RATING

Outlook

Neutral

SECTOR

Insurance and Financial Services

Chief Sustainability Officer

T: N/A

E-mail: N/A

Stock Exchange and Ticker

HKG: 1299

Website

Contact

T: 853) 8988 1822

E.mail: N/A

Listing

- #73 Global 2000 (2022) by Forbes

- #529 World’s Best Employers (2021) by Forbes – Dropped off in 2022

- #10 Change the World List by Fortune

Awards

- RANKED NO. 1 FOR BEST ESG in Asia (ex-Japan) by Institutional Investor Research, reflecting the results of their survey of over 4,500 investment professionals and over 1,000 financial services firms

- CDP – C Score

- ISS ESG – Prime

- Asia/Pacific ESG Leaders 50 Index by STOXX

- Global ESG Leader Index by STOXX

- Bloomberg Gender Equality Index

- FTSE4Good

- MSCI – AA Rating

- Sustainanalytics – ESG Industry Top Rated

- Hang Seng Corporate Sustainability Index – A+

- Received the GALLUP EXCEPTIONAL WORKPLACE AWARD from Gallup

Revenue

$19.11B

Market Capitalisation

$113.04B

Employees

23,000

Content source

AIA Sustainability Report

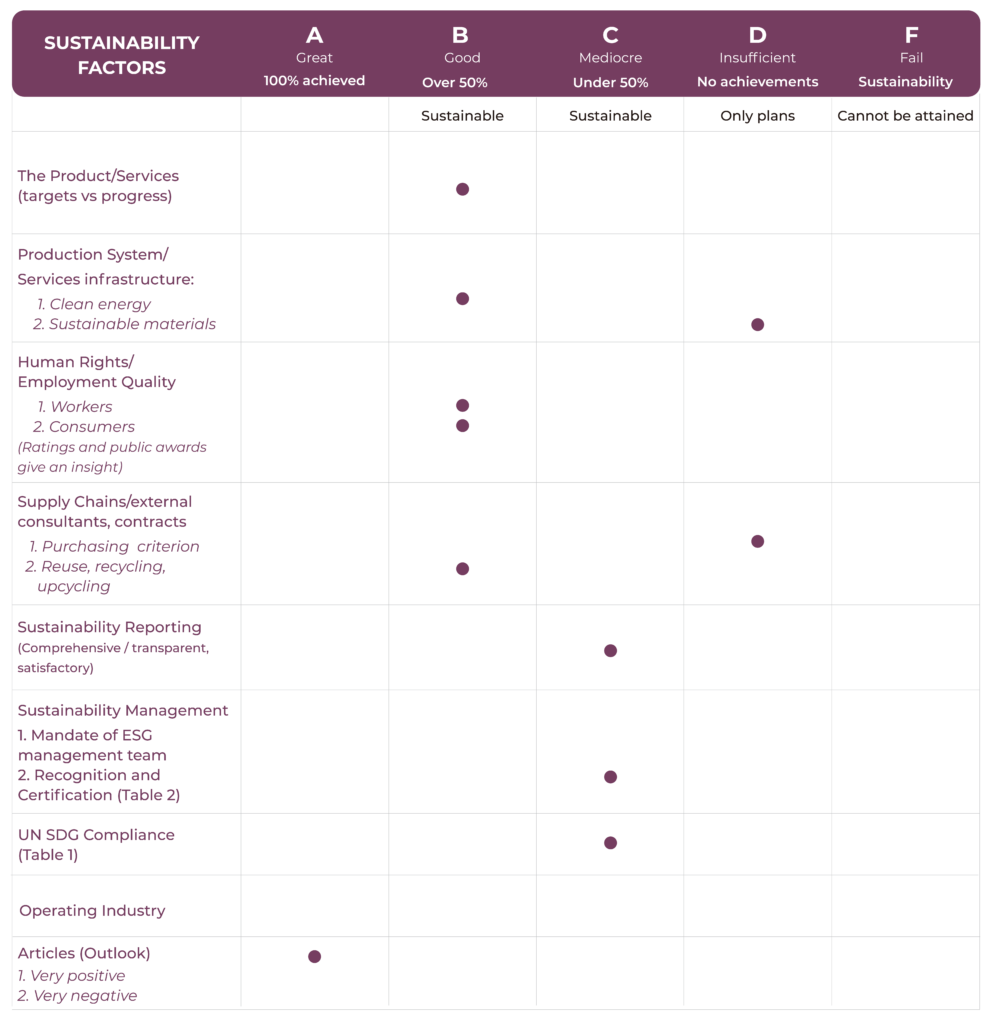

Evaluation of AIA

According to its report, AIA Group made strides in 2022 in all five areas of its ESG strategy: people and culture, sustainable operations, sustainable investment, and effective governance. By 2050, it pledges to achieve Net Zero, and it is working to have short-term targets approved by the Science Based Targets initiative. In addition, AIA has decreased GHG emissions by 23% per employee.

On the other hand, as pressure mounts on financial institutions to sever ties with the sector in 2021, AIA Group Ltd. has sold off almost $10 billion in investments in coal mining and coal-fired power businesses. However, it has since announced that it will not make any new investments in companies that are directly engaged in coal mining or the production of coal-fired electricity.

