RATING

Negative

SECTOR

Financial Service Activities

Chief Sustainability Officer

Alec Saltikoff (Executive Director, Global Head of Sustainability and Energy at JPMorgan Chase & Co.)

Contact Details:

LinkedIn

Stock Exchange and Ticker

NYSE: JPM

Website

Contact

T: 1-908-740-4000

E.mail: N/A

Listing

- #4 Global 2000 2022

- #48 America’s Best Banks 2022

- #89 World’s Best Employers 2021

- #6 Just Companies 2021

- #208 Best Employers for New Grads 2022

- #321 Best Employers for Women 2022

- #3 America’s Largest Public Companies 2018

- #74 Just Capital 2021

- #2 Top 50 Employers” for people with disabilities

- #11 The America’s Top Corporations Hall of Fame for Women’s Business Enterprises 2022

- 50 Best Company for Diversity 2018

- Top Companies 2021, LinkedIn

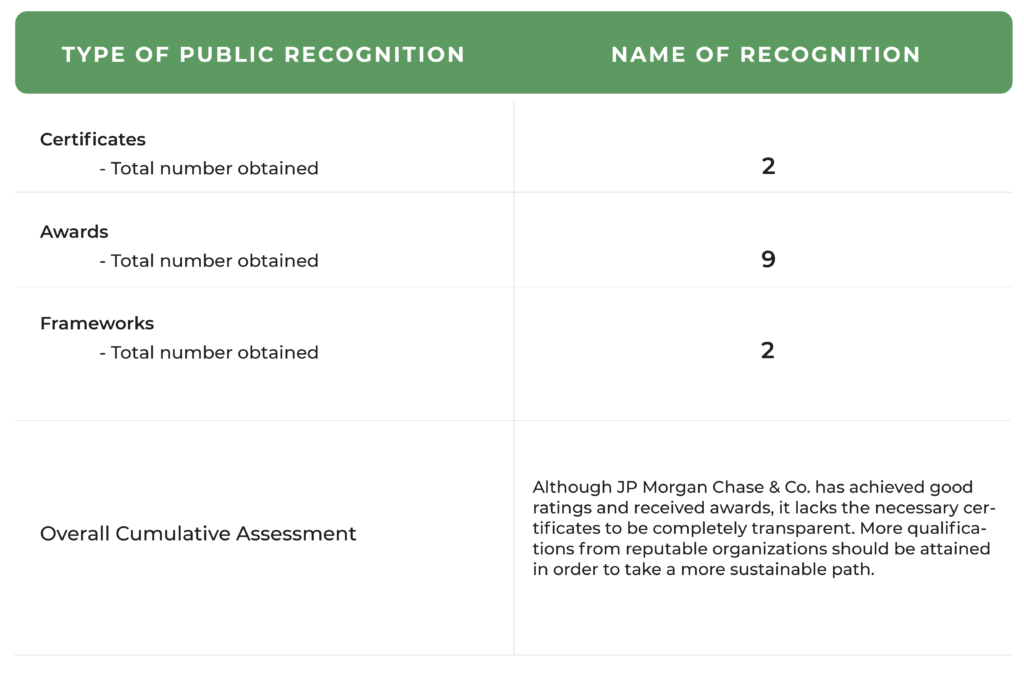

Awards

- Out & Equal Outie Award 2021

- HRC Corporate Equality Index 2020, HRC awarded %100 perfect score

- Best employer list for people with disabilities, CAREERS & the disABLED magazine

- Best Company for Multicultural Woman by Working Mother Magazine 2020

- HITEC 50 2020

- HITEC 100 2020

- Gender-Equality Index 2020

- 2021 Top Corporations for Women’s Business Enterprises, Women’s Business Enterprise National Council

- Best Companies for Latinos to Work 2021, Latino Leaders

Revenue

$124.5B

Market Capitalisation

$311.27B

Employees

250,355

Content source

JP Morgan Chase & Co Sustainability Report

Evaluation of JP Morgan Chase & Co

While JP Morgan has touched upon sustainability through its initiative to become 100% renewable and financing green projects they do not achieve the most valid certificates that approve what they do. Analyzing companies based on their SDG compliance, certificates, CSR listings, and corporate operations is integral to understanding the sustainability of a company. However, they have made good progress in integrating sustainable methods into their innovation and they have good partnerships along this way. Also, they stress gender, race, and ethnic equity as well as supporting LGBT+. Moreover, the firm has also demonstrated progress in relation to SDGs overseas. Despite boasting excessively about being 100% renewable and offering green bonds, the corporation is an enemy of the environment because it is one of the greatest promoters of fossil fuels. Additionally, they intend to foster a culture of carbon emission reduction by a few mathematical rules, which include talking less about directly lowering carbon emissions and more about carbon intensity and carbon offsetting. Additionally, there are other efforts that are in line with the SDGs. But regrettably, it is insufficient for them to qualify as a really green business.

