RATING

Outlook

Positive

SECTOR

Financial Service Activities

Chief Sustainability Officer

T: N/A

E-mail: N/A

Stock Exchange and Ticker

NSE: HDFCBANK

Website

Contact

T: 00 91 22 6760 6161

E.mail: LEA.Communication@hdfcbank.com

Listing

- #269 Global 2000 (2022)

Awards

- Morningstar – ESG Rating Risk – 31.45 (High)

- MSCI ESG Ratings Assessment: AA

- Asiamoney Best Bank Awards 2022 – Best Corporate Bank, Best Bank for SMEs, Best Bank for Diversity & Inclusion

- Euromoney Awards for Excellence 2022 – Best Bank in India

- Fortune India – Grant Thornton Bharat’s study of India’s Best Banks 2022 – Best Large Bank

- FinanceAsia’s Best Companies in Asia Poll 2022 – Most Committed to High Governance Best Standards – HDFC Bank

- National Rural Livelihood Mission (NRLM), Ministry of Rural Development, Govt of India – HDFC Bank adjudged Best Performing Bank in SHG Linkage

- Euromoney Private Banking and Wealth Management Survey 2022 – HDFC Bank ranks No. 1 in Super Affluent category (USD 100k – 5 mn)

- Business Today India’s Best Companies to work for – Ranked Best Company to work for in the BFSI sector

- Business Today India’s Best Banks – Best Large Bank

- PWM Global Private Banking Awards 2021 – Best Private Bank in India

- FinanceAsia Country Awards 2021 – Best Bank in India

- CII Digital Transformation Award 2021 ‘Most Innovative Best Practice’ for financial inclusion — HDFC Bank and Government of India’s Common Service Centres (CSC) partnership

Revenue

Market Capitalisation

Employees

141,579

Content source

HDFC Bank Sustainability Report

Evaluation of HDFC Bank

HDFC’s sustainability activity has been analysed based on their sustainability reporting for the 2022 financial year. In its reporting, the company focuses strongly on their staff well being (SDG 3) and education (SDG 4), and also in providing financial and resourceful support to local communities (SDG 2 & 10). The company has introduced a wide range of initiatives under their Parivartan umbrella brand for all social efforts. It aims to drive positive change in people’s lives by empowering them, to become self-sufficient and integrated with the society through direct or indirect interventions. This is one of the only areas in HDFC’s sustainability report which shows constant ongoing results.

The targets given outside of this umbrella rarely show results, particularly areas concerning the environment, such as energy and plastics. This brings on the next point of the company neglecting its environmental responsilibity. The company has placed Emissions and Climate Change at the bottom of their priority list, and show little efforts to improve their total emissions. Overall, particularly in comparison to other major global banks, HDFC could be in a worse position in sustainability, however, with a D+, the company has to focus more on its environmental impacts to improve upon its score and be in the C grade.

