RATING

Outlook

Negative

SECTOR

Extraction Of Crude Petroleum And Natural Gas

Chief Sustainability Officer

N/A

Contact Details:

T: N/A

E-mail: N/A

Stock Exchange and Ticker

NYSE: EQNR

Website

Contact

T: +47 51 99 00 00

E.mail: N/A

Listing

N/A

Awards

- CDP Climate, 2021, A-

- MSCI ESG ratings, 2021, AAA

- Sustainalytics ESG Ratings, 2019, O&G Producers 5th percentile 35.8 High Risk

- FTSE4Good Index Series, 2022, Constituent

- ISS Oekom, 2018, C+ (Medium)

- STOXX Global ESG Leaders indices, 2019, Constituent

Revenue

$90.9B

Market Capitalisation

$115.95B

Employees

21,126

Content source

Equinor Sustainability Report

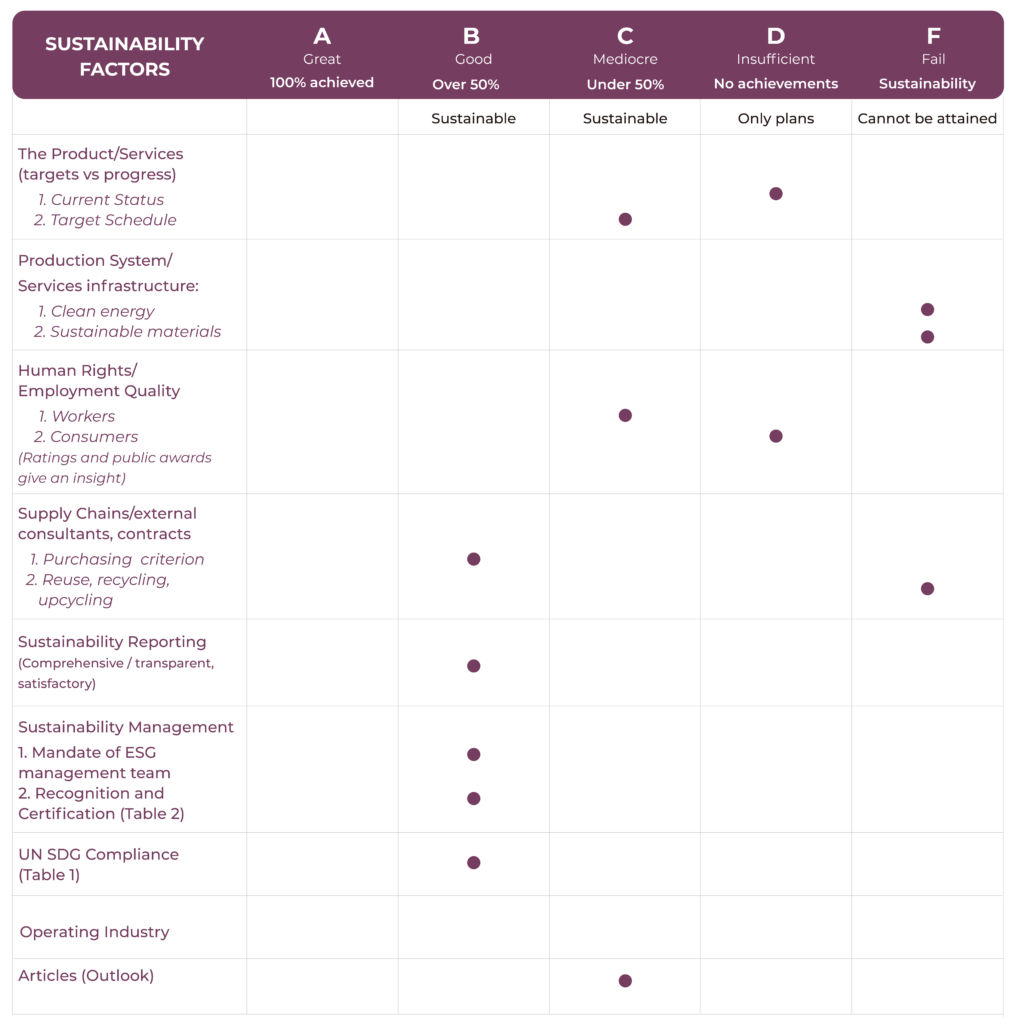

Evaluation of Equinor

Equinor presented a detailed list of targets and energy transition plan, with a goal to reach 50% of company’s gross capex in renewable energy. Even though it is admirable and we only wish more oil companies followed suit, as Equinor said itself, “the economic decarbonization is happening too slowly”. Looking at the company’s oil and gas production, it remained stable since 2016 and it is planned to increase until 2026, which is a major drawback. Scope 3 GHG emissions of sold products (e.g. the emissions from combustion of fossil fuels) are however the highest, around 250 million tonnes CO₂e per year, and reported Scope 1 & 2 GHG emissions were 14,8 million tonnes CO₂e. None of them especially Scope 3, are adequately compensated for.

The goal of reaching net zero by 2050 might seem a foot set in the right direction, but to actually achieve it, the company would have to address its main operations in the fossil fuel industry. One of the three strategies Equinor wants to adopt to achieve net zero by 2050 is by optimizing oil and gas production – capitalising on an advantaged portfolio as a strong cash engine to fund´s decarbonization and transition activities.