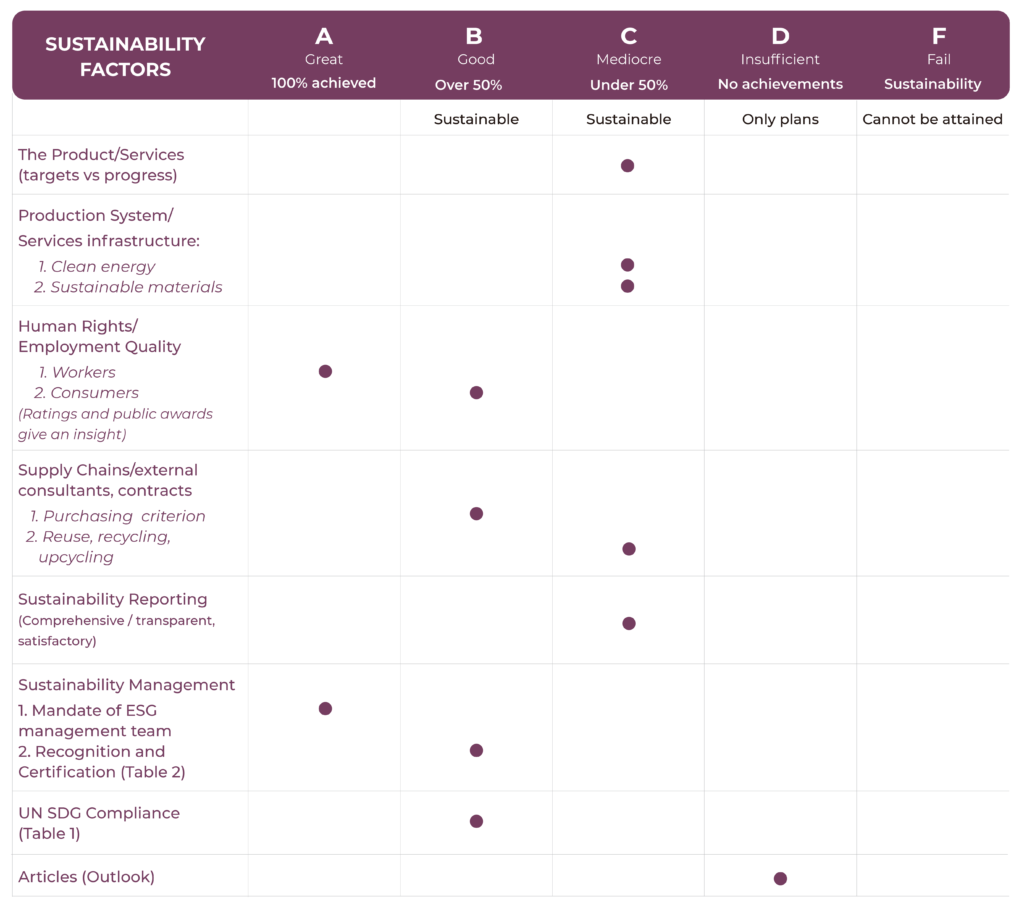

Sustainability Scorecard

JP Morgan Chase & Co Company Activity

Originally founded by J.P. Morgan in 1871, the brand has undergone numerous mergers and acquisitions over the past century. The brand is now known for its investment banking operations for JPMorgan Chase.

In 1895, the first merger occurred with Morgan & Co and Drexel which services at the time the booming railroad and steel industry. The firm was renamed into J.P Morgan & Co, and they continued this pattern of mergers. In 2000, the most notable merger of Chase Manhattan Bank and JP Morgan occurred which transferred the brand into one of the largest banks in the US. The newly named company, JPMorgan Chase & Co, offers an extensive range of services from retail banking to private equity, to asset management.

JP Morgan Chase & Co is headquartered in New York City and continues to offer services for capital raising, risk management, and trade finance services for corporations, institutions, and governments.

JP Morgan Chase & Co Sustainability Activity - As per company declarations

The racial wealth gap or developing the solutions and technologies required for the low-carbon transition are only two of the most critical environmental and social issues of our day that business can play a significant role in addressing. They think our company’s size, scope, and method of dealing with ESG issues contribute to this development and make the economy more equitable and sustainable.

ESG issues are taken into account heavily in how they do business, including how they create their goods and services, provide for their clients, assist with employee needs, and uplift their local communities. Developing Sustainable Practices One example of how these goals are being implemented is the target they established in 2021 to fund and facilitate more than $2.5 trillion over ten years to help address climate change and contribute to sustainable development.

