RATING

Neutral

SECTOR

Financial Service Activities

Chief Sustainability Officer

N/A

Contact Details:

T: N/A

E-mail: N/A

Stock Exchange and Ticker

CNY

Website

Contact

T: +86-10-66108608

E.mail: N/A

Listing

- #383 World’s Best Employers (2022)

- #2 Global 2000 (2022)

- World’s Best Banks (2022)

Awards

- “Trustworthy Green Finance Institution”

- Ranked First Among “Top 100 Chinese Banks” for the Seventh Consecutive Year

- Quanjing Gold Awards for Investor Relations

- ICBC Wins an Investor Relations “Pegasus Award” for Chinese Listed Companies

- First Place in the 2020 Evaluation of Green Banks

- Wins the “Best Bank in China” for the 15th Time

- UN Global Compact Network China – Best Corporate Practice for Achieving the Sustainable Development Goals 2021” Ecoenvironment Protection and Concern about Climate Change

- Finance.sina.com – Sustainable Development Award of the Year

- Southern Weekly – Excellent Social Responsibility Report of the Year 2020 & Outstanding Responsible Enterprise of the Year 2020

- The Economic Observer – Most Trustworthy Pension Financial Institution in 2020-2021

- Finance.china.com.cn – Most Influential ESG Brand of the Year

- China Newsweek – Most Responsible Enterprise of 2021

- All-China Women’s Federation – Four collectives receiving the National Women’s Civilization Award

- International Finance Forum (IFF) – Institution of the Year, “2021 Global Green Finance Award”

- Xinhua News Agency – “Model Case of Green Finance Practices” in the financial industry in the first year of the 14th Five-year Plan period

Revenue

$2.2B

Market Capitalisation

$229B

Employees

434,089

Content source

ICBC Sustainability Report

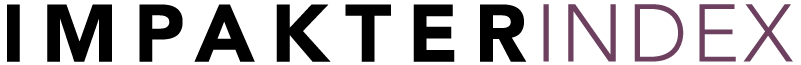

Evaluation of ICBC

Vague ESG reporting by ICBC makes it difficult to understand the actual progress and targets the company sets out. On top of this, the company claims to be investing in ‘green finance’ but never truly explains what it means by that. The data that the company does provide looks positive on the social aspect, particularly with more women in higher positions, however, its environmental aspect is very poor and makes some strong claims without sufficient evidence to back them up, including a lack of certifications. Overall, the company has nothing to boast about and is trying to cover up its dirty tracks by sprinkling ‘green’ throughout its report to seem more environmentally friendly.

Sustainability Scorecard

ICBC Company Activity

Industrial and Commercial Bank of China Limited, formerly known as Industrial and Commercial Bank of China, was established on January 1, 1984. It was wholly restructured into a joint-stock limited company on October 28, 2005, and was listed on both SSE and SEHK on October 27, 2006. Through its continuous endeavor and development, ICBC has developed into the top large listed bank in the world, possessing an excellent customer base, a diversified business structure, strong innovation capabilities, and market competitiveness.

ICBC Sustainability Activity - As per company declarations

We started our journey to quantify and decrease our operational emissions in the mid-2000s. Our initial target was to decrease our emissions by 33% by 2020 compared to our 2007 numbers. We achieved this target in 2015 for the first time, and while our progress since then has not been linear, we ultimately achieved the target in 2020.

In 2021, we established new targets to reduce our emissions in alignment with CleanBC (including a new baseline of 2010).

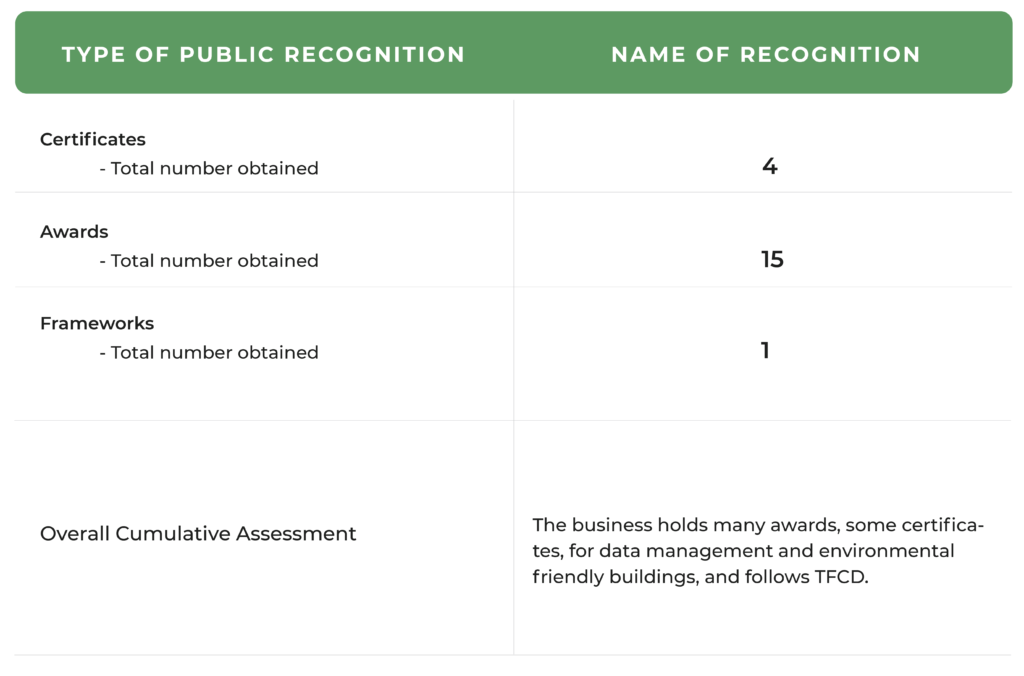

Certificate & Labels, Standards and Frameworks

- Task Force on Climate-Related Financial Disclosures (TCFD)