The other two strategies focus on renewable energy and low-carbon solutions. Unfortunately, “net zero” and “oil and gas production” should not be found in the same sentence, unless it is “We will achieve net zero by halting all oil and gas production”. The company uses four ISO certifications to qualify suppliers and we invite Equinor to obtain these certifications as well, in order to boost its reliability. Beyond the environmental achievements, we hope that Equinor will strive for more social action and cooperatives in the near future.

Even though Equinor definitely can be set aside from the worst among his oil giants’ peers (which earned an F), the lack of bold action and attempts to greenwashing are obvious. Equinor is awarded a grade no higher than D.

Sustainability Scorecard

Equinor Company Activity

Founded in 1972 Equinor is an international energy company developing oil, gas, wind and solar energy, transitioning into a broad energy company by leveraging the strong synergies between oil, gas, renewables, carbon capture and storage, and hydrogen. It aims to provide reliable energy for societies worldwide and aim to be a leading company in the energy transition. Equinor is the leading operator on the Norwegian continental shelf and has international activities in 15 countries. The company is engaged in exploration, development and production of oil and gas, as well as renewables and low carbon solutions, selling crude oil, refined products, gas and electricity, and have processing, refining and trading activities, providing energy to more than 170 million people.

Equinor Sustainability Activity - As per company declarations

Equinor openly supports the Paris Agreement and a net-zero operations by 2050. The company has already brought CO₂ emissions in the oil and gas production down below industry leading levels, and continous to do more. Equinor states that its journey to develop as a broad energy company is founded on a strong commitment to sustainability, and its strategy – always safe, high value and low carbon – is applied in everything. The company has been changing its energy landscape, by enlarging its share in renewable energy, which in 2021 achieved 11% of gross capex. Nevertheless, Equinor plans to develop its oil and gas operations further until 2026.

Equinor, agrees that the transition to a more sustainable energy system is taking place too slowly. A sustainable development path well below the two-degree target does not allow for further delays in policy, industry, and consumer action to reduce emissions. The world’s energy systems must be transformed to drive decarbonisation, which Equinor works towards.

Certificate & Labels, Standards and Frameworks

- ISO 14001

- ISO 31000

- EY third party certification

Equinor in the news: Press Reviews and Social Media

Equinor (EQNR.OL) and Wintershall Dea announced that the companies will jointly develop carbon capture and storage projects with ideas to build a pipeline from Germany to Norway to transport and store carbon dioxide (CO2) under the North Sea with expected transport capacity of 20 million to 40 million tonnes of CO2 per year, equivalent to around 20% of all German industrial emissions per year

The other side oof the coin of Equinor’s reporting and targets:

- Annual Scope 3 emissions have not been reduced and contribute the most emissions

- Equinor’s net zero ambition includes a ‘get out’ clause that “success will depend on society moving towards net zero in 2050” – leaving room to interpretation

- The company’s targets exclude its Scope 3 emissions relating to non-energy products like petrochemicals, which are a major contributor to climate change

- The company assumes “that an increasing share of oil and gas will be used for petrochemicals towards 2050”

- Equinor’s targets also exclude all non-produced traded oil and gas. As the company trades about as much as it produces it allows the company to drastically reduce its reporting emissions.

- The net income from Equinor’s renewable investments was $163 million in 2020, which is less than 5% of Equinor’s total net operating loss of 2020 of $3.4 billion

- The Bittersweet Aftertaste of Oil | BI

Equinor seemed to try to cover-up its losses created by frivulous spending culture, massive losses, neglect of advice from the Norwegian Financial Supervisory Authority. Equinor reported the loss only indirectly by grouping all international business together. Leaving shareholders and the public unaware of the alleged mismanagement connected to the investments.

Highlights from Equinor Sustainability Report

Achievements

- 28% net emissions reduction since 2015, striving towards net zero by 2050

- Target of allocating 30% annual share into renewable energy by 2025 and at least 50% by 2030 (11% currently)

- Expected growth in oil and gas production until 2026

- Twice as low CO₂ per barrel of oil equivalent than the industry average

- 0 oil spills in 2021

Weaknesses and Setbacks

- Greenwashing

Targets vs Progress Reported

| Target | Results reported |

|---|---|

| 50% reduction in net emissions compared to 2015 by 2030, aiming for 90% absolute reductions | - Total scope 1 and 2 GHG emissions were 12.1 million tonnes CO₂e in 2021 a decrease of 1.5 million tonnes from the previous year (28% emissions reduction since 2015) - scope 3 GHG emissions were 249 million tonnes CO₂e in 2021 |

| Allocate more than 30% share of annual gross capex by 2025 and more than 50% by 2030 to renewables and low carbon solutions | - The share of gross capex in renewables and low carbon solutions has increased from 4% in 2020 to 11% in 2021 |

| Methane intensity target is near zero by 2030 | - Equinor’s 2021 methane intensity for upstream and midstream business remained at approximately 0.02% |

| 12-16 GW renewable energy generation by 2030 | - Renewable power generation: 1,562 GWh (1,662GWh in 2020; 1,754GWh in 2019; 1,251GWh in 2018) |

| Diversity index score 55 by 2025 | - Diversity index score 55 by 2025 |

| Inclusion index score 80 by 2025 | - Inclusion index score 77 in 2021, 78 in 2020 |