Certificate & Labels, Standards and Frameworks

- Energy Attribute Certificate (EAC)

- Renewable Energy Certificates (REC)

- Global Reporting Initiative (GRI)

JP Morgan Chase & Co in the news: Press Reviews and Social Media

Where Will JPMorgan Chase Put Its 200 Billion Green Dollars? – Ecosystem Marketplace

Between now and 2025, JPMorgan Chase pledged to invest $200 billion in sustainable development initiatives. The pledge is a commitment to perform good actions as well as a statement of trust in the financial feasibility of the renewable energy sector, but sustainability financing covers much more than just wind and solar power projects. It also includes the $25 billion “restoration economy.” JPMorgan Chase has a solid track record of promoting sustainable finance, which is the field’s newest frontier.

The biggest investor in fossil fuels in the world, JPMorgan Chase, declared that it will connect its corporate strategy with the Paris Agreement. The pledge made by Chase to publish 2030 climate objectives was the most interesting aspect of the statement. By promising to achieve a 15% decrease in the carbon intensity of the oil and gas companies it supports by 2030, Chase has invented the complicated accounting trick known as “carbon intensity.” The most crucial thing to understand in this situation is that “carbon intensity” decreases and “real greenhouse gas emissions” reductions are two very distinct concepts.

Stop the Money Pipeline presents JPMorgan Chase branches with “2021 Greenwashing Award”

Chase has provided $317 billion in fossil fuel financing, 33% more than any other bank in the world, according to Rainforest Action Network’s 2021 Banking on Climate Chaos Fossil Fuel Finance Report. The bank committed to a 15% decrease in the Scope 3 carbon intensity of the oil and gas companies it loans by 2030 in its publication of its 2030 climate objectives on May 13. Advocacy groups have, however, been quick to point out that cutting “carbon intensity” does not equal cutting actual greenhouse gas emissions.In contrast, the JPMorgan Chase 2030 climate objectives show that the bank will support the growth of the fossil fuel sector for at least another ten years. The IEA research makes it obvious that Chase’s climate commitments to finance the continuous development of the fossil fuel sector are far from being in line with the aims of the Paris Agreement, despite Chase’s own recent vow to “Paris-Alignment.”

Highlights from JP Morgan Chase & Co Sustainability Report

Achievements

- Issued a green bond of $1.25 billion in August 2021

- More than $18 billion has been invested or pledged toward the five-year $30 billion Racial Equity Commitment

- 10 new Community Center Branches were opened, providing assistance for areas without access to regular banking, and more than 100 Community Managers were employed

- A new business unit called Morgan Health was established with the goal of enhancing the effectiveness, equality, and quality of employer-sponsored healthcare

- Three new Diversity, Equity, and Inclusion Centers of Excellence have been established: Advancing Hispanics and Latinos, Asian and Pacific Islander Affairs, and LGBT+ Affairs

Weaknesses and Setbacks

An unsatisfactory ESG report

Financing fossil fuels

- Reducing carbon intensity by carbon offsetin instead of reducing carbon emissons

Targets vs Progress Reported

| Target | Results reported |

|---|---|

| Reduce Scope 1 and Scope 2 greenhouse gas emissions by 40% by 2030 versus a 2017 baseline | - 15% of Scope 1 and 2 greenhouse gas ("GHG") emissions were cut from worldwide operations |

| Satisfy at least 70% of their renewable energy goal with on-site renewable energy and off-site long-term renewable energy contracts by 2025 | - Over 20% of their renewable procurement came from installing on-site solar systems at JPMorgan Chase properties and establishing long-term renewable energy procurement agreements (e.g., Power Purchase Agreements and green power supply contracts) |

| Mobilizing capital to advance the United Nations Sustainable Development Goals ("SDGs") in emerging economies | - $106 billion in financing and facilitation was provided to meet the Sustainable Development Target's green goal |

| Maintain carbon neutral operations annually, starting in 2020 | - Undertake a variety of energy efficiency measures – for example, optimizing the use of heating and cooling in buildings – and to

expand their implementation across operations - Purchase applicable EACs (e.g., Green-E certified Renewable Energy Certificates ("RECs"), International-RECs) and verified carbon offsets |

| Source renewable energy for 100% of global power needs annually, starting in 2020 | - Installing on-site solar systems at JPMorgan Chase properties and establishing long-term renewable energy procurement agreements In 2021, over 20% of our renewable procurement came from these solutions |

| Reduce global water consumption by 20% by 2030 versus a 2017 baseline | - The new building plans to use several state-of-the-art technologies

and systems to boost efficiencies, including advanced water storage and reuse systems to reduce water usage by more than 40% as compared to industry standard

- As of the end of 2021, theyhad reduced water use by over 5% |

| Reduce office paper use by 90% by 2025 versus a 2017 baseline | - Achieved a reduction of over 50% versus our 2017 baseline |

| Divert 100% of e-waste from landfills | - In 2021 alone, their e-waste program diverted more than 490 metric tons of solid waste, avoiding approximately 3,000 mtCO2e of GHG emissions |