcom/en/assets/pdfs/Morgan_Stanley_2021_Climate_Report.pdf

- https://www.morganstanley.com/content/dam/msdotcom/en/about-us-governance/pdf/Environmental_and_Social_Policy_Statement.pdf

Morgan Stanley Sustainability Report

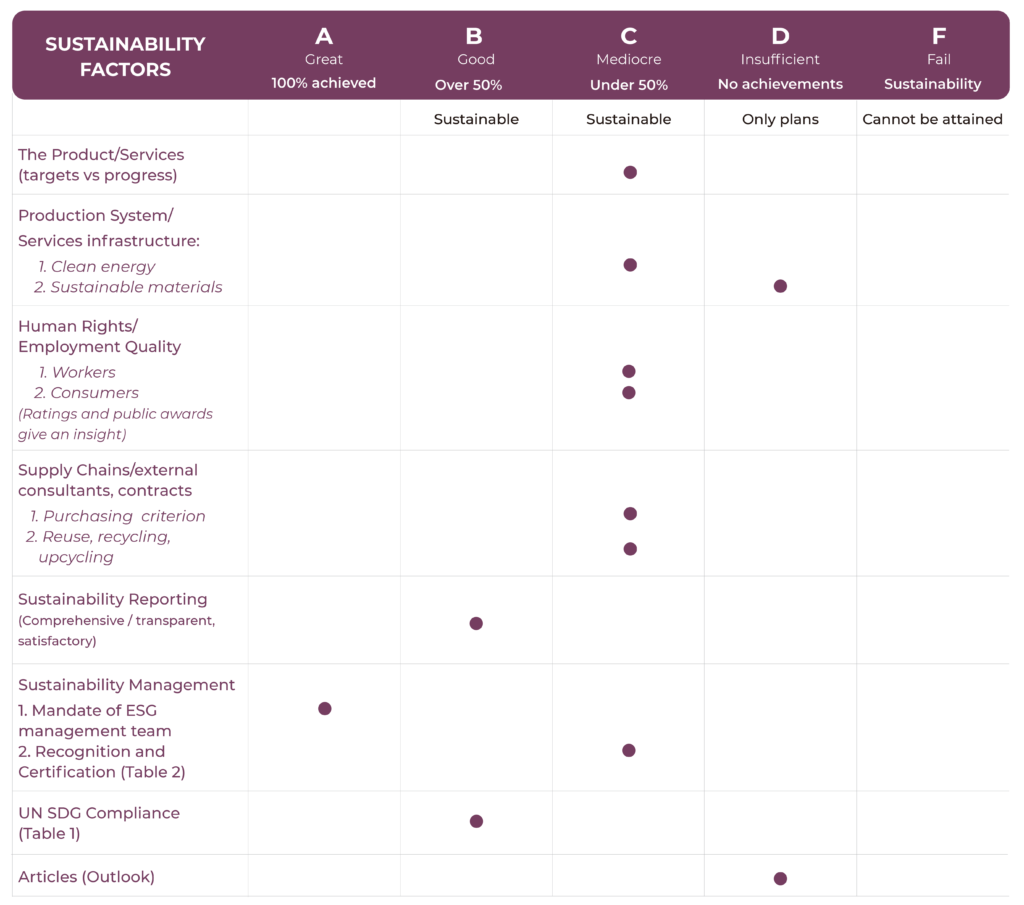

Evaluation of Morgan Stanley

Morgan Stanley’s evaluation was unfortunately disappointing. The company does a great job when it comes to sustainability governance and reporting. The goals aim to impact many different aspects of sustainability, have interim targets and KPIs. The investment firm has already channelled billions into sustainable solutions and plans to reach $1 trillion. We recognise that the company is in the midst of sustainable transition and we hope it’ll achieve all the targets, as well as completely stop financing fossil fuels. As the 12th biggest investor in non-renewable energy, it has invested in it $137.287 B since 2016. For these reasons, Morgan Stanley receives C.

Sustainability Scorecard

Morgan Stanley Company Activity

Morgan Stanley is an American multinational investment management and financial services company headquartered at 1585 Broadway in Midtown Manhattan, New York City. It is primarily an investment house, a leading player on Wall Street for the past 75 years. The firm was spun off from J.P. Morgan’s financial empire in 1935 after the Glass-Steagall Act mandated the separation of commercial banking and investment banking in an effort to end the abuses that led to the stock market crash and the Great Depression.