- “Carbon Neutrality ” labeling

- Digital Credit Certficates

- Threestar Green Building Design Certificate

- LEED gold pre-certificate

- The Level 5 certification the highest level of DCMM (Data Management Capability Maturity)

ICBC in the news: Press Reviews and Social Media

Greenpeace: China’s asset managers ‘paying lip service’ on climate – ESG Clarity

The All-China Environmental Protection Federation and Greenpeace jointly released the China Asset Management Institutions Climate Performance Report (2022). It examined 15 of the country’s top asset managers, including China Southern Asset Management, ICBC Credit Suisse Asset Management, Bosera, Harvest Fund Management, and China Universal Asset Management.

None had established any long-term climate objectives or pledged to evaluate Scope 3 carbon emissions. Additionally, the report discovered that many asset managers’ investment portfolios and sustainable-branded products contained significant positions in high-carbon industries.

Green lending: world’s biggest banks’ latest initiative at COP26 is a step backwards

Along with JPMorgan Chase and Bank of America, ICBC is one of the three major signatory banks that have committed to the responsible banking initiative over the past two years. Over the period from 2016 to 2019, Citi, ICBC, and Japan’s MUFG increased their lending for fossil fuels; MUFG and ICBC are also signatories. Despite not being a signatory to the PRBs, HSBC was not a significant lender for fossil fuel projects.

ICBC needs to increase its climate goals to zero emissions and stop providing direct and indirect financing for thermal coal projects.

ICBC Starts in Full Gear to Become A Green Financial Institution-Home-ICBC China

ICBC is a “green” bank that conserves resources and is environmentally friendly, with a total of RMB 590 billion in outstanding loans and 99.9% eco-friendly or eco-certified businesses. To categorize and manage corporate loans, monitor risk, enforce compliance, and encourage steady operation, ICBC establishes “green credit” policies and systems. ICBC develops cutting-edge green financial products, keeps an eye on environmental risks, and disburses RMB 590 billion in loans to the green economy.

Highlights from ICBC Sustainability Report

Achievements

- ICBC has issued US$9.83 billion worth of green bonds

- The Bank, as a lead underwriter underwrote 67 green bonds

- The Bank recorded RMB 2,480,621 million in green loans issued to energy saving and environmental protection, cleaner production, clean energy, ecological environment, green upgrading of infrastructure, green services and other green industries under the CBIRC’s criteria

- The criteria’s set by the CBIRC which has been criticised for lacking specific environmental risks and is up for interpretation (Christoph & Bing, 2022)

Weaknesses and Setbacks

- Thermal coal project financing, both direct and indirect

- Non-trackable progress

- Weak reporting

Targets vs Progress Reported

| Target | Results reported |

|---|---|

| Peaking carbon emissions by 2030 and achieving carbon neutrality by 2060 | - No data reported |

| Reduce building emissions by 50% (aligns with CleanBC and its mandate letter) | - Increase in carbon emissions from their Beijing-based institution, from 50077 tons of carbon dioxide in 2019 to 52096 tons of carbon dioxide in 2021 |

| Reduce fleet emissions by 77% (surpasses CleanBC target which is 40%) 0 | - No data reported |

| Reduce paper emissions by 43% | - 8% reduction in paper use |

UN SDGs Compliance Analysis

Progress made toward SDG targets

As reported by ICBC

- The Bank issued RMB 3.12 billion vaccine support loans, ranking first among peers

- Increase in female employment in top positions in the company, including at managerial and senior managerial positions

- The Bank intensified support to ensure energy supply. Since September 2021, the Bank provided RMB 296.7 billion fund support of all types to energy supply guarantee fields

- The Bank actively communicated with the National Association of Financial Market Institutional Investors and put forward the idea of innovative bond products for energy supply guarantee. The Bank underwrote the first energy supply guarantee bonds and ABS on the market. Throughout the year, the Bank underwrote RMB 45.3 billion energy supply guarantee bonds

- The Bank provided 46.1 billion substantial support for the development of major national projects in the first year of the 14th Fiveyear Plan period

- The Bank issued a full spectrum financing of RMB 234 billion to key enterprises in key fields such as foreign trade & foreign investment, service trade, residents’ living, domestic trade and retail, which effectively helped boost domestic demand

- Saving 5.2 million sheets of pape

- ICBC has issued US$9.83 billion worth of green bonds

- The Green Finance Committee was set up at the Management of the Head Office, so as to further enhance the coordinated leadership and promotion of green finance

- 43% reduction in total CO2 emissions

Sustainability Certificates, Awards and Listings