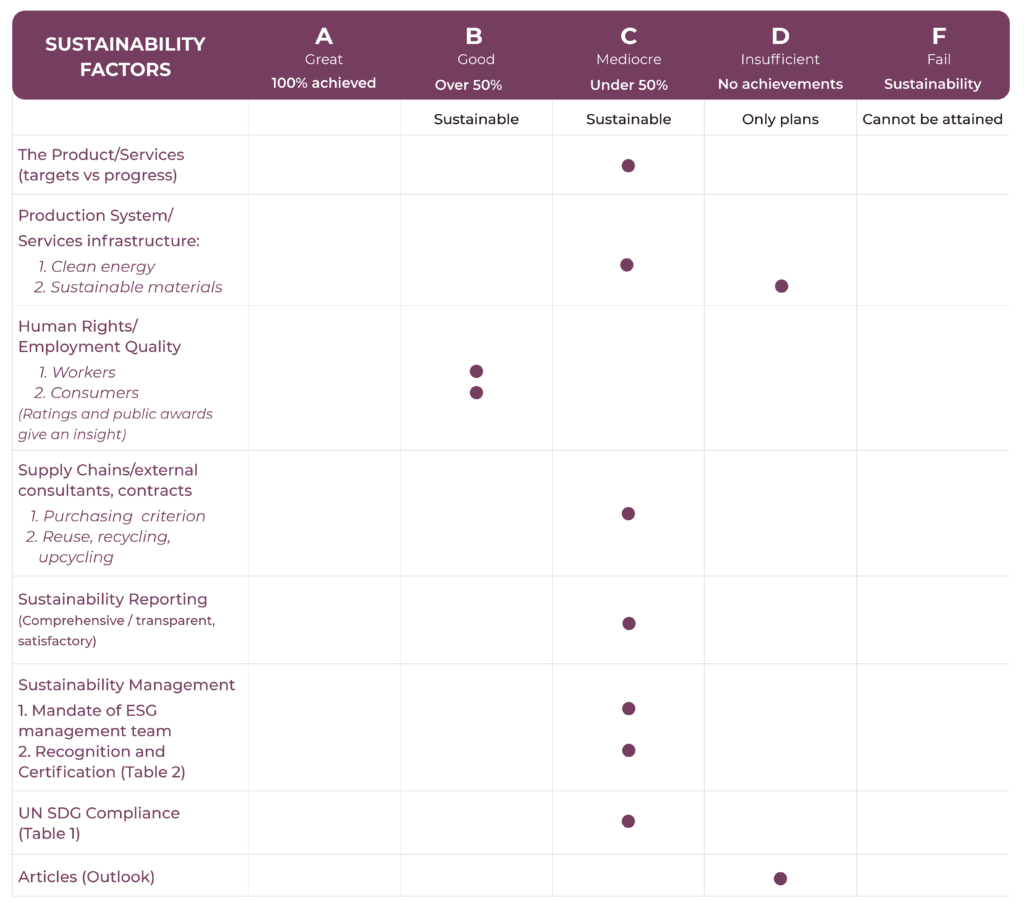

Sustainability Scorecard

HDFC Bank Company Activity

HDFC Bank is an Indian banking and financial services company headquartered in Mumbai. It is India’s largest private sector bank by assets and world’s 10th largest bank by market capitalisation as of April 2021. It is the third largest company by market capitalisation of $122.50 billion on the Indian stock exchanges. It is also the fifteenth largest employer in India with nearly 150,000 employees.

HDFC Bank Sustainability Activity - As per company declarations

As set out by their materiality map, HDFC Bank sustainability strategy strongly emphasises Compliance, Data Security, and Corporate Governance and Ethics. To pursue these areas the company has a Security Group headed by the Chief Information Security Officer and an Information Security Committee chaired by the Chief Risk Officer for exercising governance over see these matters.

At the bottom of their priority list lies Emissions and Climate Change, where the company has set out its promise to become carbon neutral by 2032, although, this target is temporally less ambitious in respect to other banks.

‘HDFC Parivartan’ is the Bank’s umbrella brand for all social efforts. It aims to drive positive change in people’s lives by empowering them, to become self-sufficient and integrated with the society through direct or indirect interventions. Parivartan works under five thematic areas: Rural Development, Promotion of Education, Skills Training and Livelihood Enhancement, Healthcare and Hygiene, and Financial Literacy and Inclusion.

Certificate & Labels, Standards and Frameworks

- Indian Ministry of Corporate Affairs (MCA) – National Voluntary Guidelines

- Global Reporting Initiative (GRI) (third-party verified)

- Carbon Disclosure Project (CDP) (third-party verified)

- International Integrated Reporting Council (IIRC)

- Task Force on Climate-related Financial Disclosures (TCFD) (recommendations)

- IGBC Platinum Certification

- IGBC Gold Certification

- IGBC Green Standards

- LEED Gold certified offices

- Great Place to Work Certification

HDFC Bank in the news: Press Reviews and Social Media

Long read: How the biggest banks are adding ESG into CEO pay – Papadopoullos, 21 November 2022

This report by Capital Monitor looks at the extent to which the largest 100 banks by assets are incorporating ESG factors into the bonus targets of their highest-level decision makers. This can reveal whether banks are incorporating ESG issues into their corporate governance whether they are taking ESG, and their publicly stated commitments around ESG, seriously. The report finds a lack of transparency from HDFC bank, which scored lower than most other banks on their list. The report comments on HDFC Bank saying “Some social and governance targets lacked transparency and Capital Monitor was unable to assess their targets.”