Morgan Stanley Sustainability Activity - As per company declarations

Morgan Stanley partners with clients and stakeholders to mobilize capital at scale for a sustainable, low-carbon economy. It strives to deliver environmental, social and governance (ESG) solutions that reduce risk, enhance value and expand the frontiers of sustainable finance.

Morgan Stanley, states that it is focused on integrating ESG initiatives into its core competencies. With its best-in-class research, advisory and investing capabilities, Morgan Stanley is in a unique position to advance sustainability across capital markets.

Certificate & Labels, Standards and Frameworks

- SASB

- Climate (TCFD) Report

- Partnership for Carbon Accounting Financials (PCAF)

- 5 million rentable square feet LEED certified

- Business for Social Responsibility (BSR)

- Ceres Investor Network on Climate Risk and Sustainability

- ICMA Green & Social Bond Principles

- Net-Zero Banking Alliance (NZBA)

Morgan Stanley in the news: Press Reviews and Social Media

Banking on Climate Chaos Report

Morgan Stanley is placed on the 12th place when it comes to top 60 banks financing fossil fuels. Since 2016 it invested $137.287 B in fossil fuels, but with a slightly decreasing trend. Morgan Stanley, RBC, and Goldman Sachs were 2021’s worst bankers of LNG, a sector that is looking to banks to help push through a slate of enormous infrastructure projects.

Morgan Stanley (NYSE:MS) Misuse of Personal Devices Costs $200 Million – Bloomberg

Morgan Stanley expects to pay a $200 million penalty connected to “the use of unapproved personal devices and the Firm’s record-keeping requirements”.

$35M fine for Morgan Stanley after unencrypted, unwiped hard drives are auctioned | Ars Technica

Morgan Stanley will pay the Securities and Exchange Commission (SEC) a $35 million penalty for data security lapses that included unencrypted hard drives from decommissioned data centers being resold on auction sites without first being wiped.

Highlights from Morgan Stanley Sustainability Report

Achievements

- Excellent sustainability management team

- Clear and comprehensive reporting, same as targets (including interim targets) and their KPIs

Weaknesses and Setbacks

- Billions invested in fossil fuels

- Some targets miss reported results

Targets vs Progress Reported

| Target | Results reported |

|---|---|

| Net-zero financed emissions by 2050

>2030 Interim Financed Emissions Reduction Targets: - Auto manufacturing, -35% - Energy, -29% - Power, -58% |

- Launched Measure-ManageReport framework to track progress - 425,495 mtCO2e carbon emissions in 2015 and 215,493 mtCO2e in 2021 → 50% reduction |

| Facilitate the prevention, reduction and removal of 50 million metric tons of plastic by 2030 | - Achieved 13mm |

| Mobilize a total of $1 trillion toward sustainable solutions in line with the SDGs by 2030 Mobilize $750Bn to support low-carbon solutions by 2030 | - $600Bn+ to date, including $450Bn+ in lowcarbon solutions |

| Carbon neutrality across global operations by 2022 | - Achieved operational completion of a wind farm that will account for 50% of Morgan Stanley’s annual global electricity consumption and 30% of carbon footprint |

| Achieve -25% energy reduction by 2025 | - Achieved 20% reduction in 2022 |

| Increase total women officers by 25% and Black and Hispanic officers in the U.S. by 50% | - 50% of the board is gender and/or ethnically diverse - 27% officers globally are women - 32% of employees in the U.S. are ethnically diverse |

| 100% reduction of single-use plastics by year-end 2024 | - Achieved 93% |

| 90% supplier agreement by year-end 2025 | - Achieved 51% |

| By 2025, certify 50% of global floor area | - As of 2021 year-end, nearly 5 million rentable square feet of real estate has achieved certification to the U.S. Green Building Council’s Leadership in Energy and Environmental Design standard (LEED) |

| By 2025, Morgan Stanley will not provide lending, capital markets or advisory services to any company with greater than 20% of revenue from thermal coal mining, unless such company has a public diversification strategy or the transaction being provided by our lending, capital markets or advisory services facilitates diversification. By 2030, the company will phase out our remaining credit exposure to companies with greater than 20% of revenue from thermal coal mining globally. | |

| Achieve a 15% reduction of water consumption by 2025, from a 2018 baseline, on an absolute basis | |

| Achieve 100% landfill diversion by 2025 | |

| 30% reduction in printed sheets of paper use by 2023, from a 2018 baseline through a systematic program of multifunction device hardware upgrades and secure print software |