The controversy over soda taxes tells us why effective public health policies are so difficult to enact.

Philadelphia Mayor Jim Kenney recently proposed a tax on sugary beverages to help fight obesity. The proposal drew national headlines after both Democratic presidential candidates weighed in, and a heated debate ensued. The back-and-forth revealed the frictions that slow public health policymaking: special interests collide with public interests, powerful policy is mangled into palatable policy, and personal beliefs clash with public benefits.

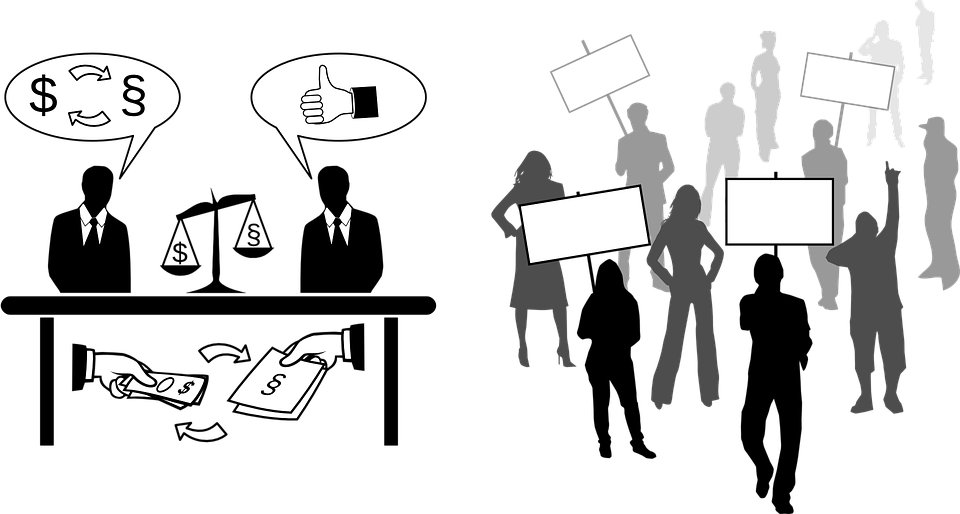

Special interests aggressively campaign against many public health proposals. When Berkeley, California introduced a ballot measure to levy a soda tax in 2014, the American Beverage Association (ABA) fought back. To counter the community efforts that led to the proposal, the ABA started “Astroturfing” – building a campaign that looks grassroots, but that was entirely artificial. “They paid people to attend rallies that they staged, so it was the complete opposite of the grassroots movement we had,” explains Sara Soka, former campaign manager for the Berkeley soda tax.

Astroturfing has also taken root in Philadelphia. The ABA had already spent $1.5 million on anti-tax ads within weeks of Mayor Kenney’s proposal. The ABA has attempted to stir populist sentiment against the soda tax, broadcasting plainspoken slogans calling soda “the kind of drinks we buy for our family.”

If Philadelphia is anything like Berkeley, this is just the beginning. In Berkeley, the ABA’s campaign against soda taxes broke spending records for California local ballot measures, costing a whopping $3.6 million. As is so often the case, the deep pockets of industry attempted to sway the direction of policy.

Industry’s influence on politics is particularly problematic when our health is at stake. Like cigarettes, sugary drinks destroy our organs and hijack our addiction pathways while we enjoy them. Much like Big Tobacco once did, soda companies market to children, deny that their products are harmful, and lobby to stop public health interventions that could reduce sales. Given the enormous burden of obesity and diabetes in the United States, a public health intervention may be warranted.

Related article: “PHARMACEUTICAL ADVERTISEMENT: THERAPEUTIC OR TOXIC?”

In the photo: Special interests aggressively campaign against many public health proposals. Credit: Pixabay.com

That said, public health interventions do not always accomplish their goals. In 1975, University of Chicago economist Sam Peltzman published a study showing that the total highway death toll did not change after seatbelts became required. However, if you were in an accident, you would be better off wearing one. Seatbelts work. So why did death rate stay the same?

Even though everyone buckled up, they started driving slightly more aggressively than they used to, Peltzman argued. Each crash became less deadly than before, but there were more crashes overall. In other words, people’s behavior changed in response to the intervention, a phenomenon that is now called the Peltzman Effect. According to Tal Gross, PhD, a health economist at Columbia University, “the Peltzman Effect occurs whenever people react to a government policy in a way that counteracts the intentions of the policymakers.”