Reserve Bank of India imposes Rs 10 crore penalty on HDFC Bank – The Indian Express, 29 May 2021

On 27 May 2021, RBI imposed a penalty of Rs 10 crore on HDFC Bank for deficiencies in regulatory compliances with regard to its auto loan portfolio. The said penalty was imposed in regards to the contraventions of certain provisions of the Banking Regulation Act, 1949.

376 mn for affordable housing schemes

In order to provide long-term, flexible funding for low- and middle-income housing projects in India, HDFC Capital raised $376 million for H-CARE 3

Highlights from HDFC Bank Sustainability Report

Achievements

- No significant highlight

Weaknesses and Setbacks

- Weak reporting

Targets vs Progress Reported

| Target | Results reported |

|---|---|

| By 2022, the company will strive to reduce its Scope 1 & 2 GHG emissions - intensity by 10%, - absolute emissions by 3% Reduce energy - total consumption by 3% - intensity by 5% |

- In 2022, Scope 1 & 2 GHG emissions intensity decreased by 14% and 6% year-on-year for per full-time employees (FTE) and per Crore income, respectively - Increase total Scope 1 emissions from 5,825.68 tCO2e for 2020-21 to 20,876.97 tCO2e 2021-22, an increase of 258%. No explanation is given by the company for this leap, however, a possible explanation may be that emissions on account of diesel consumption in diesel generator sets are now accounted for under Scope 1, instead of Scope 2% - Increase in Scope 2 emissions from 287,667 tCO2e for 2020-21 to 300,141 tCO2e for 2021-22, an increase of 4.3%. The companies attributes this increase to the enhancing their boundary and scope by including co-located data centres and captive and offsite ATMs (previously excluded due to non-availability of monitored activity data) in the boundary for Scope 2 emissions |

| Through diversity initiatives, the company aims to increase their percentage of women in the workforce from 18% (their 2020 figure) to 25% by 2022 | - Women in workforce: 21.7% (Excludes sales officers and other non-supervisory staff) |

| Become carbon neutral by 2031-32 | - Total carbon emissions across scopes 1, 2 and 3 have increased from 315,141 tCO2e in 2020-21 to 351,240 tCO2e in 2021-22, an increase of 11.4%. The company has however reduced their total carbon emission significantly if using the 2019 baseline (414,250 tCO2e). The company attributes the overall increase in emissions from 2020-21 to 2021-22 as a result of an enhanced boundary and scope |

| Create single use plastic free corporate offices | - In FY 2019-20, the Bank phased out single use plastic water bottles from all its offices pan-India. The Bank will strive to reduce the use of all forms of plastic in its offices, branches as well as in its promotional, marketing and outreach events |

| Reduce water consumption by 30% | - The company states that it does not measure water consumption |

| Convert 50% of total sourced electricity to renewable energy | - The company does not make this data clear |

| The Bank is targeting 1,000 villages to have clean and renewable energy solutions and a minimum of 10 solar lights in each village | - Solar lights installed 41,810+ |

| Increase Rooftop Solar capacity in large offices | - Installed rooftop solar plants at their offices in Jaipur, Pune, Noida, Bhubaneswar, Chandigarh, Mumbai and Mohali - 238.5 kWp of cumulative solar power generation capacity commissioned as of March 2022 - No further data provided |

| Plant 2.5 million trees by 2025 | - As of 2022, 1.77 million trees have been planted |

| Improve sanitation facilities: - 1,000 villages to have access to clean drinking water - 100% of households have sanitation facilities in usable conditions - 1,000 villages to have a waste management system in place |

- As of March 2022 - 23,800+ household toilets have been constructed - 1,810+ sanitation drives conducted |