Last but not least, there aren’t many unfavorable articles online. It follows six distinct frameworks. It has two ISO certifications and has been pursuing LEED certification for a while. It required numerous credible index scores and ratings.

It receives a B grade and the overall outlook is considered neutral.

Sustainability Scorecard

AIA Company Activity

An investment holding company that also offers life insurance is called AIA Group Ltd. Hong Kong, Thailand, Singapore, Malaysia, China, Korea, the Philippines, Australia, Indonesia, Taiwan, Vietnam, New Zealand, Macau, Brunei, Cambodia, a 97% subsidiary in Sri Lanka, a 49% joint venture in India, and a representative office in Myanmar are the countries through which it conducts business. The business was established in 1919 by Cornelius Vander Starr and has its headquarters in Hong Kong.

(Source: Forbes)

AIA Sustainability Activity - As per company declarations

The ESG Strategy of AIA Group is built around five pillars: Health & Wellness, Sustainable Operations, Sustainable Investment, People & Culture, and Effective Governance. These pillars contribute to a more sustainable and healthier development for Asia, its people and communities, as well as the planet.

Certificate & Labels, Standards and Frameworks

- Pre-Certification LEED Core & Shell Accreditation, Gold

- Pre-Certification The WELL Building Accreditation, Gold

- ISO 14064 – 1

- ISO 27001

- Best Place to Work (AIA Thailand)

- Great Place to Work (AIA Vietnam)

- Global Reporting Initiative (GRI)

- International Sustainability Standards Board (ISSB)

- Task Force on Climate-related Financial Disclosures (TCFD)

- Sustainable Development Goals (SDGs)

- Environment, Social, Governance (ESG)

- Science Based Targets (SBT)

AIA in the news: Press Reviews and Social Media

The AIA Sustainable Multi-Thematic Fund, the first custom sustainable thematic fund in Singapore for investment-linked products (ILPs), was introduced by AIA Singapore. It is run by Robeco, a renowned investment company based in the Netherlands. The AIA Sustainable Multi-Thematic Fund pursues investable themes that profit from sustainability megatrends in an effort to outperform the MSCI World Index. To increase access and opportunities for education, growth, and development, AIA Singapore invests in businesses with sound ethical practices.

Seven years ahead of schedule, AIA Group Ltd. has sold off nearly $10 billion in investments in the coal mining and coal-fired power industries. Seven years ahead of schedule, the insurer sold its directly managed equity and fixed-income portfolios in October.

Two NFOs, Sustainable Equity Fund and Dynamic Advantage Fund, have been introduced by Tata AIA Life Insurance to offer special investment advantages and life insurance coverage protection. Through ULIP offerings and investment-linked protection solutions, investments can be made. Tata AIA’s Sustainable Equity Fund gives investors a special chance to profit from environmentally friendly investment opportunities while also making a positive impact on the environment. Over three and five years, the Indian ESG 100 index has outperformed the more inclusive Nifty 50 or 100 index in terms of returns. With 75% of Millennials being environmentally conscious and 90% of them interested in making sustainable investments, sustainable investing is becoming more and more significant. A dynamic asset allocation fund is available from Tata AIA to produce steady returns despite choppy market conditions.

AIA is an insurance and reinsurance company that will incorporate the United Nations-backed Science Based Targets initiative (SBTi) into its $286 billion investment portfolio. It will also invest more in green, social, and sustainability bonds and renewable power.

Highlights from AIA Sustainability Report

Achievements

- 41 MILLION & OVER 17 MILLION individual policies and participating members of group insurance schemes served, respectively

- US$6.3 BILLION & $4.3 BILLION Investments in Healthcare & ESG bonds, respectively

- Launch of the SUSTAINABLE MULTI-THEMATIC FUND by AIA Singapore

- 100% of all new buildings and redevelopments to be green certified

- Received the GALLUP EXCEPTIONAL WORKPLACE AWARD from Gallup

- 100% of Group Board committees are chaired by and composed of Independent Non-executive Directors

- 100% of the Group Board is comprised of Independent Non-executive Directors (INEDs)

Weaknesses and Setbacks

Coal investment in 2021

Targets vs Progress Reported

| Target | Results reported |

|---|---|

| Ensure that all new buildings and any redevelopments adhere to industry-recognized green building standards | - All new buildings and redevelopments to be green certified - 11 buildings are green certified |

| Reduce its carbon footprint, while also measuring and managing the amount of waste produced from our operations | - Commitment made to achieve net-zero greenhouse gas (GHG) emissions by 2050, also committed to SBTi, draft SBTi near-term targets being developed - Reduction of GHG per employee by 23 per cent, compared with 2019 - Waste baselined, total waste amounting to 674 tonnes |

| Increase digitalization and automation to reduce the usage of paper | - 87% of its buy, service and claims transactions were submitted digitally - 98% of its buy submission journey is paperless - Across the Group, they have saved 1,750 tonnes (equivalent to more than 350 million pieces) of paper |

| Encourage improvements in ESG performance with vendors | - The Supplier Code of Conduct applies to all suppliers - By spend, over 60% of Tier 1 suppliers at Group Office are rated in the top 5th percentile of all companies assessed by a globally recognised supplier ratings provider |