The psychology behind the Peltzman Effect is simple: we compensate for good behavior in one area with bad behavior in another. You had a salad for lunch and went to the gym, so you indulge yourself with some ice cream after dinner. You bought reduced-fat Oreos instead of regular ones, so maybe you can get away with eating just a few more. We use our good behavior to justify our bad behavior, a phenomenon that lessens the effect of public health interventions.

We use our good behavior to justify our bad behavior, a phenomenon that lessens the effect of public health interventions.

Peltzman effects are common in public health. When tax per cigarette is increased, smokers may change to brands that provide more nicotine per stick. Incentivizing doctors to meet specific guidelines can distract them from the needs of a particular patient, leading to worse outcomes overall. And while some argue that a soda tax could help fight obesity, some studies show that people respond by simply switching to other sugary beverages instead.

These examples show that while public health interventions can save lives, they take careful planning. There is good evidence that cigarette taxes can discourage smoking, guidelines can help doctors treat patients better, and soda taxes can fight obesity. However, the rules have to be written carefully.

For a full mindmap behind this article with articles, videos, and documents see #sodatax

Which brings us back to Philadelphia. Lawmakers want the proposed tax to apply to a broad range of sugary drinks, not just sodas. By being more than just a “soda tax,” Philadelphia’s proposal prevents people from substituting one sugary beverage for another. It minimizes the Peltzman Effect.

However, even if a public health policy carefully avoids Peltzman Effects, and backlash from moneyed special interests, there are other consequences to consider. Where there are benefits, there are costs, which have implications for the people who pay them. Here’s economist Tal Gross again: “junk food taxes would be regressive, soda taxes would be regressive,” he points out. “Most of the public discussion about inequality is about ‘how do we get money from the rich to the poor?’ And a lot of times these kinds of interventions are about taking money back from the poor.”

Here, Dr. Gross clarifies that he is using an apolitical, economist’s definition of “regressive tax” – a tax where the average burden decreases as income increases. I would argue that diabetes is regressive, obesity is regressive, and death itself is regressive – they are problems that disproportionately hurt the poor, so by helping to address them, Philadelphia’s soda proposal is very progressive overall. However, in the short term, the soda tax asks the poor to pay more. In politics, you can emphasize whichever side of the argument best matches your political agenda.

Health is profoundly personal, and therefore politically contentious.

US presidential hopefuls have done exactly that, taking stances on the Philadelphia proposal that entirely ignore its health implications. Hilary Clinton supports the soda tax as part of a political bargain to fund preschool programs. Senator Sanders opposes it, arguing that it would hurt the working poor and exacerbate wealth inequality. Former GOP candidate John Kasich is against it, claiming that raising taxes hurts economic development, and small-government Ted Cruz went a step further, proposing a law to make all such taxes illegal in the US. Donald Trump’s stance is unclear.

What is clear, however, is that health is profoundly personal, and therefore politically contentious. Recent polls show that Americans are very divided about soda taxes. Voters are evenly split when asked whether they strongly support, somewhat support, somewhat oppose, or strongly oppose levying taxes on sugary drinks: each category accounts for 21%-28% of the vote. For that matter, both Republicans and Democrats are internally divided on the issue, with each party as evenly split as the general public.

Photo: Health is profoundly personal, and therefore politically contentious. Credit: Pixabay.com

Notably, these polls asked their participants to evaluate the very idea of a soda tax, not an actual proposal. Without specific details, respondents could not have answered based on the particulars – the policy’s effectiveness, or its costs and benefits. In short, they simply answered how the very notion of a “soda tax” fit with their deeply held beliefs. For public health policymakers, the devil is in the details, but many voters do not even consider those details.

Taken together, these factors make public health incredibly difficult to legislate. Even if a health policy proposal can avoid Peltzman Effects, distribute costs agreeably, and outmuscles specialist interests, our private political beliefs are always in play. Technocrats, wonks, and special interests can quietly hash out policies in many areas, but not in deeply personal realms like health. Staying healthy is hard work, and writing rules to make people healthy is even harder.

Recommended reading: “THE FIGHT OVER TAXING YOUR SUGARY SODA JUST KICKED INTO HIGH GEAR”

_ _

Featured Image Courtesy of PicJumbo

EDITOR’S NOTE: THE OPINIONS EXPRESSED HERE BY IMPAKTER.COM COLUMNISTS ARE THEIR OWN, NOT THOSE OF IMPAKTER.COM.

What Soda Taxes Tell Us About Lawmaking and Lawmakers Instagram.com